🎤 Expert’s voice

Contents

Listening is fundamental to making real connections.

Think about what the future needs from us

The pain and grief of 2020 has fundamentally changed how those of us alive today understand the world, and I don’t think we can go back to living the way we did in 2019. That’s a hard truth to examine – but it’s also an opportunity.

We have a chance to experience this difficult time as a teacher. What is broken, and what does it need from each of us? What skills do we need to develop to achieve that? The skills that got us here won’t get us where we're going next.

To me, the most fundamental of these is listening. Good listening takes patience, confidence, and curiosity. When you listen well, you can go beyond the obvious and find the interesting.

Look for ways to make remote connections meaningful

Anywhere that people gather, I’m always on the lookout for folks who have big ideas on making progress. In the digital world, that’s usually some combination of LinkedIn and Instagram, but I also make time to have virtual coffee with people I admire. I love to share great writing and big ideas with folks, and I always appreciate it when someone does the same.

Being too focused on an end goal – getting a job, finding a new hire, selling a prospective client – has the tendency to feel inauthentic, and in my experience, gets in the way of really hearing what anyone else is up to.

Curious listening opens the door to actually connect with others – conversations about triumphs, mistakes, and big ideas are not only more fun, but are more likely to lead you to a real need or problem that can be shared. Those moments can help you feel like you belong, which is so lovely when you’re a leader – it can be a lonely road.

I think as soon as it is safe, we will have a real gratitude for the ability to get together in person – but I also think we’ve learned that it’s possible to gather remotely and are experimenting with ways to make that type of connection meaningful as well.

Priya Parker has a great book on this called The Art of Gathering, and I recently heard her interviewed about what makes an online meeting great. Her main point is that whether it’s a room or a video call, the place where you meet is just a room. It doesn’t carry the intention of the meeting. I love that as a way to inspire us to think beyond the gathering. What are we doing to create connection and shared experiences? How does that change based on the nature of the room?

Be wary of paying too much attention to what others are doing

While I was at Ellevest, I tried to avoid watching other companies in the fintech industry too closely. Paying too much attention to everyone else can muddle your vision – just because other companies are adding certain features doesn’t mean it’s right for your business. Most of the time I found that focusing on what everyone else was doing just left the team feeling worried about the decisions they were making.

Instead, pay attention to culture. Money is by nature, cultural. Current events, art, and lived experiences are the best sources for insights about how to meet people where they are with money services that make sense.

Use your influence to improve diversity and inclusion

The finance industry is well known for it’s remarkable exclusivity if you are not white, wealthy, and male – and the tech sector isn’t really leaps and bounds ahead. I think a lot of that has to do with how we measure success as a society. Diversity creates nuance, and nuance creates friction, and friction slows things down.

So when success is defined predominantly as ‘hypergrowth’ by the industry and speed above all else is rewarded by investment dollars, diversity can feel a lot like a handicap. We should be asking ourselves what we celebrate and what we put our money towards if we want to understand why it seems like we can’t achieve equitable workplaces.

👨💻 Startup CEOs

Fintech has no shortage of dynamic CEOs – great leaders who set the company’s vision, deliver strategic expertise, nurture the right culture, and ultimately steer the company on the road to success. To compile this list, we asked our panel of judges to vote on the top CEOs in fintech.

