AI Credit Scoring Boosts Lending Accuracy by 85%: New Industry Study

Contents

Financial institutions are moving beyond traditional credit evaluation methods, adopting advanced algorithms that analyze broader data sets to assess creditworthiness with remarkable precision.

Key takeaways

-

AI-powered credit scoring expands access to credit by leveraging alternative and behavioral data for deeper, fairer risk assessment.

-

Continuous model training and adaptive segmentation enable lenders to respond to evolving financial behaviors and market conditions.

-

Transparent, explainable AI frameworks are essential to ensure fairness, regulatory compliance, and customer trust in automated lending decisions.

What sets machine learning apart from conventional credit scoring? The technology processes information from diverse sources that traditional systems ignore entirely.

Utility payments, social media activity, and transaction patterns all contribute to a more complete picture of an individual's financial behavior. This expanded view helps financial institutions serve customers with limited credit histories, addressing a significant gap in financial inclusion.

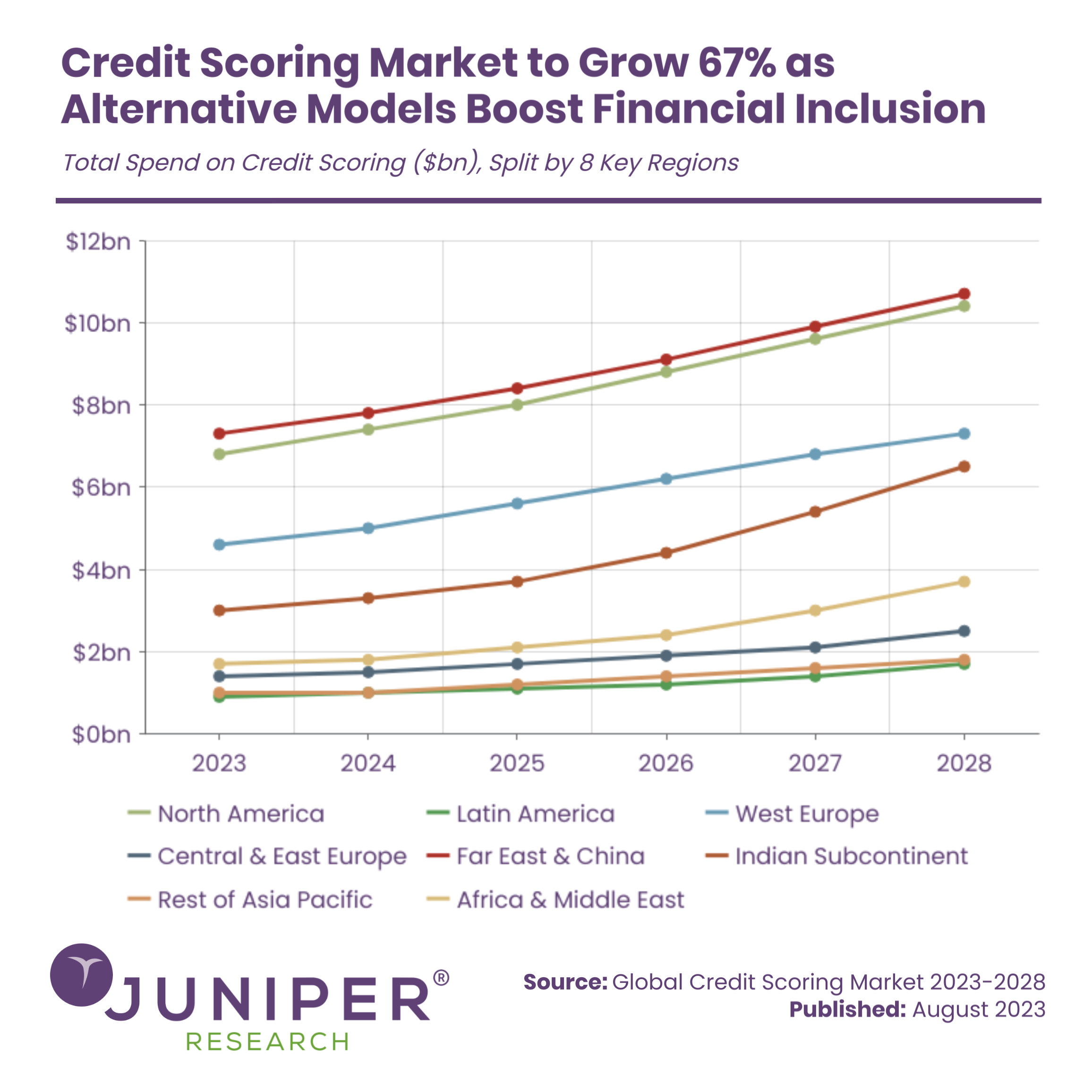

Speed matters just as much as accuracy in modern lending. Automated loan risk assessment powered by AI delivers faster decisions and quicker approvals than manual processes. Analysts project that AI will save the banking sector more than $1 trillion by 2030. Juniper Research predicts credit scoring services will grow by 67% to reach $44 billion by 2028, signaling an industry-wide shift toward intelligent solutions.

The evidence points to a fundamental change in how lenders evaluate risk. This article examines how AI credit scoring achieves 85% greater accuracy than traditional methods, explores the technology behind proactive lending systems, and shows how bias-free credit decisioning is reshaping financial services.

Limitations of Traditional Credit Scoring Systems

Traditional credit scoring methodologies persist across financial institutions despite their well-documented flaws. These shortcomings have opened doors for technological innovation in credit assessment processes.

Manual underwriting and static variables

Manual underwriting becomes necessary when automated systems flag applications or specific loan programs demand human review. The process requires extensive documentation—tri-merged credit reports, housing payment verification, and employment histories. This labor-intensive approach consumes significant time while offering limited scope for comprehensive analysis.

