5 Practical Benefits of Introducing Data Science and Machine Learning to Your Business

Data processing, task automation, product recommendations, and financial analysis are just some of the areas that they’ve revolutionized.

Experts agree that we’re still in the early stages of AI advancement and that it hasn’t come close to realizing its full potential yet. That said, in recent years the technology has finally become both powerful and affordable enough to allow for wide-ranging implementation thanks in large part to the so-called “deep learning revolution.” That’s why now is a great moment to take a look at the different ways it can be used and the results it’s already delivering to different businesses, many of which would not have been possible even a few years ago.

We asked executives and managers from companies across different sectors to tell us about how they implement artificial intelligence, data science and machine learning in their businesses and the benefits they have seen. Here is what they had to say.

Pattern Recognition

One of the most basic and practical applications of data science and machine learning is to make quick and accurate predictions based on historical data - the more data, the more accurate the predictions. For companies that have access to large amounts of such data, using ML is a no-brainer.

Visa, a company that’s been around for over 50 years and has billions of credit cards in circulation, could not be a more perfect example.

As Jakub Grzechnik, Visa’s Head of Product, Central Eastern Europe tells us, “We have embraced AI and machine learning in nearly every facet of our organization—from fraud prevention and network security, to marketing and business insights that help our clients deliver better customer experiences.”

Visa’s most recent AI product is Smarter Stand in Processing (Smarter STIP).

“Last year, the vast majority of Visa’s issuing banks experienced some type of system outage or issue that prevented them from responding to authorization requests. We have introduced Visa Smarter STIP to help issuers manage transaction authorizations when service disruptions occur. Using deep learning to analyze past transactions, Smarter STIP generates informed decisions to approve or decline transactions on behalf of issuers when their systems are offline,” explains Grzechnik.

The capability was launched globally in October 2020. Visa was able to train the model with billions of historical records, which in sample tests resulted in 95% accurate predictions. Handling millions of transactions per day will allow the system to continuously learn and improve based on real-time user behavior.

Interpreting IoT data in real time

The proliferation of Internet of Things devices provides another opportunity for machine learning and data science implementation. As the number of IoT devices continues to increase, the amount of data they collect increases with them and so do the opportunities to process and analyze it.

One of the industries that stands to benefit from this is insurance. Even though insurance has been one of the last sectors to be disrupted by digitization, the industry as a whole seems to be more receptive to the potential benefits of AI.

Wefox, an insurtech that is already envisioning the future shaped by AI, plans to use machine learning to analyze data from IoT devices to prevent accidents.

Julian Teicke, wefox’s Founder and CEO, says “Our idea is to take a proactive approach to insurance. We want to use data from people’s IoT devices to better understand the risk that an individual is in and make more accurate predictions about the likelihood of certain events happening. Then we could use that information to warn the individual that they might be in danger, instead of just paying them after the fact.”

If machine learning can be utilized to prevent even minor accidents tomorrow, it is not a stretch to imagine it preventing global catastrophes soon after.

Preventing infrastructure failures

Speaking of catastrophes, mass utility failures definitely belong on that list, as evidenced by the recent power crisis in Texas. Thankfully, machine learning is already proving capable of helping to prevent numerous kinds of failures in electric utilities.

Dr. Julia Penfield, Machine Learning Lead at BC Hydro, an electric utility in British Columbia, Canada, tells us how:

“Across the assets owned by our electric utility company, we have numerous pieces of equipment working together to maintain continued electrical production in our generation facilities. Failure in these equipment would result in down time and unavailability to generate electrical power which results in lost opportunity costs. A machine learning pilot project opened the door for us to detect developing failures based on pattern recognition and anomalous operation detection prior to occurrence. This capability enabled our engineers to prioritize focusing on these detected developing failures to recommend technical options to avoid surprise failures.”

This ML solution is already bringing the company measurable effects:

“As a result, our assets’ availability improved, which directly translated into profitability. Based on this success, the predictive performance program has been expanding to include more failure modes ever since.”