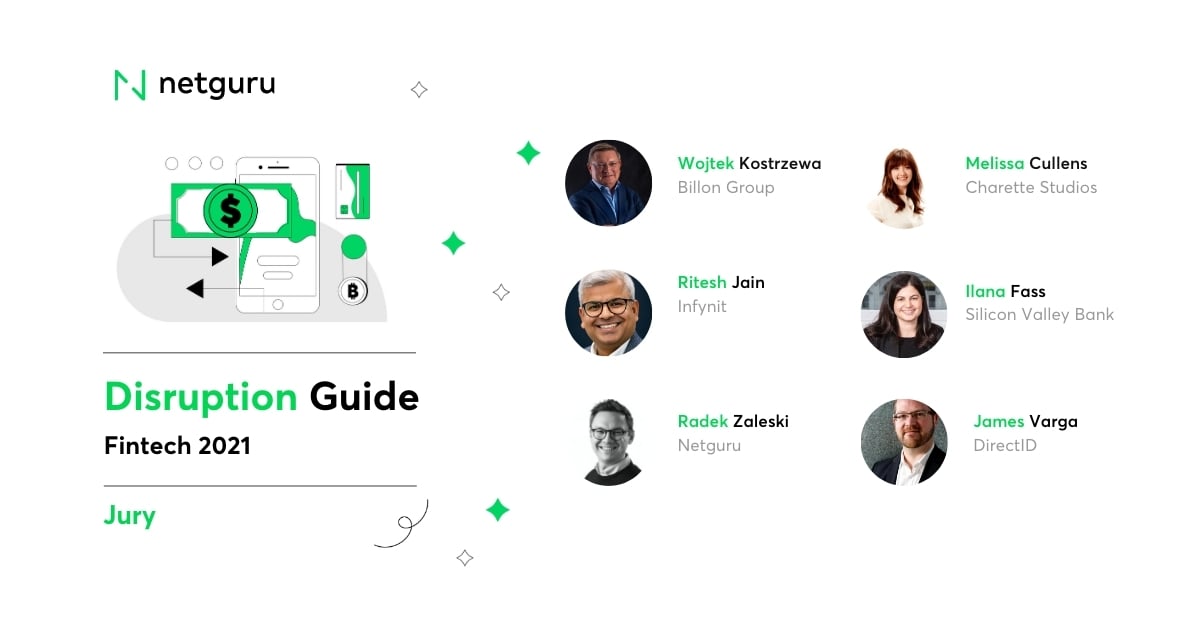

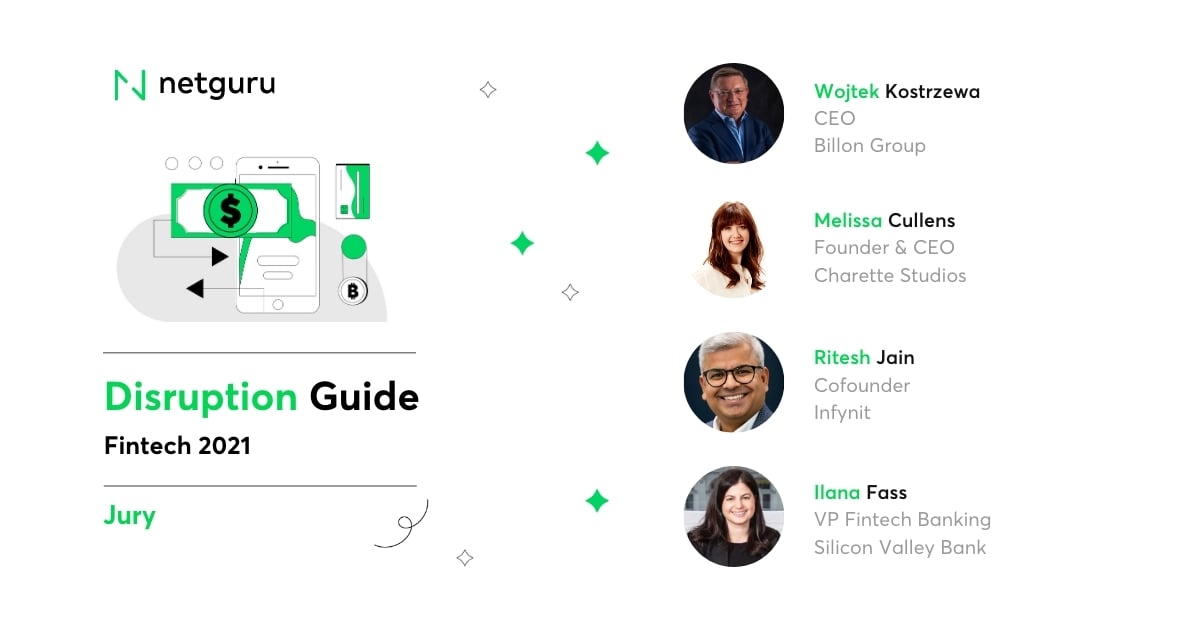

The committee consisted of Wojtek Kostrzewa, Billon Group; Melissa Cullens, Charette Studios; Ritesh Jain, Infynit; Ilana Fass, Silicon Valley Bank; Radek Zaleski, Netguru; and James Varga, DirectID.

1. Anne Boden

Founder and CEO, Starling Bank

Anne Boden founded award-winning challenger bank Starling in 2014. In her 30-year career, Anne has held a string of top positions with financial heavyweights, including Royal Bank of Scotland and Allied Irish Bank. In 2018, she was awarded an MBE for services to financial technology.

Location: London, United Kingdom

Website: starlingbank.com

Social media: LinkedIn / Twitter

2. Tom Blomfield*

President, Monzo

Tom Blomfileld co-founded Monzo in 2015 and served as the company’s CEO until June 2020 when he took on the role of President. Prior to Monzo, Tom co-founded fintech startup GoCardless in San Francisco. He is a regular conference speaker on the topics of banking and fintech.

Location: London, United Kingdom

Website: monzo.com

Social media: LinkedIn / Twitter

*Tom stepped down as President of Monzo in January 2021 after six years with the company.

3. Eric Jing

Executive Chairman, Ant Group

Eric Jing has been the Executive Chairman of Ant Group, an affiliate of e-commerce giant Alibaba Group, since April 2018 and also served as the company’s CEO between 2016 and 2019. An advocate for a sustainable, financially inclusive, and digital world, Eric is reportedly resuming the role of CEO following the resignation of Simon Hu.

