Future of Payments: How Collaboration Drives Change In the Sector

Contents

In 2025, more than half of the world’s population is expected to use digital wallets as their prime payment method.

This differs greatly from just a decade ago and shows a massive mindset change in the payments industry.

Consumers paying with their mobiles, instead of cash or card, is a common sight. The average smartphone user doesn’t even notice the moment their facial features serve for identification – this is a major shift. However, this digital acceleration wouldn’t be possible without business partnerships that drive innovation.

At Netguru, we spoke to Frantisek Jungr, Head of Product Central and Eastern Europe at Visa, and Janusz Diemko, investor, and fintech and payments expert, about the rising importance of collaboration in the future of payments. We also discussed why digital identity and cybersecurity will remain a major concern for the payments industry.

Let me recap the conversation we had at Disruption Forum: Future of Finance.

Understanding the current payments landscape

The global mobile payment market is expected to reach $12.06 trillion by 2027. This drop in cash usage is driven by a number of technological advancements, which are making face-to-face transactions more convenient – and secure – for consumers.

The market is currently dominated by contactless payment methods, including digital wallets. As Frantisek points out, they’re extremely popular across regions like Europe, where they have a 90% penetration rate.

While this statistic might seem shocking, it’s in line with global cashless payment volumes. Estimates put the number of mobile wallet users at over 4.4 billion people worldwide by 2025.

The importance of collaboration in payments

New technologies and rising customer expectations have made it difficult for most financial institutions to single handedly keep up with the market demand. That’s why most players in the fintech and banking scene are now betting on creating strategic partnerships. Businesses exploring ways to streamline these collaborations can, for example, visit NMI's official site to see how a user-friendly merchant relationship management platform supports partner integrations.

They realize that, jointly, they can widen their offerings. Wally Mlynarski, Head of Merchant Solutions and Receivables at Bank of America, makes an interesting point by saying that today’s partners come not only from complementary payment services, but also companies one could traditionally define as direct competitors.

A study by McKinsey shows that collaboration among multiple entities isn’t a passing trend; it’s an industry-wide change and a new operational model. It’s also key to adapting new technologies quicker.

That said, collaboration isn’t a novelty for all organizations in the payments sector. For businesses like Visa, it has always lied at the business core. As Frantisek says, the company is built on a four-party model. Namely, the entire transaction between customer and seller is possible through communication between their respective banks and payment instrument providers.

He argues, however, that the current rise in digital finance will only further prove that it’s impossible to survive on the market without partners.

Janusz says that no one is truly exempt from this change in the global payments ecosystem.

Even the largest banks can’t be great at everything they do.

And the more they wish to widen their digital offer to cover the entire value chain, the more likely they’ll be to choose collaborating with established payment providers.

He aptly points out that collaboration will become more important year over year, because the complexity of the fintech solutions they want to implement is also growing.

While the adoption of fintech services is going up, payments providers find it challenging to build a strong client base, as the customer acquisition cost is high. To compensate for it, a lot of firms either focus on business services right from the start or decide to pivot into a B2B2C relationship. According to EY, there are four main reasons why fintechs are keen on collaborating with banks, these are:

- Access to a more stable client base

- Gaining more credibility in the eyes of the customers thanks to partnering with a bank

- Flow of capital for further developing fintech services, as banks have bigger investment budgets

- Ability to draw from the bank's know-how in areas like regulatory and legal compliance as well as risk management.

It seems that fintechs can gain a lot by collaborating with banks, but this partnership is definitely not one-sided. Banks benefit from it too.

The way I see it, as customers become more accustomed to digital experiences, they expect or even demand the same level of digitization from banks. And at least for now, most banks are unable to meet these expectations on their own.

By cooperating with fintechs, banks can provide a whole suite of services and keep their clients satisfied.

Deloitte’s research uncovers a few more reasons why banks and fintechs decide to collaborate, including:

- Cost reduction to achieve economies of scale

- Adoption rates improvement

- Search for new revenue streams such as digital loyalty programmes and e-invoicing

- Reduction of the cost and risk of regulatory compliance especially in client onboarding processes.

