Our UX Research Process: How We Design Products That Convert?

Contents

Products often fail when teams skip research. We've watched this pattern repeat across countless projects.

Ambitious ideas crash into reality because nobody bothered to understand their users first. The UX research process determines whether your product becomes indispensable or irrelevant.

Research isn't just a checkbox activity at Netguru. We've seen how methodical user research directly affects conversion rates, customer satisfaction, and bottom-line results. Skip this foundation, and you're gambling with user frustration, abandoned shopping carts, and expensive redesigns that could have been avoided.

Our approach combines qualitative insights with quantitative data to understand what users need versus what we think they want. This dual focus helps us make decisions based on evidence rather than hunches—a distinction that often separates successful products from expensive failures.

What does effective research look like? We've structured our process around four core stages: Discovery, Exploring, Testing, and Listening. Each phase serves a specific purpose, from initial field studies and user interviews to post-launch feedback collection. This systematic approach ensures we're building products that genuinely resonate with the people who use them.

The research also changes how our entire organization thinks about users. Teams develop genuine empathy for customer challenges, keeping human needs at the center of every decision they make. It's one thing to design features; it's another to design solutions that people want to use.

This article shares our proven methodology through real case studies that generated measurable results. You'll see exactly how we applied these research principles to help fintech platforms increase activation rates, e-commerce sites boost conversion, and new products launch with remarkable success metrics.

Our UX Research Philosophy at Netguru

User research shapes everything we build, but philosophy matters more than process. Too many teams treat research like a ritual—they go through the motions without understanding why it works. Our approach centers on genuinely understanding human behavior, rather than merely collecting data points. Early UX research reduces product development cycles by 33-50%, which explains why we've made it fundamental to our methodology.

Designing with empathy and data

Empathy drives our design decisions, but it's empathy informed by evidence. We step away from our assumptions to see products through users' actual experiences- their frustrations, motivations, and daily realities. This perspective helps us create interfaces that feel intuitive because they match how people naturally think and work.

Empathy isn't merely a buzzword for us. It's about stepping into the user's shoes to uncover their underlying needs—even those they might not articulate themselves.

However, empathy alone isn't enough. We balance human understanding with rigorous data collection. Our teams use qualitative methods like interviews and observation alongside quantitative techniques such as analytics and surveys. This combination prevents us from making decisions based purely on emotion or purely on numbers—both approaches miss critical insights.

Take our work with Randstad. We used empathy maps during workshops to understand users deeply, and then synthesized competition research with these insights to create truly user-centered solutions. The empathy revealed what users felt; the data showed what they did.

Why research is embedded in every project?

Research isn't a phase we complete and move on from. We've evolved toward continuous research integrated throughout product development. This shift enables our teams to adapt quickly to changing user preferences and market conditions while fostering a culture where user insights drive every decision.

Three principles guide our approach:

- De-risking development - Research validates concepts before we invest in development, ensuring products align with real user needs.

- Iterative improvement - Continuous feedback allows refinement at every stage.

- Building shared understanding - Research creates common ground among team members about who users are and what they need.

What does this look like in practice? We establish ongoing feedback channels through session recordings, heatmaps, and regular testing to continuously analyze user interactions, identifying improvement areas and tracking how design changes impact behavior.

