🎤 Expert's voice

Contents

Every investment must have the potential to become a home run

2020 brought many interesting acquisitions in the fintech space

Visa’s proposed acquisition of Plaid was a substantial deal and the first big M&A transaction in the open banking space. Ultimately, it didn’t go through, but it’s a great example of Fintech 2.0.

While the first wave of fintech was focused on democratizing the frontend of existing financial services, the second wave is more focused on implementing applied tech through infrastructure and the middle layer.

Although a more modest exit, I believe Stripe's acquisition of Paystack will have a great positive impact on the African fintech ecosystem. It will bring attention, funding, and talent to one of the regions where fintech can have the most profound impact.

Looking back to 2020 and the impact of the pandemic, I have to say that it was an excellent example of the old saying, “Necessity is the mother of invention.” Many tech companies and the startup ecosystem as a whole provided – and are continuing to provide – innovative solutions to the unprecedented problems we’ve faced. This is especially true when it comes to payments, online banking, and infrastructure.

Looking ahead to the next five to ten years

I see two very important ingredients that will further the growth of the startup ecosystem: talented entrepreneurs and capital willing to invest in tech.

An increase in successful ventures always has a major impact on the venture space as former employees, founders, and business partners gain valuable experience that can translate into more high-caliber startups. As a consequence, we see many "venture mafias" popping up after a venture’s success – from the Rapi-mafia to UI-path-mafia.

Also, the attractiveness for institutional investors has improved greatly. This has been due to:

- The outperformance of tech stocks in public markets.

- The success of IPOs and SPACs, especially in tech.

- The more predictable fund performance of venture and growth equity funds.

There are multiple factors to consider when analyzing a potential investment

The importance of these factors depends on the space, maturity, and even geography of the company. Having said that, the top three factors I consider most relevant in the stages I operate in (Seed – Series B) are:

- Team. A team that is able to execute on the vision and can pivot and navigate difficult times.

- Market timing and size. Is the market ready for the innovation the solution delivers, or is it already too late? Is the market big enough and growing?

- Initial validation. Be it on the product side or traction side, we expect some type of initial results (though pre-seed might be different).

Venture investors intend to invest in outliers that are able to return a big portion – if not all – of the fund and compensate for the writing-off of unsuccessful portfolio companies. Therefore, every investment needs to have the potential to become a home run (fund returner) – that is the most successful investment you can have in venture.

However, from my personal experience, venture isn't so binary and has more outcomes:

- Write-offs – multiple of 0x

- Saves – multiple of around 1x

- Small to large wins – multiple of 3-15x

- Fund returners

The key for startup founders is strong execution

After a successful fundraising round, entrepreneurs sit on top of a lot of money and need to execute on the vision and business plan they agreed on with investors. This often means aggressive growth – from hiring to performance marketing – which can be a challenge for entrepreneurs. I have seen great entrepreneurs failing after massive rounds due to mediocre execution.

The remedy is to hire and fire fast, don't fall in love with a certain go-to-market strategy, and surround yourself with people better than yourself.

🦄 Unicorns

Unicorns – private startups valued at over $1 billion – used to be rare. Now, there are more than 500 unicorns around the world, and fintech companies are strongly represented. To compile this list, our experts combined their insights and experience with valuation data from sources such as StartupsTips to bring you ten unicorns to watch in 2021.

1. Stripe

Payment processing software that provides economic infrastructure for the internet

Stripe offers a suite of payment APIs that are used by businesses – from new startups to giants like Salesforce and Facebook – to accept online payments and run technically sophisticated financial operations in more than 100 countries.

HQ Location: San Francisco, United States

Valuation: $36B

Industry: Payments Processing & Networks

Website: stripe.com

Social media: LinkedIn / Twitter

2. Ripple

Technology for sending money globally using the power of blockchain

Ripple unifies the infrastructure underlying global payments to enable the secure transfer of funds in any currency in real time. The company aims to accelerate value exchange in the Internet of Value (IoV) – creating a world where money moves like information does today.

HQ Location: San Francisco, United States

Valuation: $10B

Industry: Crypto

Website: ripple.com

Social media: LinkedIn / Twitter

3. Robinhood

Platform offering commission-free trading of stocks, ETFs, options, and cryptocurrencies

On a mission to democratize finance, Robinhood offers a mobile app and web platform that aims to make investing in financial markets more affordable, intuitive, and fun, no matter how much experience an investor has.