Location: Hangzhou, China

Website: antgroup.com

Social media: LinkedIn / Twitter

4. Brian Armstrong

Co-founder and CEO, Coinbase

Brian Armstrong co-founded Coinbase, the largest cryptocurrency exchange in the United States, in 2012. The company became the blockchain industry’s first unicorn in 2017, and in the same year, Brian was included in Fortune’s 40 under 40 list.

Location: San Francisco, United States

Website: coinbase.com

Social media: LinkedIn / Twitter

5. Jacob Pedersen

Co-founder and CEO, Fellow Pay (Formerly CreditStretcher)

Jacob Pedersen is on a mission to change the way SMEs pay and get paid with Fellow Pay, which he co-founded in 2018. Jacob gives his time to several organizations that help startups, including the World Economic Forum (WEF) and the WBAF Global Startup Committee.

Location: Copenhagen, Denmark

Website: fellowpay.com

Social media: LinkedIn

6. Sallie Krawcheck

Co-founder and CEO, Ellevest

Sallie Krawcheck co-founded Ellevest in 2014 with the goal of getting more money into the hands of women. The company is one of the fastest-growing digital investment platforms and has received a raft of accolades. Sallie is a best-selling author and the chair of Ellevate Network, a global professional women's network.

Location: New York, United States

Website: ellevest.com

Social media: LinkedIn / Twitter

7. Chris Larsen

Co-founder and Executive Chairman, Ripple

Chris Larsen co-founded Ripple in 2012 to streamline global payments using blockchain technology. He served as CEO of the company until stepping down in 2016 but remains Executive Chairman. In 2019, Chris, his wife, and nonprofit foundation Rippleworks made a historic donation of $25 Million in XRP to San Francisco State University.

Location: San Francisco, United States

Website: ripple.com

Social media: LinkedIn / Twitter

8. Nikolay Storonsky

Co-founder and CEO, Revolut

Nikolay Storonsky co-founded Revolut, the UK’s fastest-growing financial super app, in 2014. Today, the company is one of Europe’s top unicorns, serving 15 million personal customers and half a million business customers. Nikolay started his career as a derivatives trader at Lehman Brothers, followed by several years at Credit Suisse.

Location: London, United Kingdom

Website: revolut.com

Social media: LinkedIn / Twitter

9. Kenneth Lin

Co-founder and CEO, Credit Karma

Kenneth Lin founded Credit Karma in 2007 after growing tired of paying to see his credit score. Having spent his early career with mission-driven businesses like Upromise and Eloan, he was inspired to pursue his own goal of helping consumers better understand their own financial health. In 2020, Intuit acquired the company in a deal valued at $8.1 billion.

Location: San Francisco, United States

Website: creditkarma.com

Social media: LinkedIn / Twitter

10. Brock Blake

Co-founder and CEO, Lendio

Brock Blake founded Lendio in 2011 out of a passion to make small business lending simple. The company is growing rapidly and has funded more than 216,000 small business loans. In 2020, Brock and his co-founder, Trent Miskin, were named as winners of the EY Entrepreneur Of The Year Utah Region Award.

Location: Salt Lake City, United States

Website: lendio.com

Social media: LinkedIn / Twitter

👨💼 Corporate Innovators

Fintech exists to solve problems, which makes innovation the lifeblood of the industry. The most successful fintech companies have visionary leaders who not only push the boundaries of innovation but inspire their employees to do the same. To compile this list, we asked our panel of judges to vote on the top corporate innovators in fintech.

The committee consisted of Wojtek Kostrzewa, Billon Group; Melissa Cullens, Charette Studios; Ritesh Jain, Infynit; Ilana Fass, Silicon Valley Bank; and Konrad Jarociński, Netguru.

1. Lindsey Argalas

CEO, PagoNxt

In her current role, Lindsey Argalas is striving to deliver innovative digital solutions in the areas of P2P and P2M, digital wallet, and financial inclusion. Prior to this, she spent three years as Chief Digital & Innovation Officer at Banco Santander, where she led the digital, innovation, and platform agenda.

Location: San Francisco, United States

Website: pagonxt.com

Social media: LinkedIn

2. Katy Huberty

Managing Director, Morgan Stanley

Katy Huberty has been a Managing Director in Research at Morgan Stanley for over 20 years. In her equity analyst role, she collaborates with data scientists to gain better insights into how leading tech players are disrupting their markets. Katy also sits on the Morgan Stanley Research Operating Committee and Artificial Intelligence Steering Committee.

Location: New York, United States

Website: morganstanley.com

Social media: LinkedIn

3. Lisa Frazier

Chief Innovation Officer, Wells Fargo

An expert in digital transformation, Lisa Frazier leads the Enterprise Innovation Group at Wells Fargo. In her role, she is focused on developing next-generation technology platforms for the bank, including artificial intelligence and distributed ledger technology. Lisa is also President of the Wells Fargo Startup Accelerator program.

Location: San Francisco, United States

Website: wellsfargo.com

Social media: LinkedIn

4. Megan Brewer Koptchev

Global Head of the Technology Innovation Office, Morgan Stanley

Megan Brewer Koptchev has over 15 years of experience in senior innovation roles with financial institutions. Prior to her current role with Morgan Stanley, she spent five years as Head of Innovation at Credit Suisse, where she was responsible for connecting business divisions to the fintech ecosystem.

