The Growth Banks Miss by Not Using Transactional Data for Next Best Offer

Contents

Purchase patterns, loan payments, and recurring subscriptions offer valuable insights for Next Best Offer (NBO) strategies, but without a clear plan, this data often goes unused.

In 2025, banking customers are no longer satisfied with generic, one-size-fits-all interactions. Nearly 70% of consumers expect their banks to use personal data to provide tailored financial advice and solutions. However, many banks fail to capitalize on the vast amounts of transactional data at their disposal.

This gap highlights a missed opportunity. Consumers increasingly demand seamless, relevant engagement, with 65% saying financial institutions should make it easier to discover and shop for products.

This is where Next Best Offer (NBO) strategies come in. By analyzing transactional data, NBO identifies and delivers the most relevant financial products or services to individual customers. NBO helps banks meet customer needs in real time, like offering travel rewards to frequent flyers or savings plans to young families.

In this article, we’ll explore how leveraging transactional data for NBO can transform customer relationships and ensure banks stay competitive in 2025 and beyond.

The value of transactional data in modern banking

What is transactional data?

Transactional data consists of detailed records of a customer’s financial activities, offering banks a comprehensive view of their behaviors, preferences, and needs. This data is generated through various interactions and can be categorized into the following examples:

- Purchases: Patterns of retail or online spending, such as frequent dining, luxury shopping, or seasonal purchases.

- Recurring payments: Regular expenses like mortgage installments, utility bills, or gym memberships.

- Subscription trends: Insights from digital services like streaming platforms, meal delivery, or fitness apps.

- Transfers: Fund movements between accounts, signaling saving habits or financial planning priorities.

- Deposits and withdrawals: Cash inflows and outflows that reveal income patterns and spending behaviors.

- Payments: Settlements of bills, subscriptions, or invoices that indicate financial obligations and priorities.

In addition to transaction types, contextual information—such as time, location, and involved parties—adds another layer of detail, enabling a more nuanced understanding of customer behavior. This comprehensive view provides valuable customer insights that can drive targeted marketing strategies.

Transactional data becomes a powerful tool for uncovering customer preferences and predicting life events. For example:

- Life changes: Frequent purchases of baby products may suggest a growing family, opening the door to offers like savings accounts or insurance policies.

- Travel behaviors: Recurring international transactions could indicate an opportunity to promote premium travel credit cards or foreign exchange services.

- Savings potential: Consistent deposits into a savings account may signal readiness for investment products or retirement planning.

Transactional data vs. traditional segmentation

Traditional customer segmentation typically groups individuals based on broad categories like age, income, or geographic location. While this method has its merits, it often fails to capture the nuances of individual behavior, leading to generic and less effective offers.

Transactional data takes personalization to the next level by focusing on what customers do—not just who they are. This real-time, behavior-driven approach enables banks to deliver offers that are both relevant and impactful.

Example:

In a traditional model, a “high-income professional” might receive generic investment service offers. However, transactional data could reveal that this customer frequently shops at cycling stores. With this insight, the bank could create a more targeted offer—such as a partnership discount at cycling retailers or financing options for premium gear.

Market potential of using transactional data

The financial benefits of leveraging transactional data for personalization are undeniable. Satisfied customers are a significant asset, generating approximately 2.4 times more revenue than neutral customers, according to McKinsey. Personalization plays an important role in creating such satisfaction, with 72% of North American banking customers reporting that they find product recommendations more valuable when tailored to their needs.

Moreover, the impact of advanced personalization is clear: in the financial services sector, companies utilizing sophisticated personalization strategies see conversion rates increase by nearly 28%, compared to just 2% for those employing basic approaches.

Personalized engagement drives loyalty, enhances customer experiences, and transforms every interaction into a measurable business opportunity.

What is the Next Best Offer?