HQ Location: Menlo Park, United States

Valuation: $8.3B

Industry: Retail Investing & Secondary Markets

Website: robinhood.com

Social media: LinkedIn / Twitter

4. Coinbase

Digital currency wallet and platform that makes it easy to buy, sell, and store cryptocurrency

Coinbase is the leading mainstream cryptocurrency exchange in the United States. The company offers merchants and consumers a secure platform that allows them to transact with new digital currencies like bitcoin, ethereum, and litecoin.

HQ Location: San Francisco, United States

Valuation: $8B

Industry: Crypto

Website: coinbase.com

Social media: LinkedIn / Twitter

5. Chime

Online-only bank that provides fee-free financial services via its mobile app

One of the fastest-growing banks in the United States, Chime aims to help its members get ahead by offering a simple range of free personal banking products. The company boasts fee-free overdrafts, no hidden fees, and early direct deposit.

HQ Location: San Francisco, United States

Valuation: $5.8B

Industry: Digital Banking

Website: chime.com

Social media: LinkedIn / Twitter

6. Revolut

Range of solutions making up the world’s first global financial superapp

Revolut provides digital banking services to half a million businesses and more than 12 million personal customers. Through its mobile app, customers can exchange, send, and receive 27+ currencies instantly with no hidden fees.

HQ Location: London, United Kingdom

Valuation: $5.5B

Industry: Digital Banking

Website: revolut.com

Social media: LinkedIn / Twitter

7. Klarna

Payment solutions that aim to make paying as simple, safe, and smooth as possible

Now one of Europe’s largest banks, Klarna allows online shoppers to purchase from major retailers without paying upfront. The company offers direct payments, pay after delivery options, and installment plans in a smooth one-click purchase experience.

HQ Location: Stockholm, Sweden

Valuation: $5.5B

Industry: POS & Consumer Lending

Website: klarna.com

Social media: LinkedIn / Twitter

8. Wise

Money transfer service that allows users to transfer and exchange money internationally

Serving over 10 million customers, Wise (formerly TransferWise) aims to make moving money abroad low-cost, fast, and easy. The company has recently added a multi-currency account, which allows customers to hold and convert over 50 currencies at once.

HQ Location: London, United Kingdom

Valuation: $5B

Industry: Mobile Wallets & Remittances

Website: wise.com

Social media: LinkedIn / Twitter

9. Toast

Cloud-based point of sale technology that is transforming the restaurant industry

Toast offers a suite of restaurant management products that digitally transform point of sale, front of house, back of house, and guest-facing areas. The company aims to enable its community of restaurateurs to delight their guests, do what they love, and thrive.

HQ Location: Boston, United States

Valuation: $4.9B

Industry: Payments Processing & Networks

Website: pos.toasttab.com

Social media: LinkedIn / Twitter

10. SoFi

Mobile-first platform that aims to help customers get their money right

SoFi is a personal finance company that allows customers to borrow, save, spend, invest, and protect their money through its mobile app and desktop interface. It offers a large suite of products, including student loan refinancing, home loans, personal loans, and mortgages.

HQ Location: San Francisco, United States

Valuation: $4.8B

Industry: POS & Consumer Lending

Website: sofi.com

Social media: LinkedIn / Twitter

💰 Funding Rounds in 2020

To compile this list, we collated data on the biggest funding rounds of 2020 from sources including Crunchbase, Fintech Futures, and European Startups. We then combined this research with the opinions of our experts to bring you our predictions of the companies that will shape fintech in 2021.

1. Howden Group Holdings – $1.5 billion

International insurance intermediary group comprising insurance broking and underwriting companies

Previously known as Hyperion Insurance Group, Howden Group Holdings is a global insurance specialist made up of two companies. Dual is the world's largest international underwriting agency, and Howden Broking is an independent broker with employee-ownership at its heart.

HQ Location: London, United Kingdom

Funding round: $1.5 billion in Private Equity

Industry: Insurance

Website: howdengroupholdings.com

Social media: LinkedIn / Twitter

2. Convex Group – $1 billion

International insurer and reinsurer of complex speciality risks

Following the success of the Catlin Underwriting Agencies, Stephen Catlin and Paul Brand co-founded Convex in 2019. The company underwrites insurance and reinsurance focusing on large commercial clients with complex insurance requirements.