Location: New York, United States

Website: morganstanley.com

Social media: LinkedIn

5. Danielle Fava

Head of Strategic Development, Envestnet

Danielle Fava leads strategy for Envestnet, delivering products that future-proof the registered investment advisor (RIA) industry. Before joining Envestnet, Danielle held roles with major institutions, including Citi. She was named a Woman to Watch by Investment News in 2020 and one of the Top 16 Women in Wealthtech by ThinkAdvisor in 2019.

Location: West Chester, United States

Website: envestnet.com

Social media: LinkedIn / Twitter

6. Ben Rayner

Head of Innovation and Productivity, Citigroup Global Capital Markets Operations and Technology

Ben Rayner moved to Citigroup in 2005 and was appointed Head of Innovation and Productivity in 2015. In his current role, he runs a practice that focuses on new product innovation, developing and deploying emerging technologies across the organization, data analytics, and workforce management. Ben is a certified Six Sigma Black Belt.

Location: London, United Kingdom

Website: citigroup.com

Social media: LinkedIn

7. Ekaterina Frolovicheva

VP, Digital partnerships and innovation, Gazprombank

Ekaterina Frolovicheva leads digital distribution and partnerships at Gazprombank. In her role, Ekaterina is responsible for overseeing the bank’s innovation hub, which includes a CX and UX lab, startup acceleration program, and technology adoption team. She is a regular speaker at fintech events.

Location: Moscow, Russia

Website: gazprombank.ru

Social media: LinkedIn

8. Delphine Maisonneuve

CEO of AXA Next & Group Chief Innovation Officer, AXA

Delphine Maisonneuve is CEO of AXA Next, the innovation ecosystem of the AXA Group. Made of up eight units designed to accelerate innovation, AXA Next was created to tackle emerging and global risks, drive innovative solutions for populations and communities, and improve customer experience.

Location: Paris, France

Website: axa.com

Social media: LinkedIn / Twitter

9. Megan (Caywood) Cooper

Managing Director, Head of Digital Strategy, Barclays

In 2016, Megan Cooper relocated from San Francisco to the UK on an Exceptional Talent visa to help set up Starling Bank as Chief Platform Officer. She joined Barclays as Head of Digital Strategy in 2019. Megan has received a string of accolades throughout her career, including being named to Business Insider’s Top Women in Fintech list and Forbes 30 under 30.

Location: London, United Kingdom

Website: barclays.co.uk

Social media: LinkedIn / Twitter

10. Giovanni Giuliani

Chief Strategy, Innovation & Business Development Officer, Zurich Insurance

Giovanni Giuliani joined Zurich Insurance in 2016 with the aim of expanding the business using a customer-led innovation strategy. Each year, he gives entrepreneurs an opportunity to shape the insurance industry through the Zurich Innovation Championship. Prior to Zurich, Giovanni spent 14 years at McKinsey & Company.

Location: Zürich, Switzerland

Website: zurich.com

Social media: LinkedIn

💁🏼 Thought Leaders & Authors

As you navigate any industry, it’s valuable to have a diversity of perspectives from educated sources. The people on this list are not only experts in their field but are among the most respected in the fintech space. To compile this list, we asked our panel of judges to vote on top thought leaders in fintech.

The committee consisted of Wojtek Kostrzewa, Billon Group; Melissa Cullens, Ritesh Jain, Infynit; and Ilana Fass, Silicon Valley Bank.

1. Anne Boden

Founder and CEO, Starling Bank

Anne Boden founded award-winning challenger bank Starling in 2014. In her 30-year career prior to Starling, Anne held a string of top positions with financial heavyweights, including Royal Bank of Scotland and Allied Irish Bank. In 2018, she was awarded an MBE for services to financial technology.

Location: London, United Kingdom

Website: starlingbank.com

Social media: LinkedIn / Twitter

2. Christine Lagarde

President, European Central Bank

Named by Forbes as the second most powerful woman in the world, Christine Lagarde began her career as a lawyer and politician. She was the first woman to hold the roles of France’s Finance Minister, Managing Director of the International Monetary Fund, and President of the European Central Bank, which she was appointed to in 2019.

Location: Frankfurt, Germany

Website: ecb.europa.eu

Social media: LinkedIn / Twitter

3. Efi Pylarinou

Founder, Efi Pylarinou Advisory

Efi Pylarinou is an independent advisor covering finance, fintech, and blockchain. She is widely regarded as a global influencer, and, alongside many other accolades, Efi was ranked the number one woman influencer on the RefinitivSocial100 list in 2019 and 2020. She is also a renowned author and international speaker on blockchain and fintech trends.