Next Best Offer (NBO) is a data-driven marketing strategy that leverages predictive analytics to determine the most relevant and personalized offer for a customer at a specific point in time. By analyzing a customer’s purchase history, preferences, and behaviors, NBO strategies can predict the likelihood of a customer accepting a particular offer. This approach allows businesses to make targeted and personalized offers, maximizing revenue and profitability.

Benefits of Next Best Offers (NBOs)

Next Best Offers (NBO) drive value for both customers and banks by creating personalized, timely interactions that meet specific needs. By analyzing transactional data, banks can craft offers that are not only relevant but also engaging, fostering stronger connections with customers.

This personalized approach increases the likelihood of customer engagement, leading to greater loyalty and higher revenue. Tailored offers significantly boost cross-sell and upsell conversion rates and customer retention, as customers are more likely to respond to products that align with their preferences and behaviors.

Beyond revenue, NBO strengthens trust by demonstrating that the bank understands its customers’ needs and priorities. When customers receive offers that add real value to their financial journey, they view the institution as a reliable partner.

Maximizing customer lifetime

Maximizing customer lifetime value (CLV) is a key objective for any business. CLV represents the total value a customer brings to a business over their lifetime, considering their purchase history, loyalty, and retention. Implementing a Next Best Offer strategy can significantly enhance CLV by making targeted and personalized offers that align with the customer’s needs and preferences. This approach fosters increased customer loyalty and retention, ultimately driving revenue and profitability.

Next Best Offer (NBO) use cases in action

How NBO works

Next Best Offer (NBO) strategies rely on analyzing transactional data to deliver tailored solutions to customers at the right time. The process involves four key steps:

- Identify patterns: Analyze transactional data to uncover recurring behaviors, such as frequent grocery payments or regular travel expenses.

- Define triggers: Establish specific triggers that activate NBOs, such as a large transaction prompting a deferred payment plan offer.

- Deliver offers: Use email, push notifications, or in-app messages to deliver personalized recommendations in real time.

- Monitor results: Track key metrics like engagement rates, customer satisfaction, and conversion rates to refine future offers.

To demonstrate how NBO strategies translate into actionable outcomes, here’s a structured framework aligning transactional data with customer-focused offers:

|

Type of Transactional Data |

Proposed NBO |

Action |

Outcome/Monitoring |

|

Recurring grocery payments |

Credit card with cashback on grocery purchases |

Personalize credit card offers with grocery benefits |

Track spending by category for further insights |

|

Mortgage payment activity |

Investment product suggestions |

Automated promotion of savings and investment options |

Analyze mortgage payment duration and savings gaps |

|

Frequent salary deposits |

Premium account or higher-yield savings account |

Personalize account upgrades for regular earners |

Monitor salary deposit patterns and savings growth |

|

High ATM withdrawal frequency |

Debit card with lower withdrawal fees |

Suggest cost-saving debit card options |

Analyze withdrawal frequency by location and amount |

|

Frequent retail spending |

Consumer credit or larger credit limits |

Propose credit cards tailored for retail shoppers |

Track number and value of retail transactions |

|

Frequent travel expenses |

Travel rewards credit card |

Promote travel-centric benefits like air miles |

Analyze travel-related transactions for patterns |

|

Delayed credit payments |

Restructured payment plans |

Offer proactive restructuring options |

Monitor overdue payments and follow-up actions |

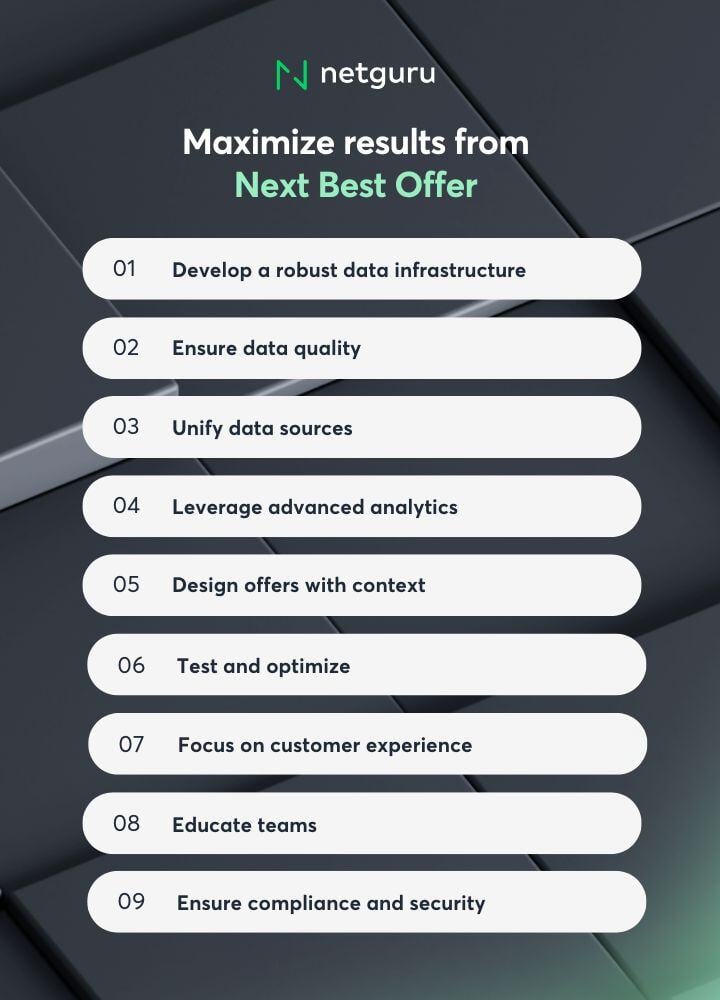

Recommendations: steps to maximize results from Next Best Offer (NBO)

Develop a robust data infrastructure

- Build systems for collecting, integrating, and processing data in real time.

- Use cloud platforms, data lakes, and APIs to manage large datasets from diverse sources.

- Ensure the infrastructure complies with data privacy regulations like GDPR and CCPA.

Ensure data quality

- Maintain accuracy, consistency, and completeness with regular data cleansing and validation.

- Audit data inputs from all channels, such as mobile apps, branches, and online banking, to identify and address inconsistencies.

Centralize and unify data sources

- Create a single platform that merges transactional, behavioral, and contextual data for a comprehensive customer view.

- Break down silos across departments to ensure seamless data sharing and consistent insights.

Leverage advanced analytics and AI

- Use AI-powered tools to analyze data at scale and predict customer needs in real time.

- Implement machine learning models to optimize triggers and enhance the relevance of NBOs.

Design offers with context and timing

- Personalize NBOs based on the customer’s immediate needs and behaviors.

- Example: Recommend a travel insurance policy immediately after a flight booking.

Test and optimize continuously

- Conduct A/B testing for NBO campaigns to identify what works best for different customer segments.

- Measure conversion rates, customer satisfaction, and revenue growth, and refine strategies based on results.

Focus on seamless customer experiences

- Simplify processes, such as product applications, to make offers easy to understand and act on.

- Integrate offers into digital touchpoints like mobile apps for a frictionless experience.

Educate teams on personalization

- Train employees on the benefits of personalization and how NBO strategies align with business goals.

- Promote a customer-centric culture that encourages collaboration across departments.

Ensure compliance and security

- Integrate regulatory checks into NBO processes to adhere to privacy laws.

- Use advanced cybersecurity measures to protect customer data and build trust.

AI Models and algorithms for transactional data analysis

To effectively analyze transactional data and implement Next Best Offer (NBO) strategies, banks can leverage specific AI models and algorithms designed for pattern recognition, prediction, and decision-making. These include:

- Recommendation systems: Algorithms that identify patterns in customer behavior to suggest personalized financial products.

- Machine Learning models: Supervised learning techniques that classify transactional data and predict customer needs, uncovering complex relationships in spending habits and financial goals.