Digital identity and cybersecurity – main trends dominating the space

On top of mentioning the multiple business opportunities of collaboration, both Frantisek and Janusz also talk about how partners are tackling security and digital identity verification. Both these areas are essential for interoperability.

The integration of digital ID into payment processes

As Janusz notices, proper digital identification will be crucial wherever consumers ditch physical cards in favor of digital wallets. These methods are now not only popular online, but also for shopping at brick-and-mortar locations.

He notes that the shift started with the move to contactless methods. Then, our phones enabled creating digital wallets. All this has happened in a matter of years. Nowadays, however, digital wallets contain a lot of sensitive information on consumers, which raises the bar for proper ID-ing.

I agree with Janusz that the topic will be critically important for all industry players. Depending on their role in the value chain, they’ll either search for B2B collaborations, invest in innovative fintech solutions themselves, or build their own technologies with the help of a skilled tech partner.

This opinion is also proven true if we look at the available numbers. According to Allied Market Research, the identity market value will reach $70.7 billion by 2027, translating to an annual growth rate of 16.1% between 2020-27.

Frantisek points out that there’s one key ID method which is currently on the rise, i.e., biometric authentication, which offers the best user experience for identity verification. The market is estimated to exceed a global worth of $82.9 billion by 2027.

Focus on battling cybersecurity threats

In terms of the future of payments, cybersecurity and fraud are two areas that will need to be prioritized, says Frantisek. Even young consumers worry about keeping their savings safe.

By 2025, the cybercrime cost is expected to reach a staggering $10.5 trillion annually.

This doesn’t come as a surprise if we consider two factors. Firstly, the record-high volume of digital transactions, which in itself raises the potential number of attacks. Secondly, the widespread adoption of new technologies, which can come with their own vulnerabilities, too.