Location: Fribourg, Switzerland

Website: efipylarinou.com

Social media: LinkedIn / Twitter

4. Denise Chisholm

Sector Strategist, Fidelity Investments

Through her 20 year career, Denise Chisholm has worked in many capacities, from equity analyst to portfolio manager and now sector strategist. Denise strives to uncover the best insights for shareholders and regularly shares visuals and succinct video explainers about market trends. She was named to LinkedIn’s annual Top Voices list for 2020.

Location: Boston, United States

Website: fidelity.com

Social media: LinkedIn / Twitter

5. Marcel van Oost

Fintech Startup Investor/Advisor, Marcel van Oost

Marcel van Oost is an advisor and connector to companies in the banking and fintech space. After starting his career with acquiring bank PaySquare, Marcel founded his own payments consultancy company, followed by a payment service provider, which completed its exit in 2017. He is also a fintech commentator through his blog and LinkedIn.

Location: Amsterdam, Netherlands

Website: marcelvanoost.nl

Social media: LinkedIn / Twitter

6. Larysa Melnychuk

Founder and CEO, FP&A Trends Group; Managing Director, International FP&A Board

Larysa Melnychuk founded the FP&A Trends Group, a leading resource for financial planning and analysis professionals, in 2012. She went on to set up the International FP&A Board, a highly-regarded professional think-tank, in 2013 and has since expanded it into 27 chapters in 16 countries. Larysa is a passionate conference speaker on FP&A-related topics.

Location: London, United Kingdom

Website: fpa-trends.com

Social media: LinkedIn / Twitter

7. Kristina Hooper

Chief Global Market Strategist, Invesco US

Prior to joining Invesco, Kristina Hooper began her career in the financial industry in 1995 and held various senior roles at Allianz Global Investors spanning 13 years. Kristina has been regularly quoted in leading publications, including The New York Times, The Wall Street Journal, and Reuters. She has also been a keynote speaker at numerous national and regional conferences.

Location: New York, United States

Website: invesco.com

Social media: LinkedIn / Twitter

8. Ritesh Jain

Founder & Publisher, World Out Of Whack

Ritesh Jain is a trend watcher, global macro investor, and former CIO at BNP Paribas Asset Management in India. On his blog, Ritesh writes about macro opportunities and challenges, economics, business, and financial issues. He has more than 20 years of experience in financial markets and was one of LinkedIn’s Top Voices in 2019.

Location: Calgary Canada

Website: worldoutofwhack.com

Social media: LinkedIn / Twitter

9. Chris Skinner

CEO, The Financer

Chris Skinner writes daily about fintech and the financial markets on his blog The Finanser. Alongside his blog, he supports the next generation of fintech innovators as Non-Executive Director of consultancy 11:FS and Global Ambassador for Innovate Finance. Chris is a regular conference and podcast speaker and the author of 14 books.

Location: Konstancin-Jeziorna, Poland

Website: thefinanser.com

Social media: LinkedIn / Twitter

10. Sonia Wedrychowicz

Senior Advisor, McKinsey & Company

Sonia Wedrychowicz has over 25 years of experience in financial services and technology, having spent her career in major banking organizations, including JPMorgan Chase, DBS Bank, and Citi. Sonia is a Power Profile on LinkedIn and has been a keynote speaker at over 50 conferences worldwide covering digital banking and technology transformation.

Location: United Arab Emirates

Website: mckinsey.com

Social media: LinkedIn / Twitter

11. Yulia Chernova

Reporter, The Wall Street Journal

Yulia Chernova covers technology, startup, and venture capital news for the Wall Street Journal, including her weekly column, Chernova's Take. Throughout her career, Yulia has been recognized with many awards and is a winner of the William R. Clabby Dow Jones Newswires Award, Newswires’ highest internal honor for outstanding journalism.

Location: New York, United States

Website: wsj.com

Social media: LinkedIn / Twitter

12. Isabel Woodford

Senior Reporter, Sifted

Isabel Woodford is a Senior Reporter at Sifted, covering the European tech and startup scene. Prior to Sifted, Isabel was a reporter at US fintech news publication The Block, where she helped to grow its monthly readership from 100,000 to over a million. She has also been featured in The New York Times, Reuters, and The Guardian.

Location: London, United Kingdom

Website: sifted.eu

Social media: LinkedIn / Twitter

👩🎨 Design Directors

At the heart of every successful company is great design. From building outstanding products to creating memorable marketing campaigns, good design puts users firmly in the center. To celebrate the creative leaders shaping the world of fintech, we asked our panel to select ten of the best.

The committee consisted of Wojtek Kostrzewa, Billon Group; Melissa Cullens, Charette Studios; Ritesh Jain, Infynit; Bartosz Białek, Netguru.

1. Cynthia Maller

Head of CGI, Walmart

Cynthia Maller has spent more than two decades working in senior creative roles for leading brands, including Yahoo, Johnson & Johnson, and PayPal. Now at Walmart, she is Head of CGI for Walmart, Art.com, and Hayneedle, two of Walmart's first digitally-native verticals. Cynthia is a regular conference and podcast speaker on the topics of AR and VR.