HQ Location: London, United Kingdom

Funding round: $1 billion in Private Equity

Industry: Insurance

Website: convexin.com

Social media: LinkedIn / Twitter

3. Klarna – $650 million

Payment solutions provider that aims to make paying simple, safe, and smooth

One of Europe’s largest banks, Klarna allows online shoppers to purchase from major retailers without paying upfront. The company offers direct payments, pay after delivery options, and installment plans in a smooth one-click purchase experience.

HQ Location: Stockholm, Sweden

Funding round: $650 million in Private Equity

Industry: POS & Consumer Lending

Website: klarna.com

Social media: LinkedIn / Twitter

4. Stripe – $600 million

Payment processing software that provides economic infrastructure for the internet

Stripe offers a suite of payment APIs that are used by businesses – from new startups to giants like Salesforce and Facebook – to accept online payments and run technically sophisticated financial operations in more than 100 countries.

HQ Location: San Francisco, United States

Funding round: $600 million in Series G

Industry: Payments Processing & Networks

Website: stripe.com

Social media: LinkedIn / Twitter

5. Chime

Online-only bank that provides fee-free financial services via its mobile app

One of the fastest-growing banks in the United States, Chime aims to help its members get ahead by offering a simple range of free personal banking products. The company boasts fee-free overdrafts, no hidden fees, and early direct deposit.

HQ Location: San Francisco, United States

Funding round: $533.8 million in Series F

Industry: Digital Banking

Website: chime.com

Social media: LinkedIn / Twitter

6. Ki Insurance – $500 million

Lloyd’s of London syndicate offering brokers instant access to an underwriting decision

Ki provides brokers and clients with a fast and simple way to get a quote in the Lloyd’s market. Its mobile and desktop platform is built on machine learning technology and a proprietary algorithm and uses available data to price the risk and generate a quote.

HQ Location: London, United Kingdom

Funding round: $500 million in Private Equity

Industry: Insurance

Website: ki-insurance.com

Social media: LinkedIn

7. Revolut – $500 million

Range of solutions making up the world’s first global financial superapp

Revolut provides digital banking services to half a million businesses and more than 12 million personal customers. Through its mobile app, customers can exchange, send and receive 27+ currencies instantly with no hidden fees.

HQ Location: London, United Kingdom

Funding round: $500 million in Series D

Industry: Digital Banking

Website: revolut.com

Social media: LinkedIn / Twitter

8. Robinhood – $460 million

Platform offering commission-free trading of stocks, ETFs, options, and cryptocurrencies

On a mission to democratize finance, Robinhood offers a mobile app and web platform that aims to make investing in financial markets more affordable, intuitive, and fun, no matter how much experience an investor has.

HQ Location: Menlo Park, United States

Funding round: $460 million in Series G

Industry: Retail Investing & Secondary Markets

Website: robinhood.com

Social media: LinkedIn / Twitter

9. Bakkt – $300 million

Platform designed to help consumers and institutional clients manage digital assets

Launched by Intercontinental Exchange, owner of the New York Stock Exchange, Bakkt is a digital asset marketplace. It serves institutional clients in an end-to-end regulated market with price transparency and helps consumers aggregate and manage digital assets.

HQ Location: Atlanta, United States

Funding round: $300 million in Series B

Industry: Asset Management

Website: bakkt.com

Social media: LinkedIn / Twitter

10. Greenlight Financial Technology – $215 million

Debit card for children featuring app-based parental controls

Through it’s debit card for kids, Greenlight aims to help parents raise financially-savvy children. Via its mobile app, parents can add funds, create goals, set parental controls, and receive real-time notifications whenever the card is used.

HQ Location: Atlanta, United States

Funding round: $215 million in Series C

Industry: Digital Banking

Website: greenlightcard.com

Social media: LinkedIn / Twitter

🚀 Fast-growing Startups

As new technologies and trends emerge, fintech startups continue to push the boundaries of innovation in financial services. To identify the fastest growing startups in 2020, we looked at information from a variety of resources. We analyzed data from sources such as Growjo, including growth indicators like revenue growth, funding news, employee growth, and company announcements, and combined this with the knowledge of our experts.

1. Clearbanc

Leading ecommerce investor for entrepreneurs and small business owners

Clearbanc provides growth capital for ecommerce, SasS, and mobile businesses. The company’s alternative funding model is based on business data rather than a personal credit score and uses proprietary underwriting and servicing technology.

