What are the common types of healthcare apps?

The use cases of healthcare mobile app development are many and versatile. Businesses are becoming increasingly creative in applying technology to enhance medical care. Here are some of the most common healthcare application types:

Telemedicine

Interest in telemedicine and mobile healthcare app development surged with the outbreak of the COVID-19 pandemic. On-demand access to licensed doctors and physicians allows patients to consult their health conditions conveniently and in a timely manner, without the need to visit medical facilities.

E-prescription and medication trackers

Healthcare mobile apps can be used to provide prescriptions virtually or to remind patients about their next medication dose. Such systems can also be used by pharmacies to monitor and manage medication stocks.

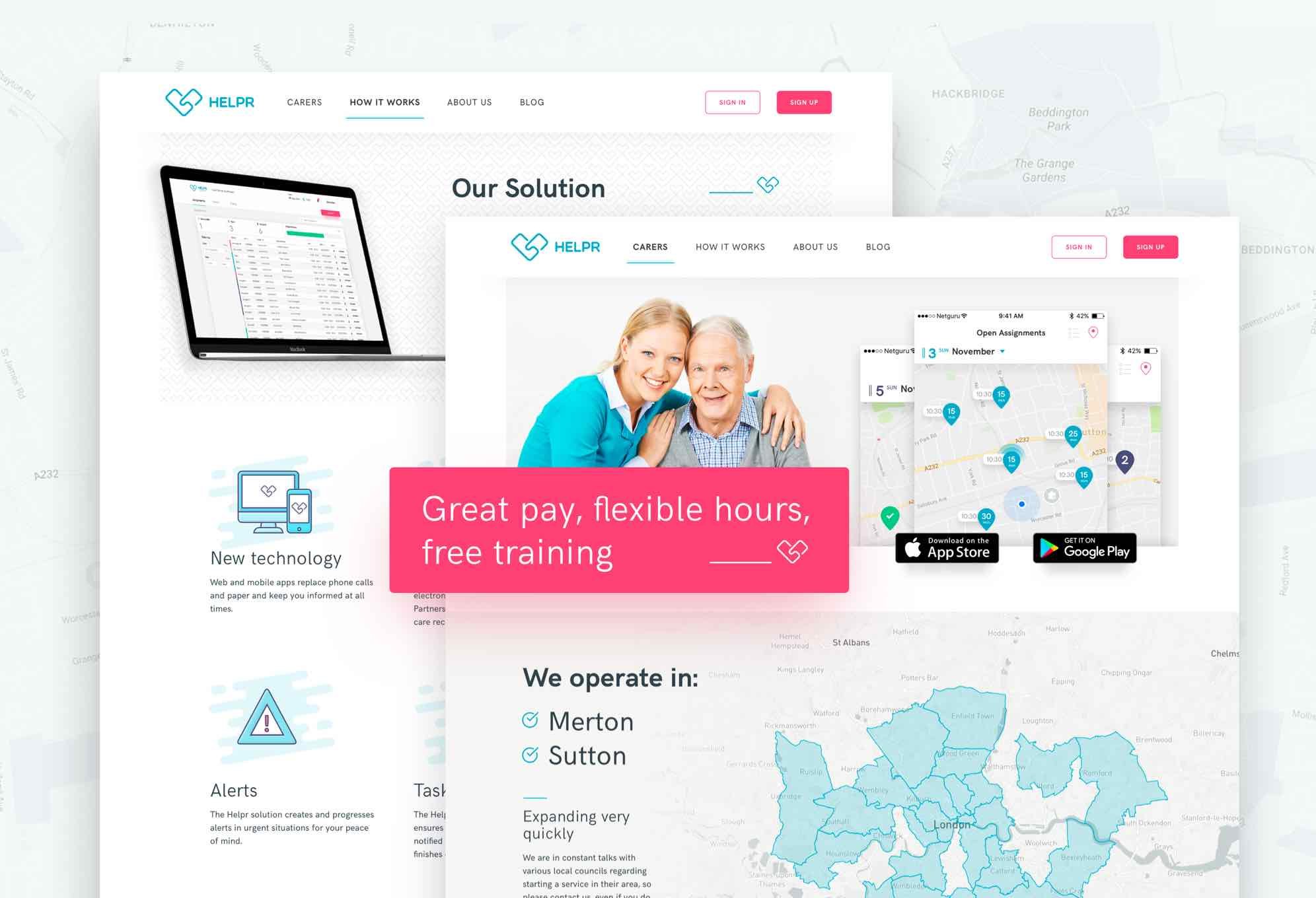

Hospital management systems

Web and mobile healthcare app development services are used to create custom systems that help manage information related to health conditions of patients and facilitate the administration of healthcare facilities.

Medical diagnosis

Healthcare apps are increasingly applied to aid with medical diagnoses and predictions. With technology, these can often be done more holistically, based on the available medical records, while minimizing the risk of errors.

Medical scheduling apps

Internal apps for healthcare facilities that automate and manage medical staff schedules more effectively.

Patient scheduling apps

Systems where patients can easily schedule and manage their appointments at medical facilities.

Health and fitness companions

Often accompanied by a wearable, this type of mobile healthcare app is used to track fitness activities and monitor health indicators, such as heart rate, blood pressure, glucose levels, or sleep quality.