At Netguru, we have seen a fundamental flaw in how traditional systems rely on static variables. Parameters like age, years of employment, or number of previous loans change slowly or remain fixed throughout a consumer's lifetime. This approach misses the dynamic nature of financial behavior and personal evolution.

Consider a budding entrepreneur with minimal employment history but substantial future earning potential. Rigid evaluation criteria would penalize such applicants based on technical specifications rather than genuine creditworthiness. The system lacks flexibility for individuals with unique circumstances.

Scorecard models and population drift

Admittedly, one of the most critical weaknesses in traditional credit scoring involves what experts call "population drift" or "concept drift"—changes in socioeconomic conditions that alter the underlying distribution of the modeled population. Credit bureau models become less effective as market realities shift away from their development parameters.

Building credit scoring models requires historical data spanning at least 1-2 years. Factor in implementation time, and you get a lag of 3 or more years between the data used for model building and current population dynamics. This delay proved particularly problematic during the 2008 subprime mortgage crisis, when FICO scores became increasingly ineffective at predicting defaults between 2003 and 2006.

Traditional scoring updates occur periodically, often monthly. This approach cannot capture a borrower's current financial situation—a significant limitation when real-time information proves increasingly vital for accurate risk assessment.

Credit bureaus attempt to address these issues through continuous monitoring and periodic recalibration. However, these measures often fall short as predictive variables lose relevance over time, becoming "omitted variables" that seriously bias and weaken scoring effectiveness.

Exclusion of thin-file borrowers

The most significant limitation of traditional credit scoring lies in its failure to assess "credit invisible" or "thin-file" consumers—individuals without sufficient credit history to generate conventional scores. This exclusion affects approximately 45 million Americans, with 26 million having no file at major credit bureaus and another 19 million lacking sufficient data for traditional scoring.