Location: San Francisco, United States

Website: walmart.com

Social media: LinkedIn

2. Zane Bevan

Creative Director, Robinhood

At Robinhood, Zane Bevan has led a tight-knit design team for almost eight years. The company’s app has won several awards, including an Apple Design award in 2015, a prize only given to 12 apps that year. Prior to Robinhood, Zane received a BFA in Graphic Design from Virginia Commonwealth University before embarking on a career in graphic design.

Location: Redwood City, United States

Website: robinhood.com

Social media: LinkedIn / Twitter

3. Hugo Cornejo

VP of Design, Monzo Bank

Hugo Cornejo was part of the founding team at Monzo and the only designer. Today, he leads a team of 30 people spanning product design, visual design, and user research. Together, they have created an app that serves more than 5 million customers and is changing the way people bank.

Location: London, United Kingdom

Website: monzo.com

Social media: LinkedIn / Twitter

4. Dmitry Scheglov

Design Lead, Revolut

Dmitry Scheglov joined Revolut in 2018 after spending five years as Head of Design at Sberbank, Russia’s largest bank. Dmitry previously stated that everything Revolut does is design-driven – even managers and developers are design-addicts. The company now has more than 15 million personal customers and half a million business customers.

Location: London, United Kingdom

Website: revolut.com

Social media: LinkedIn / Twitter

5. Charlotte Wilkinson

Creative Director, Zopa

Charlotte Wilkinson spent much of her early career working for arts and charity organizations, most notably with the National Theatre, where she became the company’s first female Creative Director in 2010. Charlotte joined the innovative peer-to-peer lender Zopa in 2018 alongside freelancing for clients including the English National Ballet.

Location: London, United Kingdom

Website: zopa.com

Social media: LinkedIn

6. Thomas Foster

Global Head of Service Design, J.P. Morgan

Thomas Foster has been leading the introduction of design as a core business capability for more than 20 years. An experienced human-centered designer, Thomas has worked in various roles for companies including Orange, Cisco, and IBM. He joined J.P. Morgan in 2017 and is currently Global Head of Service Design.

Location: London, United Kingdom

Website: jpmorgan.com

Social media: LinkedIn / Twitter

7. David Rivers

Global Digital Creative Director, HSBC

Throughout his career, David Rivers has worked in creative roles with a range of prestigious brands such as OgilvyOne and Satchi & Satchi. He has won numerous industry awards, including a Cannes Grand Prix. David joined HSBC as Global Digital Creative Director in 2017.

Location: London, United Kingdom

Website: hsbc.com

Social media: LinkedIn / Twitter

8. Connie Yang

Design Leader, Stripe

At Stripe, Connie Yang leads design on payments, connect, billing, and climate. Connie has experience of scaling a design team in a fast-paced environment, having spent two years as Head of Design at fellow San Francisco fintech Coinbase. While there, she grew her team from 3 to 22 in just a year.

Location: San Francisco, United States

Website: stripe.com

Social media: LinkedIn / Twitter

9. Chris Irwin

Creative Director, Capital One

An award-winning Creative Director, Chris Irwin leads creative for Capital One Commercial Bank's brand strategy, social media, brand activation events, experiential, and the Capital One Arena. Chris has over a decade of experience in creative roles and is Nielsen Norman Group UX Certified.

Location: New York, United States

Website: capitalone.com

Social media: LinkedIn / Twitter

10. Danielle Macdonald

Design Director, Wise

Danielle Macdonald has almost a decade of experience in user research and strategy-related roles with companies that include Facebook and Bankwest. Danielle joined Wise in 2020 and is focused on ensuring that customer insights drive decision making, alongside a passion for user satisfaction through user-centered design.

Location: London, United Kingdom

Website: wise.com

Social media: LinkedIn

🗓 Events

From keeping your knowledge up-to-date to making crucial personal connections, events are a great way to pack a lot of value into a short time. We scoured the internet and mined our personal experiences to bring you ten of the biggest and best fintech events happening around the world in 2021.

1. The US Fintech Symposium

Discuss practical innovations at the intersection of finance and advanced technology

The US Fintech Symposium aims to foster meaningful conversation around the practical uses of advanced enterprise technologies in financial services. Over two days, attendees will get professional networking opportunities alongside educational sessions.

Date: 23 - 24 September 2021

Location: Chicago, United States

Key speakers: Trupti Natu, Uber; Chuck Xenakis, JPMorgan Chase Global Technology

Topics: Blockchain, AI & machine learning, real time payments & reporting, robotic process automation, open banking & banking APIs.

Website: fintechsymposium.com

Social media: LinkedIn / Twitter

2. FinovateEurope

Discover the innovators and ideas at the forefront of banking and financial services

FinovateEurope offers a mix of keynotes, fireside chats, demos, and panel discussions – live or on-demand – from a large pool of speakers, analysts, innovators, and experts. Delegates can network and connect virtually with more than 1,000 attendees.

