Grocery Shopping and the Pandemic — How Quick Commerce Went Viral

While ecommerce got a boost, it can be argued that it didn’t gain the long-term advantage that some observers initially claimed — the crisis simply compressed five years into two. One notable exception, however, is quick commerce.

A handful of companies offering on-demand delivery had experienced moderate success, but when the pandemic struck, it catapulted quick commerce into a new stratosphere. With consumers reluctant to leave home and groceries severely impacted, investing in q-commerce was a no-brainer for investors and entrepreneurs looking for opportunities.

Company valuations and revenues skyrocketed and, in turn, new companies sprang up like mushrooms after rain. Among the success stories, Gopuff became a unicorn in August 2020, having been in business since 2013. And just nine months after launching, Gorillas became one of the fastest European startups to reach unicorn status in March 2021.

A slow start for quick commerce

The quick commerce and grocery delivery business models are far from new. In the late 1990s, companies like Kosmo.com and Webvan launched delivery services that promised to get small items such as food, DVDs, books, and magazines to customers within an hour.

Early signs of success looked promising. In 1998, Kosmo.com raised more than $250 million in venture capital funding, and in 1999, it generated revenue of $3.5 million. Webvan had a similarly auspicious start, raising $375 million at IPO in 1999 and achieving a peak stock market value of $1.2 billion. However, despite strong investment interest and substantial revenue, neither company could make a profit, and both called it quits in 2001.

An idea ahead of its time

Even though the market could clearly see the potential for e-grocery and quick commerce 20 years ago, the timing wasn’t right to create sustainable business models. Firstly, with no previous companies paving the way, the customer base wasn’t ready for digital convenience solutions, and companies couldn’t achieve the scale necessary to run profitably.

Secondly, the technology wasn’t yet available to allow companies to minimize operating costs. This issue caused a dilemma — if companies added enough margin to make a profit, they’d make the price too high for customers, and if they reduced the margin to make the service affordable, they’d make a loss.

Thirdly, convenience services like quick commerce and e-grocery weren’t deemed affordable by a big enough customer base, which affected companies’ ability to build the necessary scale for profitable operations.

Achieving critical mass

Fast forward 15 years and another company had noticed the weak signals of potential for on-demand delivery. Gopuff launched in 2013 to deliver hookah products to students and quickly extended its offering to include groceries and other small items.

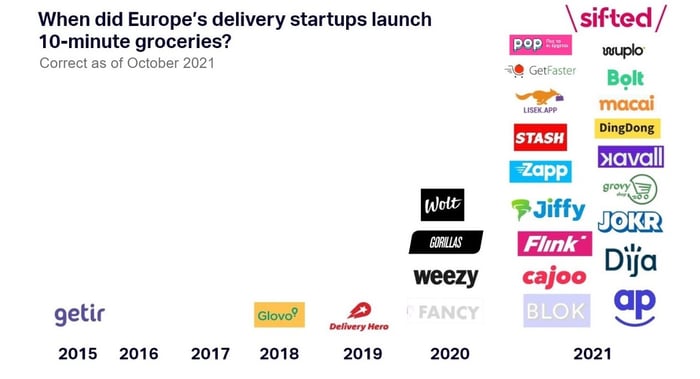

Courier and food delivery companies also spotted the opportunity with Glovo and Delivery Hero entering the quick commerce space in 2018 and 2019, respectively. Delivery Hero has since acquired a majority stake in Glovo in a deal expected to close in the second half of 2022 worth $2.6 billion.

At the same time, the use of technology had developed considerably. Companies could now automate back-office functions to reduce costs, and consumers were embracing mobile solutions to make their lives easier.

Although the market was gathering pace, the watershed moment for quick commerce came in 2020 when the pandemic struck.

Consumer behavior changed almost overnight, and with many people preferring home delivery for safety reasons, new entrants flooded the market.

Funding levels and company valuations exploded, which created a snowball effect of investors and new companies entering the market. In March 2021, Gorillas secured $290 million in Series B funding, propelling it to unicorn status less than a year after launching. Likewise, Flink became a unicorn with a $750 million Series B round after just seven months of operating. And incumbents Gopuff and Getir joined the unicorn club in 2020 and 2021, respectively.

What does the future hold for quick commerce?

Arguably, the nature of quick commerce means that only the largest two or three companies will ultimately survive, and companies are battling fiercely for market share. We are already seeing consolidation in the market, such as Gopuff and Delivery Hero actively acquiring smaller competitors, and we are likely to see more.

Once companies have solidified their positions, they will turn their attention to profitability and building a sustainable business model. In particular, many companies have reached a point of diminishing returns in the value they can offer customers.

Customers are unlikely to switch services to save an extra couple of minutes on delivery.

Therefore, companies will need to find ways to innovate or differentiate their offerings to survive and thrive in the long term.