Financial exclusion disproportionately impacts historically underprivileged communities:

- Black and Hispanic individuals face substantially higher rates of unmet credit needs

- Lower-income consumers (particularly those earning under $50,000 annually) encounter higher denial rates

- The "thin file" designation typically applies to consumers with five or fewer total credit accounts

Without mainstream credit access, many consumers turn to alternative financial services (AFS)—a $140 billion market growing 7-10% annually. These services include payday loans, cash advances, and short-term installment loans, none of which appear in traditional credit files, further perpetuating the exclusion cycle.

Approximately 106 million U.S. adults—a staggering 42% of the credit-eligible population—cannot access mainstream credit rates. This massive underserved market represents both a significant social inequity and an untapped business opportunity that AI credit scoring addresses.

How AI Credit Scoring Models Work

Modern AI credit scoring operates on fundamentally different principles than traditional methods. These systems employ sophisticated technology to deliver superior predictive accuracy, representing a complete shift in how lenders evaluate creditworthiness.

Data ingestion from 600+ structured and unstructured sources

AI credit scoring starts with massive data collection, gathering information from hundreds of structured and unstructured sources. Traditional models rely primarily on credit history, but AI systems analyze a much broader range of data points:

- Traditional sources: Credit history, outstanding debts, payment records

- Alternative sources: Utility payments, rental history, telecom data, mobile payments

- Behavioral indicators: Transaction patterns, cashflow trends, checking account information

This data-rich approach creates a complete view of an applicant's financial situation. FinTech lender SoFi uses machine learning to process over 100 direct and indirect variables from personal information and other databases. Zest AI develops models incorporating over 10 times the number of credit variables typically used, enabling their clients to experience 20% to 30% increases in loan approval rates while maintaining risk levels.

Machine learning model training on repayment outcomes

AI credit scoring employs supervised learning where models train on labeled datasets—typically whether borrowers defaulted on loans or repaid them successfully. This approach shifts focus from historical approval decisions to actual repayment outcomes.

The process follows several critical steps:

- Data preparation and cleaning

- Feature selection (identifying relevant variables)

- Dataset splitting into training and validation sets

- Algorithm training to recognize patterns

- Model validation and fine-tuning

The resulting models identify subtle correlations between seemingly unrelated factors and repayment likelihood. Machine learning algorithms excel at pattern recognition within vast datasets, spotting indicators of credit risk that traditional models miss. These algorithms determine which data features are most significant for processing incoming information.

Real-time scoring via REST API integration

Once deployed, AI credit scoring models operate through cloud-based microservices architecture with REST API integration. This enables:

- Instant credit scoring for real-time decision-making

- Seamless integration with existing financial systems

- Scalable processing of large application volumes

A typical API response contains comprehensive financial insights in structured format, including credit scores, income verification, payment patterns, and overall risk assessment. The implementation of these APIs alongside existing workflows delivers a frictionless experience that fits with lenders' digital ecosystem while providing positive customer experiences.

Continuous Learning and Model Retraining

AI credit scoring systems continuously evolve. While traditional models become outdated as market conditions change, AI models adapt through:

- Incremental learning: Updating existing models with new data

- Online learning: Processing incoming data in real-time

- Transfer learning: Applying knowledge from one domain to another

This continuous improvement cycle ensures models remain relevant amid changing financial behaviors and market conditions. As the system processes more applications and receives feedback on predictions (whether borrowers actually repay loans), it refines its algorithms to enhance accuracy.

The adaptation process operates cyclically: new data arrives, the model updates its parameters, performance is evaluated, and if improved, the updated model replaces the old one. This mechanism allows AI credit scoring systems to deliver increasingly accurate predictions over time, maintaining their edge over static traditional models.

Key Drivers Behind the 85% Accuracy Boost

Recent empirical evidence shows that AI credit scoring dramatically outperforms traditional methods. Several specific innovations drive this remarkable accuracy boost.