HQ Location: Toronto, Canada

Industry: Business Lending & Finance

Website: clearbanc.com

Social media: LinkedIn / Twitter

2. Brex

Credit cards and cash management for growing companies

Brex is simplifying finance for its customers, from newly founded startups and ecommerce brands to established tech companies. New customers can quickly access corporate credit cards and cash management in a single strategic account.

HQ Location: San Francisco, United States

Industry: Digital banking

Website: brex.com

Social media: LinkedIn / Twitter

3. BlueVine

Banking provider offering a full suite of tailored banking services to small businesses

BlueVine aims to empower small businesses with accessible and modern financial services designed for them. Working with more than 200,000 businesses, its services include a business checking account, invoice factoring, and line of credit.

HQ Location: Redwood City, United States

Industry: Business Lending & Finance

Website: bluevine.com

Social media: LinkedIn / Twitter

4. Robinhood

Platform offering commission-free trading of stocks, ETFs, options, and cryptocurrencies

On a mission to democratize finance, Robinhood offers a mobile app and web platform that aims to make investing in financial markets more affordable, intuitive, and fun, no matter how much experience an investor has.

HQ Location: Menlo Park, United States

Industry: Retail Investing & Secondary Markets

Website: robinhood.com

Social media: LinkedIn / Twitter

5. Root Insurance Company

Car insurance provider disrupting the industry with mobile app-powered pricing

Currently operating in 30 states in the USA, Root Inc. offers car insurance based on data from its mobile app which assesses how customers actually drive, not their demographics. The company also works with carriers and fleet owners through Root Enterprise.

HQ Location: Columbus, United States

Industry: Insurance

Website: joinroot.com

Social media: LinkedIn / Twitter

6. Plaid

Data network that connects fintech companies with their customers’ bank accounts

Plaid makes it easy for people to connect their financial accounts to apps and services like Betterment, SoFi, and Venmo through its API and suite of analytics products. Its network covers more than 11,000 financial institutions across the US, Canada, UK and Europe.

HQ Location: San Francisco, United States

Industry: Core Banking & Infrastructure

Website: plaid.com

Social media: LinkedIn / Twitter

7. Chainalysis

Compliance and investigation software that tackles illicit cryptocurrency activity

Chainalysis provides banks, governments, and businesses with cryptocurrency investigation and compliance solutions that aim to build trust in blockchains. The company supports more than 87 leading cryptocurrencies and has users in over 50 countries.

HQ Location: New York, United States

Industry: Crypto

Website: chainalysis.com

Social media: LinkedIn / Twitter

8. Avant

Digital consumer lending platform offering personal loans and credit cards

Avant was established in 2012 with the mission of lowering the costs and barriers of borrowing for everyday people. Since then, it has streamlined the online borrowing process and connected more than a million consumers to over $6.5 billion in funds.

HQ Location: Chicago, United States

Industry: POS & Consumer Lending

Website: avant.com

Social media: LinkedIn / Twitter

9. OnDeck

Online lender providing flexible financing solutions to small businesses

OnDeck combines data analytics with digital technology to assess customers’ creditworthiness rather than relying on a credit score alone. The company aims to make it efficient and convenient for small businesses to access financing online.

HQ Location: New York, United States

Industry: Business Lending & Finance

Website: ondeck.com

Social media: LinkedIn / Twitter

10. tZERO

Blockchain-based marketplace trading digital private securities

tZero is a cutting-edge liquidity platform for private companies and assets. The company’s goal is to democratize access to private capital markets by providing a simple automated trading venue to investors, broker-dealers, and institutions.

HQ Location: New York, United States

Industry: Capital Markets

Website: tzero.com

Social media: LinkedIn / Twitter

🏦 Venture Capital Firms

Technology is changing the face of financial services, and leading the charge is a dynamic group of innovators, entrepreneurs, and disruptive thinkers. While some startups may have access to private funding, many wouldn’t be where they are today without the backing of venture capital firms. If you’re an ambitious fintech entrepreneur with a groundbreaking idea, here are ten of the world’s top venture capital firms to consider.