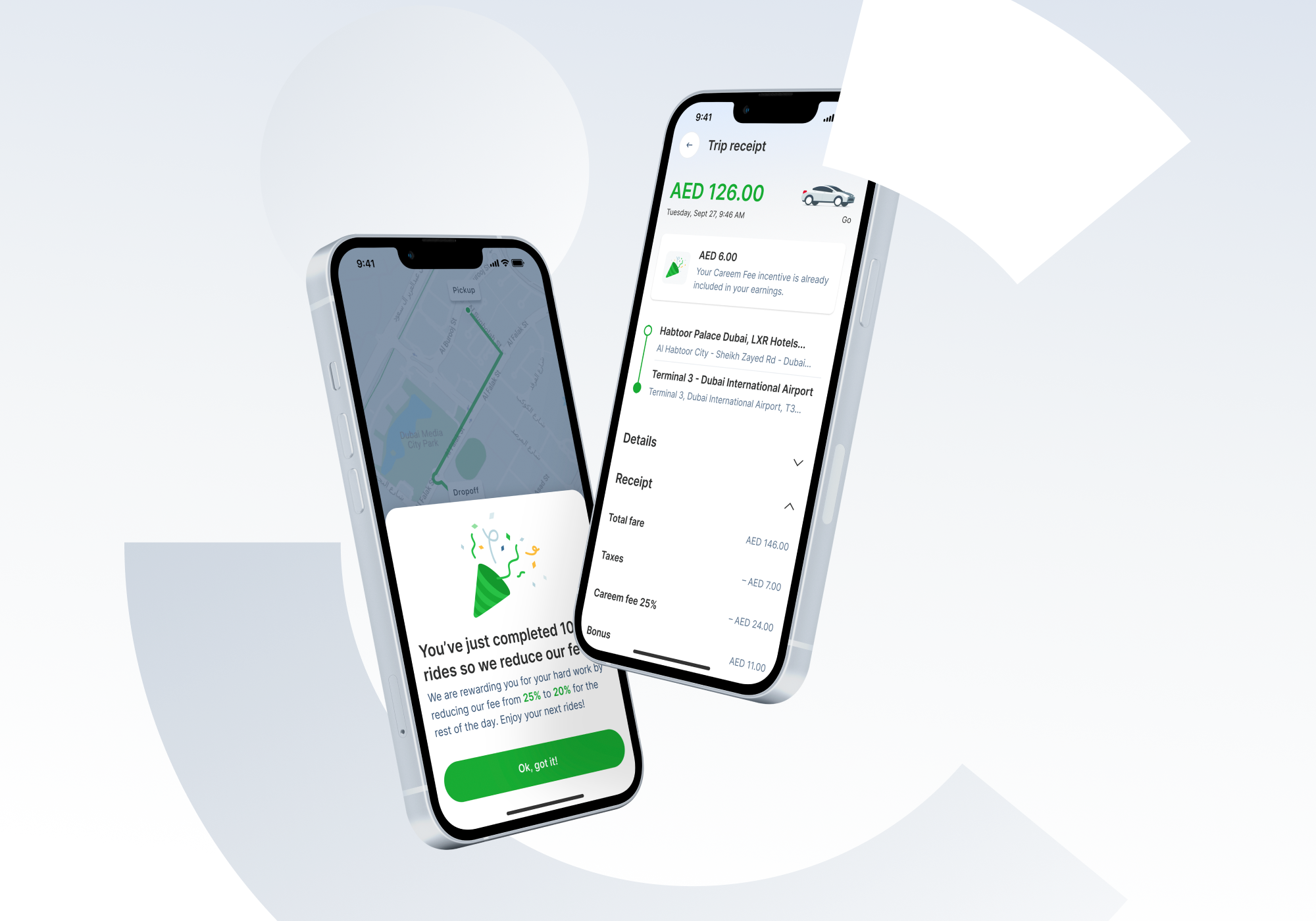

The Careem Captain project exemplifies this approach. UX research was central to improving drivers' experience. We conducted interviews with Captains and team members to identify pain points in user journeys, followed by multiple usability testing sessions to evaluate new flows and designs.

How we define success in UX research?

Success means generating actionable insights that drive meaningful improvements, not just accumulating data. We measure success through several key metrics that balance quantitative measurement with qualitative understanding.

Task success rates form our foundation—the percentage of users who can complete specific actions without assistance. This bottom-line metric gives us clear insight into usability effectiveness. For complex tasks, we sometimes grant partial credit for partial success, depending on the magnitude of user error.

Satisfaction and engagement metrics matter equally. Through Customer Satisfaction Scores (CSS) and Net Promoter Scores (NPS), we gauge users' emotional responses to products.

Conversion and retention metrics connect user experience directly to business outcomes.

Inclusivity and accessibility ensure products work for diverse audiences regardless of abilities or backgrounds. Good design should be universal, not exclusive.

Ultimately our success is measured by our client's success. Creating products that not only work efficiently but genuinely resonate with users.

This philosophy has helped clients like Careem, OLX, and Fundid create products that meet user needs while achieving business goals. Research becomes the bridge between what users want and what businesses need to succeed.

Our UX Research Process: Step-by-Step

Consistency separates successful research from scattered efforts. We've refined our methodology over years of client work, developing a six-step framework that delivers reliable results across industries and project types. Each step builds on the previous one, creating a systematic approach that eliminates guesswork.

1. Define goals and success metrics

Clear objectives drive effective research. We begin by formulating specific research questions that address real problems and opportunities. These questions might explore user behavior (why customers abandon carts), design effectiveness (which CTA performs best), or feature priorities (which capabilities would improve the experience).

Research goals must align with broader business objectives. This connection helps stakeholders understand how user insights translate to measurable outcomes. During our Fundid project, establishing clear goals helped us verify product needs and understand specific challenges affecting female entrepreneurs in the US.

2. Select research methods

Method selection determines the quality of insights you'll gather. We balance different approaches based on what we need to learn:

- Qualitative research (interviews, usability testing) reveals the "why" behind user actions

- Quantitative research (analytics, surveys) measures "how many" and "how much"

The project stage influences method choice. Discovery phases, like our Careem Captain project, benefit from interviews and contextual inquiries to understand user needs. Validation stages require usability testing and A/B testing for concrete evidence.

3. Recruit and screen participants

The right participants make or break research quality. We define ideal user characteristics through demographics, behaviors, goals, and pain points. For OLX Motors Europe, careful screening helped us build meaningful user personas that reflected actual usage patterns.