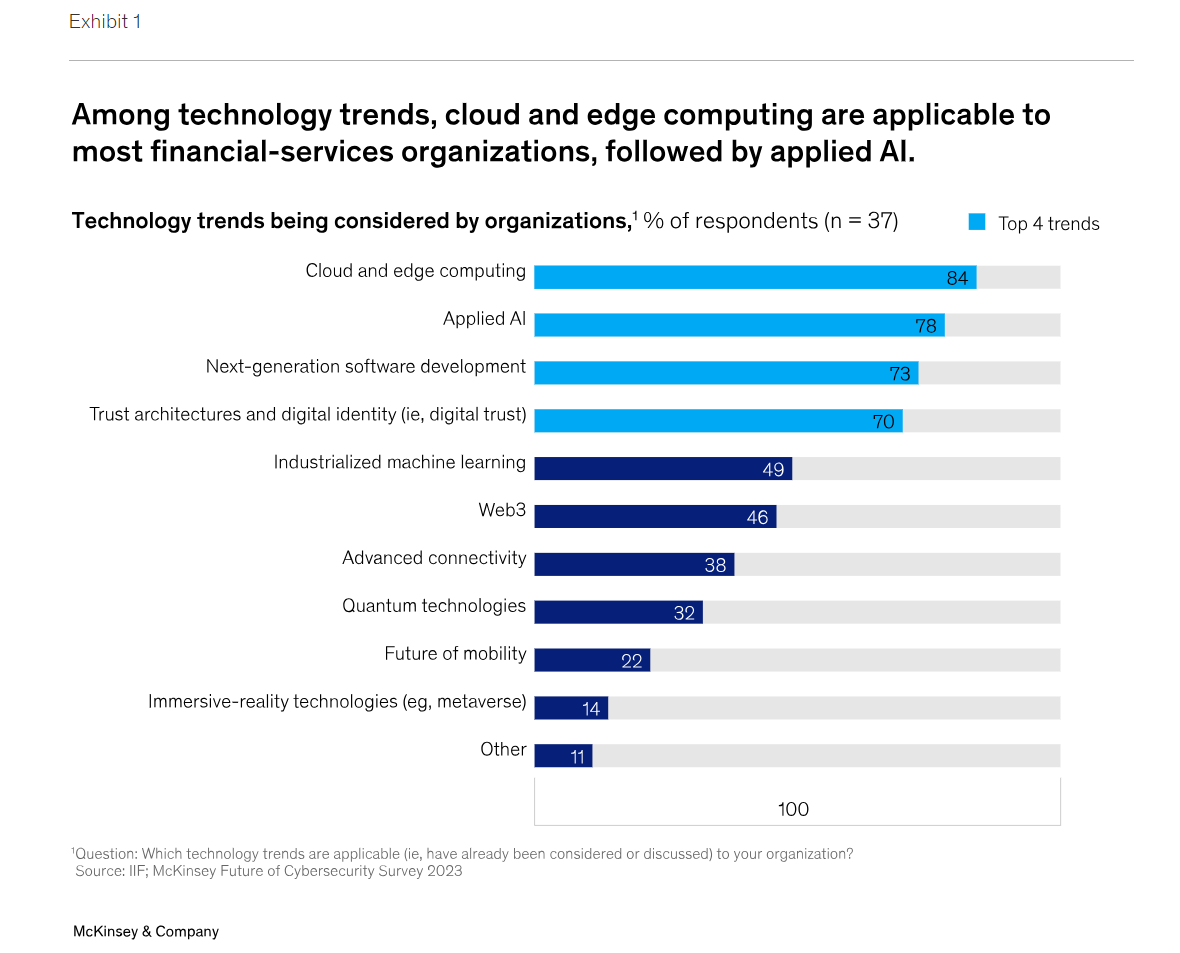

As reported by McKinsey, these include solutions for cloud and edge computing, next-gen software development, and digital identity and trust architecture.

Image source

Without a doubt, these technologies foster digital acceleration in the financial services sector, so the solution isn’t not to use them. So, what can companies do before adopting them to prevent cybersecurity threats?

It’s worth answering a few questions to check their readiness:

- Are we betting on the right technologies? Are they in line with our security capabilities?

- Do we have the right metrics and reporting in place to guarantee security?

- Do we have the right talent to manage the chosen technologies?

Additionally, to reduce cybersecurity threats, companies can turn to AI-powered solutions dedicated specifically to fraud detection, for example, trustfull, which reviews digital interactions in real-time and alerts the company about any behavior which could point to unauthorized data access or hacking attempt.

Use of more blockchain-powered solutions

Blockchain lies at the core of many API-driven ecosystems and open finance solutions. As Janusz points out, it stands behind popular, new payment methods such as subscription models and recurring payments.

But it’s also currently attracting more attention due to its potential to improve security and transparency of digital payments. All blockchain transactions leave a trace, anonymity is not allowed. This can lead to the reduction of terrorist financing and money laundering as well as lessen fraud.

While this technology isn’t free from challenges, the impact it has on cross-border transactions and digital currencies is significant enough to be worth the risk. In 2022, the global cross-border market was valued at $181.9 trillion, and is expected to grow to $356.5 trillion by 2032, which represents a CAGR of 7.3% from 2023 to 2032.

Given its size and value, it’s critical to implement mechanisms that will help protect it from security threats, and blockchain is one of them.

Visa’s approach to safeguarding payment systems

As one of the leading payment service providers, Visa has been a pioneer in the latest cybersecurity technology. They’ve made significant investments in ensuring payment systems’ security and minimizing the risk of users falling victim to fraud.

Frantisek says that it’s one of the main areas of focus across the entire business. They realize that technologies like AI can create opportunities for the business, but also introduce potential threats into the payment security process. That’s why they’re investing vast resources into cybersecurity.

This approach is true to the company’s on-site statement, where Visa declares that “payment security is embedded in everything” they do.

On top of using advanced security technologies, Visa also conducts cyber-awareness training for all their staff to detect and nip fraudulent activities in the bud.

They also run internal and external IT infrastructure and cybersecurity audits every year.

The future of payments will be driven by partnerships

Customer expectations are rising, which is partly caused by the growing number of fintechs which offer great in-app experiences, but don’t usually have budgets equal to banks. They also have high customer acquisition costs, which blocks them from growing their user base quickly.

To improve customer experience and keep your clients happy, you need innovative technologies AND a budget to develop them. That’s why partnerships between payment providers, fintech startups, and banks is a match made in heaven.