Preventing power outages for residents and at the same time increasing company profits is practically a textbook definition of a “win-win.”

Fraud prevention

Financial institutions, which by their very nature handle large sums of money, have to deal with a constant flow of fraudulent transactions. For a global company such as American Express, successful fraud prevention can mean savings of billions of dollars. Having access to a large dataset of customer behavior makes it only logical for them to apply machine learning to fraud prevention.

“There is an emerging need for automation in the risk processes of almost every financial institution,” explains Stamatis Tsianikas, Senior Manager in Credit and Fraud Risk at American Express. “It is of course great to offer digital and fancy products to your customers, but it is equally important to create all the necessary tools and frameworks for fast, efficient and customer-friendly decision-making. This is exactly where machine learning is coming into play in financial services, and American Express in particular. The risk problems we are facing are mostly related to credit and fraud. After every swipe or tap, we need to identify potentially problematic transactions almost instantly. ML algorithms offer not only short inference time, but great accuracy as well.“

The common apprehension is that the machines, if they’re working this well, will take jobs away from humans. But they can actually complement one another:

“We should always remember that producing business value is a matter of not only giving the right answer, in which machine learning thrives, but also asking the right questions, which is ultimately up to us.”

Improving communication

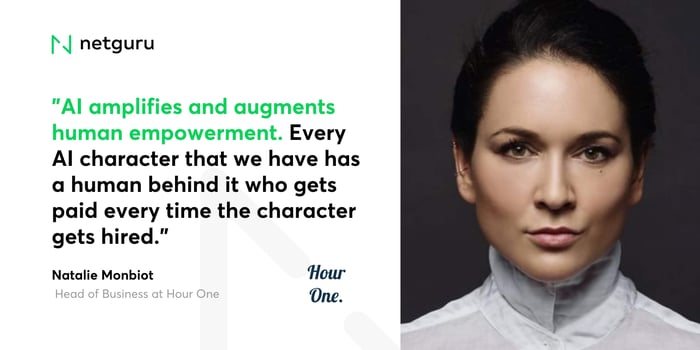

Hour One is different from the above-mentioned companies in that it doesn’t just apply AI to improve its services. In fact, the company wouldn’t exist without AI. Hour One creates “synthetic characters” - digital doubles of real people which provide video content to businesses, making money for the human originals in the process.

Companies using this service benefit by having a friendly face deliver their message instead of presenting it as text, which can significantly increase customer engagement. The service is already being used in education, e-commerce, wellness, and other fields.

Hour One uses AI to make their characters indistinguishable from real humans in voice and facial expression, passing the Turing test, which was a major challenge. Thus, Hour One has succeeded in making machine communication more human-like.

“Communication is one of the most unique human skills, and is very difficult to replicate,” says Natalie Monbiot, Head of Business at Hour One. “We want to be able to scale something that is deeply and intrinsically human, and that is the ability to communicate not just with text or with voice, but with the whole face in a kind of embodied communication experience. That’s why we see AI as a way to augment human capacity and not to replace it.”

Most importantly, the humans that each synthetic character is based on benefit from AI doing the work for them.

“For us, AI amplifies and augments human empowerment. Every AI character that we have has a human behind it who gets paid every time the character gets hired.”

Conclusions

The above examples demonstrate just a fraction of the benefits that data science and machine learning can bring to businesses in various industries. Moreover, we are only starting to take advantage of the possibilities afforded by AI. Companies are constantly discovering new benefits of those technologies, improving services and increasing their business value.

Every business that involves data processing and automation and wants to scale up their operations should look into implementing data science and machine learning solutions.

Still not sure if machine learning, artificial intelligence and data science can help your business grow? Sign up for our free consultation at https://www.netguru.com/ai-consultation.

-450071-edited.jpg?width=50&height=50&name=Opala%20Mateusz%202%20(1)-450071-edited.jpg)