Date: 23 - 25 March 2021

Location: Online

Key speakers: Katharina Lueth, Raisin; Joe Lichtenberg, InterSystems; Steve Suarez, HSBC; Jessica Colvin, J. P. Morgan.

Topics: Innovation, digital transformation, digital engagement & CX, open banking, strategy, and more.

Website: informaconnect.com/finovateeurope

Social media: LinkedIn / Twitter

3. Empire Fintech Conference

Attend a packed day of keynotes, demos, live podcasts, and networking to see the latest in fintech

A highlight of New York Fintech Week, the conference brings together over 600 attendees to hear from speakers who are forging new trails across the world of fintech. Also meet the investors and service providers that help accelerate startups.

Date: 19 October 2021

Location: New York, United States

Key speakers: Steve Mclaughlin, FT Partners; Sheila Bair, Federal Depository Insurance Corporation; Valentin Stalf, N26.

Topics: Payments, blockchain, lending, wealth, insurtech, real estate, and more.

Website: empirestartups.com/events/fintech-conference

Social media: LinkedIn / Twitter

4. Mobey Forum Member Meetings

Connect with fellow Mobey Forum members to explore finance in the digital age

Member Meetings are exclusive to members of Mobey Forum and take place quarterly. They bring together innovation leaders, decision makers, thought leaders, and domain experts to explore and shed light on the innovation strategies of banks globally.

Date: 20 April 2021

Location: Online

Key speakers: Tanja Hessdoerfer, Giesecke+Devrient; Ville Sointu, Nordea.

Topics: Digital currencies and more.

Website: mobeyforum.org/member-meetings

Social media: LinkedIn / Twitter

5. Future of Fintech

Look at what’s ahead in fintech with the popular event hosted by CB Insights

Now in its sixth year, the Future of Fintech addresses today’s most pressing challenges and looks at what’s next for the industry. The event brings together executives from disruptive startups, major financial institutions, and the venture capital community.

Date: TBA

Location: TBA

Key speakers: TBA

Topics: Banking, payments, lending, wealth management, and insurance.

Website: events.cbinsights.com/future-of-fintech

Social media: LinkedIn / Twitter

6. Fintech World Forum

Join 200 delegates for 48 hours of discussions on the hot topics defining fintech in 2021

Fintech World Forum brings together 25 speakers and 200 delegates for keynotes, panel discussions, and networking opportunities. The event covers everything from the technologies currently shaping fintech to the future of financial services.

Date: 25 - 26 March 2021

Location: Online

Key speakers: Ricky Knox, Tandem Bank; Siri G. Børsum, Huawei; Emmanuel Marchal, ConsenSys; Nigel Vierdon, Railsbank; Caroline Kaeb, European Commission, DG CONNECT; Katrin Herrling, Funding Xchange; Sophie Guibaud, OpenPayd; Richard Davies, Allica Bank; Søren F. Mortensen, IBM.

Topics: Blockchain, open banking, AI and machine learning, cryptocurrency, regtech, wealthtech, digital transformation, and more.

Website: fintechconferences.com

Social media: Twitter

7. Fintech Talents

Experience a fintech festival featuring speakers and conversations alongside craft beer and live music

The Fintech Talents festival is a hybrid fintech event connecting tech startups, financial institutions, and academia. More than 3,000 festival-goers enjoy speakers, over 100 hours of content sessions, live tech demos, craft beer, and live music.

Date: November 2021

Location: London, United Kingdom

Key speakers: TBA

Topics: TBA

Website: fintechtalents.com/london

Social media: LinkedIn / Twitter

8. Blockchain Expo Global

Explore the key industries that are set to be most disrupted by Blockchain

Hosting its fifth annual global event, the Blockchain Expo brings together more than 5,000 attendees from across the globe. Across two days of content and discussion, over 100 speakers share their industry knowledge and real-life experiences.

Date: 6 - 7 September 2021 (online 13 - 15 September 2021)

Location: London, United Kingdom, and online

Key speakers: Patrick O’Donnell, Mastercard; William Lovell, Bank of England; Rahul Vijay, Uber; and more.

Topics: Blockchain, AI & big data, Cybersecurity & cloud, and IoT.

Website: blockchain-expo.com/global

Social media: LinkedIn / Twitter

9. Paris Fintech Forum

Tune in to an exclusive collection of digital events spread throughout the year

One of the major global international events covering fintech, Paris Fintech Forum has reinvented itself for 2021. Rather than the usual two-day format, this year will see the same rich content organised across a series of events.

Date: Events throughout the year, starting on 25 March 2021

Location: Online

Key speakers: Yoni Assia, eToro; Thierry Bedoin, Banque de France; Anne Boden, Starling Bank; Ann Cairns, Mastercard; and more.

Topics: Payments, open banking, digital assets, sustainable finance, beyond finance, and global fintech.

Website: parisfintechforum.com

Social media: LinkedIn / Twitter

10. MoneyFest

Get five half days of big ideas and practical insights delivered straight to your screen

Attendees can join live or catch up on-demand as MoneyFest presents 35 industry insiders, 5 keynotes, and 7 deep-dive panel discussions tackling what’s next in fintech. This free online event covers all angles, from regulators to unicorns and global banks to tech titans.