Behavioral pattern recognition in transaction data

Transaction data analysis is the pillar of advanced credit assessment. AI systems excel at identifying subtle patterns in spending behaviors that strongly correlate with repayment likelihood. These systems detect discretionary versus essential spending patterns, evaluate repayment frequency, and analyze account management habits.

The process begins with income extraction from bank transactions. Models filter out non-income items like account transfers and reverse charges. The algorithms then evaluate transaction timing, merchant categories, and purchase locations to build comprehensive behavioral profiles.

This transactional analysis proves especially valuable for underserved borrowers, as models built using transactional data alone have predictive power comparable to those relying solely on credit history.

Incorporation of employment and income signals

AI credit scoring models precisely identify and verify income streams with remarkable accuracy. These systems accomplish several key tasks:

- Group similar transactions into source streams using clustering algorithms

- Determine income frequency with 95% accuracy for salary streams and 97% for government income

- Categorize income sources into up to 13 distinct categories

- Analyze stability patterns across varying repayment tenures and amounts

Employment data integration correlates strongly with repayment outcomes. One analysis found that higher earnings, more working hours, and better driver ratings all associated with lower repayment risk.

Dynamic risk segmentation using clustering algorithms

Multivariate time series clustering represents a significant advancement in customer segmentation. Whereas traditional models create static risk bands, AI employs sophisticated clustering techniques to create dynamic, multi-dimensional risk profiles.

Spectral clustering, affinity propagation, and k-medoids algorithms generate well-separated customer segments based on financial behaviors over time. These algorithms continuously reassess borrowers as new data emerges, preventing the population drift that plagues traditional models.

Reduction of false positives in high-risk applications

Traditional systems often generate excessive false positives—flagging legitimate transactions as suspicious—which diminishes both accuracy and efficiency. Some financial sectors see false positive rates reach an astonishing 95%. AI models dramatically reduce these errors through contextual understanding, analyzing interconnected factors rather than isolated variables.

Machine learning algorithms enhance this capability by incorporating entity-level data to better understand each applicant's unique context. The result is a balanced approach that maintains regulatory compliance while significantly reducing unnecessary application reviews.

Building a Proactive Lending Engine with AI

Financial institutions are moving beyond waiting for customers to apply for credit. AI-powered systems now identify qualified borrowers before they even consider seeking a loan, fundamentally changing how credit products reach consumers.

Pre-approval identification using predictive scoring

Modern predictive modeling frameworks spot potential borrowers who meet pre-approval criteria without requiring personal details or affecting credit scores. These sophisticated AI models continuously learn from fresh data, updating their predictions as new information becomes available.

The technology monitors behavioral patterns to predict when consumers might need additional credit. For example, it tracks whether users have opened new bankcard accounts while maintaining their existing portfolio.

Automated loan risk assessment for new applicants

Automated underwriting systems evaluate applicants across multiple dimensions simultaneously. These tools process credit scores alongside income verification, transaction patterns, payment timing, and employment stability signals.

Real-time monitoring capabilities give lenders unprecedented visibility into borrower profiles. Advanced AI systems track repayment patterns continuously, sending instant alerts when credit scores dip or bankruptcy filings occur.

Machine learning technologies predict default probability by processing vast data volumes. This allows lenders to customize loan products for specific risk profiles, reducing exposure to problematic loans while improving overall portfolio performance.

Proactive engagement via eligibility forecasting

Proactive engagement systems detect potential issues before they emerge. When applied to lending, these tools identify customers for targeted pre-approval campaigns through eligibility forecasting.

AI-powered forecasting analyzes customer data to reveal preferences and needs, enabling personalized financial advice and product recommendations. Some platforms examine digital signals across multiple touchpoints, scoring risk based on behavioral patterns rather than just historical outcomes.

The predictive credit scoring system helps dealerships qualify buyers instantly, prioritize high-potential leads, and close deals with confidence—all without requiring detailed personal information or impacting credit scores.