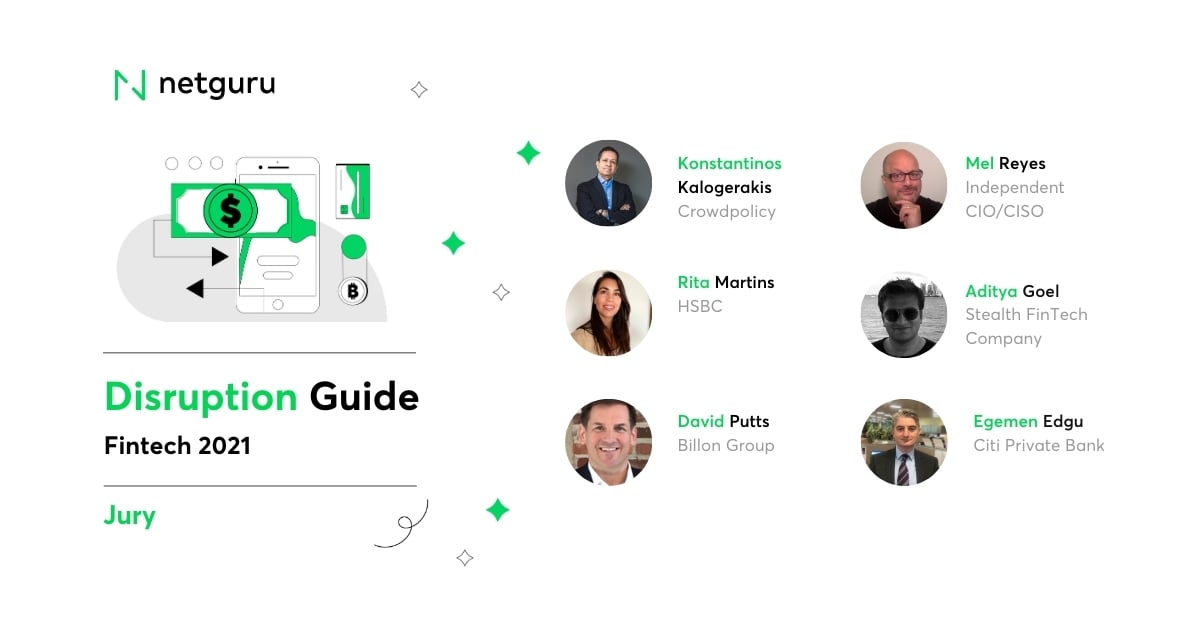

This list was compiled from the results of our judging panel. The committee included Egemen Edgu, Citi Private Bank; David Putts, Billon Group; Aditya Goel, Stealth FinTech Company; Rita Martins, HSBC; Mel Reyes, Independent CIO/CISO; and Konstantinos Kalogerakis, Crowdpolicy.

1. Andreessen Horowitz

Stage-agnostic firm that backs bold entrepreneurs shaping the future through technology

Andreessen Horowitz – also known as a16z – was founded in 2009 by Ben Horowitz and Marc Andreessen. The firm backs seed to late-stage technology companies and has nearly $16.6 billion in assets under management across multiple funds.

Number of investments: 909

Number of exits: 148

Location: Menlo Park, United States

Standout investments: Stripe, Coinbase, Airbnb, Pinterest, Facebook, Slack, Instagram, GitHub, Skype, Asana, Plaid, Wise.

Website: a16z.com

Social media: LinkedIn / Twitter

2. Balderton Capital

UK-based firm focused exclusively on backing European-founded tech companies

Since it was founded in 2000, Balderton Capital has become Europe’s leading early-stage venture capital investor. The firm has raised over $3 billion in capital to invest in European startups and has helped more than 220 companies.

Number of investments: 324

Number of exits: 61

Location: London, United Kingdom

Standout investments: Revolut, MySQL, Betfair, The Hut Group, Yoox Net-a-Porter, The Walt Disney Company, Workhuman.

Website: balderton.com

Social media: LinkedIn / Twitter

3. Index Ventures

Firm working with transformative technology companies at every stage, across every sector

Based in London, San Francisco, and Geneva, Index Ventures helps ambitious tech entrepreneurs turn their ideas into global businesses. The firm covers all investment stages, from earliest seed through to explosive growth.

Number of investments: 884

Number of exits: 187

Location: San Francisco, United States

Standout investments: Adyen, Deliveroo, Dropbox, Farfetch, King, Slack, Supercell, Robinhood, Zendesk, Revolut, Raisin, Spendesk.