- Natural Language Processing (NLP): Models that analyze unstructured data, such as transaction descriptions or customer feedback, to provide deeper insights into preferences and sentiments.

- Clustering algorithms: Unsupervised learning techniques that group customers based on similar behaviors, such as spending habits or financial goals, for precise targeting.

- Time series models: Techniques for forecasting trends in transactional data, such as identifying seasonal spending patterns or predicting future financial activities.

Ensuring data privacy compliance in NBO strategies

Compliance with data privacy regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) is crucial for banks implementing Next Best Offer (NBO) strategies. These regulations directly shape the technical architecture of data storage and processing systems.

- Data minimization and purpose limitation: Banks should collect and process only the data necessary for specific purposes, such as improving NBO recommendations. Implementing privacy-by-design principles ensures that all systems are built with data minimization in mind.

- Secure data storage: Encrypt transactional data both at rest and in transit using protocols like AES-256 or TLS 1.3. Employ tokenization to replace sensitive data with non-sensitive equivalents, ensuring the original data is stored in a highly secure environment.

- Anonymization and pseudonymization: To comply with GDPR’s principle of data protection by default, banks can anonymize or pseudonymize customer data where possible, especially for analysis purposes. This reduces the risk of re-identification in the event of a breach.

- Consent Management Platforms (CMPs): Integrate CMPs to give customers control over their data. These platforms enable users to provide, modify, or revoke consent for data processing in a transparent manner, ensuring compliance with GDPR and CCPA.

- Access control mechanisms: Implement role-based access control (RBAC) to ensure that only authorized personnel have access to sensitive customer data. Incorporate logging and monitoring systems to track access and detect unauthorized activities.

- Data localization and residency: Respect data localization requirements under GDPR (e.g., data processing within the EU). Use cloud providers that offer compliance-focused data centers and ensure proper data residency controls are in place.

- Regular audits and impact assessments: Conduct Data Protection Impact Assessments (DPIAs) to evaluate the risks associated with data processing activities. Regular audits ensure compliance with evolving regulations and identify vulnerabilities in data systems.

- Automation for compliance: Deploy AI-powered tools to monitor data handling, automatically flagging activities that deviate from compliance standards. These tools can also streamline the creation of audit trails and reporting required by GDPR and CCPA.

Overcoming challenges in implementation

Implementing NBO strategies involves navigating challenges like disconnected systems, regulatory requirements, and organizational resistance.

Data integration challenges

- Problem: Legacy systems make it difficult to consolidate data from different sources.

- Solution: Invest in cloud-based platforms and customer data platforms (CDPs) to centralize customer information. Use APIs to connect older systems and enable real-time processing.

Navigating regulations

- Problem: Compliance with GDPR, CCPA, or other privacy rules can feel overwhelming.

- Solution: Use AI-powered tools to monitor data handling and enforce compliance automatically. Adopt consent management platforms to give customers control over their data.

Cultural resistance

- Problem: Teams may resist adopting new data-driven strategies or tools.

- Solution: Provide training that explains how NBO benefits both the bank and its customers. Highlight success stories and use leadership champions to drive adoption.

Why transactional data is the key to growth

As banks navigate 2025, they face significant challenges, including slowing revenue growth, intensifying competition from fintechs, and rising customer demands for personalization. At the core of these issues lies a transformative opportunity: transactional data.

Failing to utilize this valuable resource results in customer churn, missed revenue opportunities, and a widening gap between traditional banks and data-driven competitors. However, banks that adopt Next Best Offer (NBO) strategies can leverage transactional data to deliver hyper-personalized experiences, foster loyalty, and drive sustainable growth.

To succeed, banks must focus on transactional data: Use it to identify customer preferences, predict key life events, and offer tailored solutions in real time.

By embracing transactional data and NBO strategies, banks can redefine customer relationships, boost revenues, and secure their leadership in an increasingly competitive market.

Supervised by Patryk Szczygło R&D Lead at Netguru