These proactive systems increase conversion rates by focusing efforts on leads most likely to qualify, improving operational efficiency while expanding credit access.

Addressing Bias and Improving Explainability

Complex AI models create a transparency problem that traditional credit scoring never faced. Enhanced performance through machine learning sophistication often comes at the cost of clarity, producing "black box" models that make decisions without clear explanations. Fortunately, significant advances in explainable AI techniques are addressing these concerns.

SHAP value visualization for feature impact

The SHapley Additive exPlanations (SHAP) framework offers a solution for understanding AI credit scoring decisions. Built on game theory principles, SHAP values quantify exactly how each feature contributes to individual predictions. Financial institutions now use SHAP visualizations to explain how specific factors influence credit decisions.

SHAP values provide critical advantages for credit analysis:

- They reveal which features drive high-risk predictions

- They quantify positive and negative contributions to credit scores

- They provide both global model interpretations and local explanations for individual decisions

Research shows that SHAP values relate directly to weights of evidence—a familiar measure in traditional scorecard literature—making them particularly valuable for credit practitioners adapting to AI methods.

Bias-free credit decisioning with stratified modeling

Accuracy means nothing if AI credit models discriminate against certain populations. Stratified modeling techniques address sampling bias that could disadvantage particular groups. One approach uses bias-aware self-labeling algorithms for scorecard training, which removes bias from training data through careful selection techniques.

Financial institutions also implement fairness-aware algorithms that use diverse training datasets. Researchers have identified multiple fairness definitions including demographic parity, predictive rate parity, and equalized odds. These mechanisms help lenders identify and eliminate discriminatory patterns that might persist in automated systems.

Hybrid scorecard transformation for regulatory compliance

Satisfying regulatory requirements while maintaining AI advantages requires a balanced approach. Many lenders adopt hybrid systems that transform complex models into more transparent formats. These hybrid systems balance predictive power with interpretability—a crucial consideration as regulators increasingly scrutinize automated lending decisions.

A practical implementation develops explanations for individual predictions through waterfall plots that illustrate each feature's contribution. This visualization technique helps stakeholders understand not just what decision was made, but precisely why it was made, building trust among customers and regulators.

The financial industry continues adopting various interpretability techniques including Integrated Gradients, Class Activation Maps, LIME, and Counterfactuals alongside SHAP. Together, these methods ensure AI credit scoring systems maintain compliance while delivering the 85% accuracy improvement that makes them valuable.

Conclusion

AI-powered systems have delivered an 85% accuracy improvement over traditional methods, fundamentally changing how lenders assess risk and extend credit. Financial institutions now analyze data from hundreds of sources, building comprehensive borrower profiles that capture the full spectrum of financial behavior rather than relying on limited historical records.

Several key innovations drive this performance leap. Behavioral pattern recognition mines transaction data for spending insights that predict repayment likelihood. Employment and income verification reaches new levels of precision through automated analysis. Dynamic risk segmentation adapts to changing borrower circumstances in real-time. Perhaps most importantly, these systems dramatically reduce false positives that plague traditional scoring methods.

The change toward proactive lending represents another major development. Rather than waiting for applications, AI systems identify qualified borrowers and present targeted offers. This approach benefits both lenders and consumers—institutions see higher conversion rates while borrowers access credit products without lengthy application processes.

Trust and fairness remain essential as these systems become more sophisticated. SHAP value visualization helps explain individual credit decisions, while stratified modeling techniques prevent discriminatory outcomes. Hybrid approaches satisfy regulatory requirements without sacrificing the performance gains that make AI scoring so valuable.

Institutions that adopt these technologies can serve broader customer segments while managing risk more effectively. The ability to process applications instantly through API integration creates seamless user experiences that fit modern digital expectations.

Traditional credit scoring served the industry well for decades, but its limitations have become increasingly apparent. However, as AI systems continue learning from new data and market conditions, their advantage over static models will likely expand further.