Website: indexventures.com

Social media: LinkedIn / Twitter

4. Citi Ventures

Venture investment arm of leading global banking giant Citigroup

Citi Ventures invests in and partners with innovative startups offering cutting-edge solutions that augment Citi’s products and services. Its aim is to harness the power of Citi to help businesses, communities, and people thrive in a world of change.

Number of investments: 114

Number of exits: 24

Location: San Francisco, United States

Standout investments: Square, Betterment, BlueVine, Grab, Plaid, Udaan, Braze, Tanium, Jet.

Website: citi.com/ventures

Social media: Twitter

5. Atomico

International investment firm helping ambitious tech founders at Series A and beyond

Built by founders for founders, Atomico is focused on helping Europe’s disruptive technology companies scale globally. The firm was founded in 2006, and its team of investors and advisors includes the founders of six billion-dollar companies.

Number of investments: 172

Number of exits: 32

Location: London, United Kingdom

Standout investments: Klarna, Skype, Supercell, Stripe, LendInvest, Compass, Ofo.

Website: atomico.com

Social media: LinkedIn / Twitter

6. Khosla Ventures

Firm providing venture assistance to entrepreneurs working on breakthrough technologies

Khosla Ventures was founded in 2004 by Vinod Khosla, co-founder of Sun Microsystems. The firm has over $5 billion under management and focuses on a wide range of areas, including financial services, big data, education, advertising, and health.

Number of investments: 862

Number of exits: 118

Location: Menlo Park, United States

Standout investments: Stripe, Square, Uber, Instacart, Affirm, DoorDash, RingCentral, Swift Capital.

Website: khoslaventures.com

Social media: LinkedIn / Twitter

7. Kleiner Perkins

American firm partnering with forward-thinking founders from inception to IPO and beyond

Kleiner Perkins has been helping tech and life sciences founders to build iconic companies for almost fifty years. The firm has invested $10 billion in trailblazers such as Amazon and Google through its twenty venture funds and four growth funds.

Number of investments: 1,226

Number of exits: 274

Location: Menlo Park, United States

Standout investments: Stripe, Square, Google, Apple, Amazon, Salesforce, IBM, Cisco, Facebook, ClearStory Data.

Website: kleinerperkins.com

Social media: LinkedIn / Twitter

8. Notion Capital

Early stage investor in European SaaS, enterprise tech, and cloud

Notion has been investing in European-headquartered SaaS companies since 2009 and now has more than $500 million in assets under management. The firm’s mission is to create the conditions for extraordinary success, with the entrepreneur at the center.

Number of investments: 129

Number of exits: 13

Location: London, United Kingdom

Standout investments: GoCardless, Tradeshift, Currencycloud, Workable, Dealflo, Concentra.

Website: notion.vc

Social media: LinkedIn / Twitter

9. QED Investors

Fintech-focused venture firm helping companies in the US, UK, LatAm, and Asia

QED is a leading boutique venture capital firm founded in 2007 by Capital One Financial Services co-founder Nigel Morris and Frank Rotman. The firm focuses on early stage investments in disruptive, high-growth financial services companies.

Number of investments: 161

Number of exits: 25

Location: Alexandria, United States

Standout investments: Credit Karma, ClearScore, Nubank, SoFi, Avant, Remitly, GreenSky, Klarna, QuintoAndar, Konfio, Creditas, Mission Lane.

Website: qedinvestors.com

Social media: LinkedIn / Twitter

10. Ribbit Capital

Global investment organization on a mission to change the world of finance

Ribbit Capital targets disruptive, early-stage companies that leverage technology to drive financial innovation. Since launching in 2012, the firm has invested in companies spanning ten countries and serving customers in every major city in the world.

Number of investments: 124

Number of exits: 6

Location: Palo Alto, United States

Standout investments: Coinbase, Robinhood, Credit Karma, Nubank, Affirm, Brex, Root Insurance, Revolut, Hippo Insurance.

Website: ribbitcap.com

Social media: LinkedIn / Twitter

📈 Promising Startups

Given the number of innovative companies entering the fintech industry and their potential for explosive growth, it can be tough to decide who to add to your portfolio. To give you some food for thought, we asked our panel of judges to vote on which companies they believed had the most investment potential, and these are the top ten.

The committee included Egemen Edgu, Citi Private Bank; David Putts, Billon Group; Aditya Goel, Stealth FinTech Company; Rita Martins, HSBC; Mel Reyes, Independent CIO/CISO; and Konstantinos Kalogerakis, Crowdpolicy.