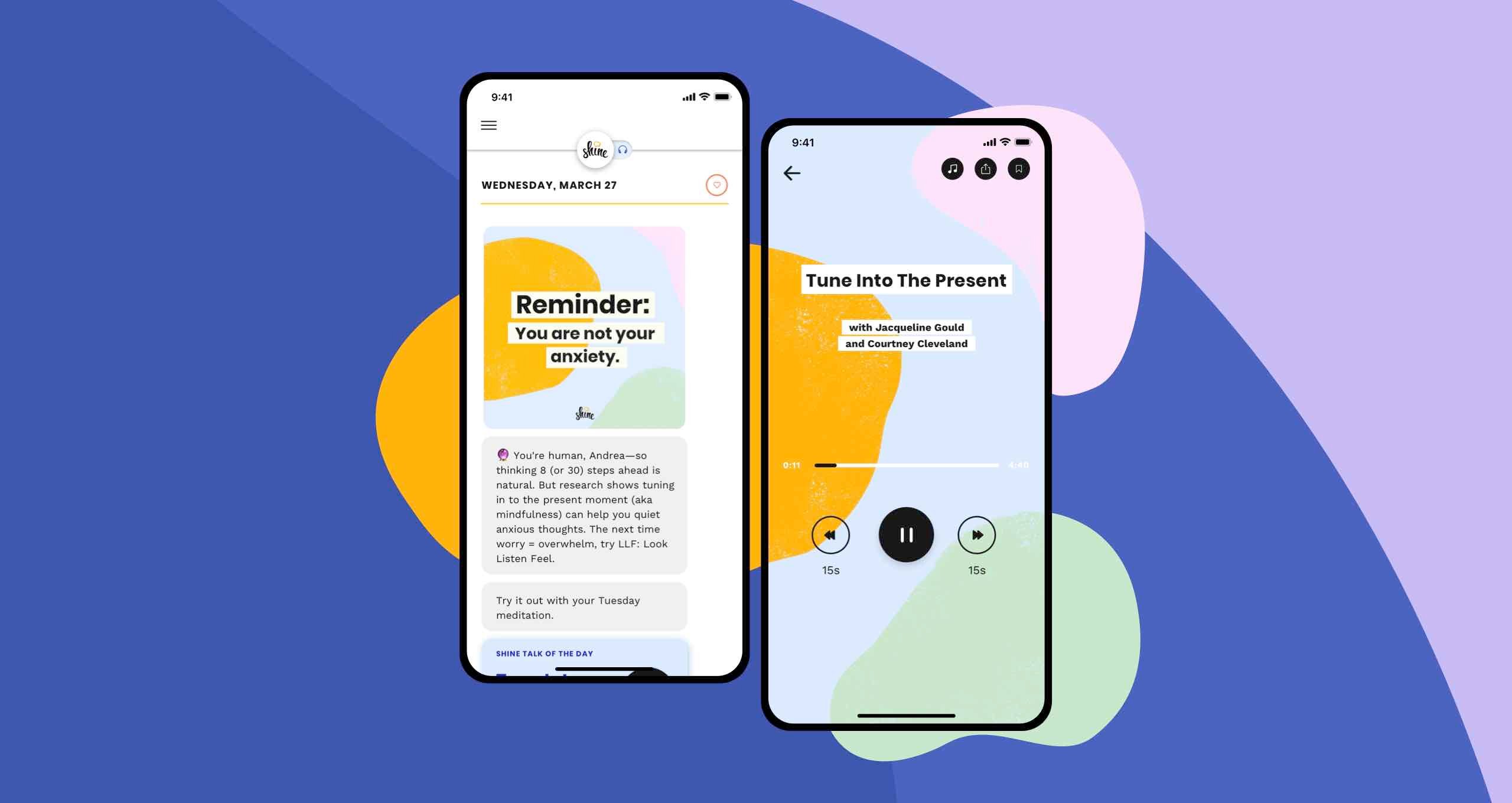

Mental health and wellness apps

Healthcare mobile apps are used to build positive mental habits, promote mindfulness, meditate and de-stress. They often rely on expert content that can be used for self-monitoring and personal growth.

What benefits does mobile health app development bring?

Healthcare apps benefit both patients and healthcare organizations by bringing them closer together and increasing trust.

With mobile healthcare apps, patients don’t have to be present at the clinic to be diagnosed and treated. The cost of treatment is also reduced, as certain tasks can be performed via the app itself.

Healthcare apps also ensure fast and secure payment systems and introduce greater transparency when it comes to healthcare costs, allowing patients and their families to better plan their budgets.

How much does it cost to develop a healthcare app?

The overall costs will be impacted by the number and complexity of the features. If you are developing the solution from scratch, the overall cost will be higher than if you expand an existing system.

Finally, the tech stack and framework will also have an impact on the overall cost. Cross-platform app development tends to incur lower costs than native app development.

How can augmented reality be used in healthcare app development?

Augmented reality can greatly enhance the quality of medical care. Real-world images coupled with virtual information overlays are being increasingly used in medical training, especially in the study of anatomy.

Numerous startups and businesses are also exploring this field to create solutions supporting medical professionals, such as vein locators for nurses, or engaging healthcare apps that can be used to distract kids from painful procedures.