Date: 19 - 23 April 2021

Location: Online

Key speakers: TBA

Topics: TBA

Website: money2020.com/moneyfest

Social media: LinkedIn / Twitter

*11. Disruption Forum Fintech

Learn what’s next in fintech from some of the brightest minds in the industry

Disruption Forum Fintech gathers influential speakers from across the fintech ecosystem to examine the trends shaping the industry. This free one-day event gives attendees a chance to network while getting expert insights from leading companies.

Date: 13 April 2021

Location: Online

Key speakers: Andrés López Josenge, Visa; Isabel Woodford, Sifted; Nivin Al Kuzbari, Société Générale; Paulina Skrzypińska, BNP Paribas.

Topics: Innovation, payments, design trends & ethics, and more.

Website: netguru.com/disruption/events/fintech-forum

Social media: LinkedIn / Twitter

*Ok, so this one’s a Netguru event! Disruption Forum Fintech is relatively new on the world circuit, and early feedback has been overwhelmingly positive. We hope to turn it into one of the highlights of the year – and one day make it onto our top ten list too!

🎤 Expert’s voice 2

Diversity and inclusion are critical to growth.

Networking creates a wealth of opportunities

Fundamentally, networking allows individuals to build networks with people who have complementary interests and values. This often leads to opportunities to hire, source new clients, and develop partnerships.

As a community of around 1,200 entrepreneurs in fintech and cybersecurity, it’s fantastic to see our members being able to share their ideas and expertise with each other so freely, whether their talents lie in exploring new markets, approaching investors, scaling their teams, or engaging with corporates.

The main tool I use to network in the virtual space is LinkedIn. Personally, I like to connect with someone once I’ve met them. I send a short personal message to re-introduce myself and also to remind them of our conversation or reason for connecting. LinkedIn is a powerful tool to identify relevant profiles, connect internationally, and join special interest groups that I think are relevant to our community.

Virtual options have made events more accessible

In the wake of multiple lockdowns both in the UK and globally, the events industry has rapidly pivoted by offering advanced tools for virtual engagement, collaboration, and networking. Platforms such as HopIn and Remo, for example, have enabled organizations to continue building relationships in a virtual setting.

Additionally, virtual events allow the organizer to widen their audience as attendees no longer have to travel, often overseas, to attend. This means attendees are able to join events hosted anywhere in the world, and they can easily opt-in and out of viewing content.

However, personally, no tool can ever replace the energy and serendipitous nature of face to face networking, and I look forward to in-person events returning in 2021 once it’s safe to do so.

LinkedIn and Twitter are my go-to sources for insights

At Level39, our international network is made up of entrepreneurs, investors, corporates, governments, and academics. Many of them share news and updates through LinkedIn and Twitter, which are my go-to sources for fresh tech insights.

I also follow some well-known tech journalists online who tend to cover emerging technologies and trends, insights from founders, and companies to watch. Some tech publications I’d recommend reading include Sifted, AltFi, FinExtra, Computer Weekly, and City AM.

Diverse teams outperform homogeneous ones

The biggest challenge facing the tech sector right now is the representation of talent from diverse backgrounds, spanning gender, race, disability, and other protected characteristics. It is critical to have a diverse workforce – innovation, creativity, and agility are only possible when a business has diverse talent and an inclusive culture.

It is well known that diverse teams outperform homogeneous ones, so diversity and inclusion practices must be implemented as part of the growth strategy of any business.

In recent years we have seen an increased number of organizations shining a spotlight on the lack of diversity and inclusion within the tech sector, specifically fintech and financial services. The research and data provided by these organizations have been vital in identifying challenges faced by those working in the sector and driving the industry to become a more inclusive space.

At Level39, we are a proud supporter of the Fintech for All Charter – an initiative launched in 2020 by InChorus, an organization providing analytics and data-led training to build more inclusive workplaces. The Charter – supported by Level39, Innovate Finance, Fintech Alliance, Anthemis, the FCA, and more – was set up following InChorus’ research into the key challenges facing the fintech industry. In particular, the research highlighted the micro-aggressions and harassment experienced by individuals working within the sector.

The Charter aims to provide resources and tools to organizations to enable them to develop diverse and inclusive best practices and bring the sector together to tackle harassment and foster inclusion in order to support sustainable growth.

Remote working has widened the talent pool

Following the developments in Fintech, Big Data, AI, and regtech in recent years, I expect we’ll continue to see a growing need for skills in data science and analysis, AI and ML, cybersecurity, and compliance, to name just a few. Roles that require these skills are in high demand and are expensive to fill, especially in London, but a benefit of the prolonged lockdown is the move to more flexible and remote working.

This shift opens an important avenue for companies who have only ever considered hiring in a location, but current circumstances mean they now have a pool of eligible candidates across the UK and around the world to consider.