1. Stripe

Payment processing software that provides economic infrastructure for the internet

Stripe offers a suite of payment APIs that are used by businesses – from new startups to giants like Salesforce and Facebook – to accept online payments and run technically sophisticated financial operations in more than 100 countries.

HQ location: San Francisco, United States

Total Funding Amount: $1.6B

Industry: Payments Processing & Networks

Website: stripe.com

Social media: LinkedIn / Twitter

2. Robinhood

Platform offering commission-free trading of stocks, ETFs, options, and cryptocurrencies

On a mission to democratize finance, Robinhood offers a mobile app and web platform that aims to make investing in financial markets more affordable, intuitive, and fun, no matter how much experience an investor has.

HQ location: Menlo Park, United States

Total Funding Amount $5.6B

Industry: Retail Investing & Secondary Markets

Website: robinhood.com

Social media: LinkedIn / Twitter

3. Lemonade

AI-powered homeowners, renters, and pet health insurance driven by social good

Lemonade provides homeowners, renters, and pet health insurance based on AI and behavioral economics. The company is a certified B-Corp and donates unused premiums to selected non-profits as part of its annual Giveback program.

HQ location: New York, United States

Total Funding Amount: $480M

Industry: Insurance

Website: lemonade.com

Social media: LinkedIn / Twitter

4. Revolut

Range of solutions making up the world’s first global financial superapp

Revolut provides digital banking services to half a million businesses and more than 12 million personal customers. Through its mobile app, customers can exchange, send and receive 27+ currencies instantly with no hidden fees.

HQ location: London, United Kingdom

Total Funding Amount: $905.5M

Industry: Digital Banking

Website: revolut.com

Social media: LinkedIn / Twitter

5. Chime

Online-only bank that provides fee-free financial services via its mobile app

One of the fastest-growing banks in the United States, Chime aims to help its members get ahead by offering a simple range of free personal banking products. The company boasts fee-free overdrafts, no hidden fees, and early direct deposit.

HQ location: San Francisco, United States

Total Funding Amount: $1.5B

Industry: Digital Banking

Website: chime.com

Social media: LinkedIn / Twitter

6. Checkout

Connected payment services that empower businesses to adapt, innovate, and thrive

Checkout processes payments in over 150 currencies for businesses ranging from startups to global superbrands. The company’s end-to-end platform enables seamless payments and gives companies flexible tools, granular data, and deep insights.

HQ location: London, United Kingdom

Total Funding Amount: $830M

Industry: Payment Processing & Networks

Website: checkout.com

Social media: LinkedIn / Twitter

7. Tink

Open banking platform built to power the new world of finance

Tink provides Europe’s leading open banking platform and enables startups, fintechs, and banks to create data-driven financial services. The platform connects to more than 3,400 banks and reaches over 250 million bank customers through a single API.

HQ location: Stockholm, Sweden

Total Funding Amount: $308.4M

Industry: Core Banking & Infrastructure

Website: tink.com

Social media: LinkedIn / Twitter

8. Affirm

Alternative to credit cards offering customers transparent and flexible products

Affirm operates in the interest of consumers by providing simple, honest, and transparent financial products. The company serves over 6.2 million consumers in the US and promises no hidden fees or surprise interest on its 0% APR offers.

HQ location: San Francisco, USA

Total Funding Amount: $1.5B

Industry: POS & Consumer Lending

Website: affirm.com

Social media: LinkedIn / Twitter

9. Coinbase

Digital currency wallet and platform that makes it easy to buy, sell, and store cryptocurrency

Coinbase is the leading mainstream cryptocurrency exchange in the United States. The company offers merchants and consumers a secure platform that allows them to transact with new digital currencies like bitcoin, ethereum, and litecoin.

HQ location: San Francisco, United States

Total Funding Amount: $547.3B

Industry: Crypto

Website: coinbase.com

Social media: LinkedIn / Twitter

10. Ripple

Technology for sending money globally using the power of blockchain

Ripple unifies the infrastructure underlying global payments to enable the secure transfer of funds in any currency in real time. The company aims to accelerate value exchange in the Internet of Value (IoV) – creating a world where money moves like information does today.

HQ location: San Francisco, United States

Total Funding Amount: $293.8M

Industry: Crypto

Website: ripple.com

Social media: LinkedIn / Twitter