Screening surveys identify optimal candidates while filtering out poor fits. These questionnaires gather information about candidates' experiences, starting with the most important exclusion criteria to quickly eliminate obvious misfits.

4. Conduct sessions and gather data

Research sessions require structure with flexibility for unexpected discoveries. Our Volkswagen Home interviews followed prepared scripts while allowing deeper exploration when valuable information emerged.

We capture four types of data: observations (what users do), quotes (what they say), interpretations (what their actions mean), and potential solutions. This approach ensures we don't miss critical insights that could shape design decisions.

5. Analyze and synthesize findings

Raw data becomes actionable through careful analysis. We use affinity diagramming—grouping similar observations to identify patterns and themes. This collaborative process reduces cognitive bias and builds shared understanding among team members.

Synthesis means stepping back to see the bigger picture, and translating themes into research insights that answer our core questions. For Randstad, this involved combining empathy maps with competitive research to create truly user-centered solutions.

6. Share insights and implement changes

Communication determines whether insights drive action. Effective research reports include goals, methods, findings, and recommendations. We tailor presentations to specific audiences - emphasizing design recommendations for designers while focusing on business outcomes for stakeholders.

Most importantly, we translate insights into concrete next steps. Our Automarket project exemplifies this approach: findings directly informed improvements to user flows and wireframes, which we then validated through additional usability testing sessions.

Tools and Techniques We Use

The right tools make the difference between surface-level insights and actionable intelligence. We've tested dozens of research platforms over the years, keeping only those that consistently deliver reliable data across different project types and user groups.

User interviews and surveys

Conversations reveal what analytics can't. Our interview approach focuses on 30-60-minute structured sessions that uncover the motivations behind user decisions. The key lies in building genuine rapport without leading participants toward predetermined answers.

Our researchers rely on verbal acknowledgments and nonverbal cues to encourage honest sharing. This technique proved crucial during our Careem Captain project, where driver interviews revealed workflow pain points that never showed up in usage data.

Surveys complement interviews by capturing broader patterns across larger user groups. We've learned to avoid "How likely are you to..." questions in favor of "Have you ever..." prompts that generate more specific, measurable responses. This shift alone improved our data quality significantly.

Session recordings and heatmaps

User behavior tells stories that surveys miss. Heatmap analysis has become one of our most reliable conversion optimization tools.

We deploy different heatmap types for specific insights:

- Clickmaps show engagement patterns with interface elements,

- Scrollmaps reveal how deeply users explore content,

- Dynamic heatmaps track interactions with moving or changing elements.

Each type answers different questions about user intent and attention patterns.

Card sorting and tree testing

Information architecture can make or break user experiences. Card sorting and tree testing form what we call our "navigation duo"—one reveals how users naturally categorize information, while the other tests whether they can find what they need within a proposed structure.

Our process starts with open card sorting to understand user mental models, then moves to closed card sorting or tree testing for validation. This combination helped OLX Motors Europe create navigation that matched actual user expectations rather than internal business logic.

Prototyping tools

Research insights need rapid translation into testable designs. Figma serves as our primary prototyping platform because it enables interactive mockups without coding requirements. The cloud-based collaboration keeps our distributed teams aligned, while AI features handle repetitive design tasks.

The combination of these tools creates a research ecosystem that captures both broad patterns and specific user moments, giving us the complete picture needed for confident design decisions.

Research-Driven Design Leads to Products That Convert

What separates products that succeed from those that fail? The answer lies in understanding users before building solutions.

The case studies we've shared demonstrate this principle in action. Each success followed our systematic approach—defining clear goals, selecting appropriate methods, recruiting the right participants, conducting rigorous sessions, analyzing findings thoughtfully, and implementing data-backed changes.

The tools matter, but they're only as good as the expertise behind them. Session recordings show you where users struggle. Heatmaps reveal what they ignore. User interviews explain why they make certain choices. Yet without the right methodology, even the best tools won't save a product that misses the mark.

Research changes how teams think about users. Instead of building features based on internal assumptions, teams develop genuine empathy for customer challenges. They make decisions rooted in evidence rather than guesswork. This shift in mindset often proves more valuable than any single design improvement.

The pattern holds across industries. Whether we're working with established companies like Randstad and Volkswagen or helping startups like Fundid define their MVP, research-driven design consistently delivers better business outcomes. Products built on thorough user research outperform those based on assumptions every time.

What's your next step? Start by understanding the people you're designing for. Ask the right questions. Test your assumptions. Make decisions based on evidence rather than hope. The difference between products that convert and those that don't often comes down to this simple choice: will you design for real users or imaginary ones?

Research isn't just about creating better experiences—though that happens. It's about creating products that people want to use, recommend, and keep coming back to. That's how you build something that truly converts.