Top 5 Financial Advisor Apps for Wealth Management in 2026

Contents

Ever thought about optimizing your financial management and investments while effectively managing your budget?

With the rapid advancements in technology, top apps for wealth management have become essential tools for individuals aiming to take charge of their finances and attain financial success. These apps also allow clients to grant their financial advisor access to their spending and budgeting information, facilitating a collaborative approach to financial management.

In this blog post, we will delve into a detailed exploration of the standout budgeting apps for 2025. Explore their unique features, benefits, and gain valuable insights into choosing the perfect app that aligns with your specific needs.

From providing comprehensive financial oversight to automating investment strategies, these leading wealth management apps offer an array of tools and resources designed to boost your net worth and reach your financial goals.

Wealth management apps come in various shapes and sizes, catering to different aspects of personal finance.

The selected apps provide:

-

Insight into your income and expenditure

-

Connect to your bank accounts and credit cards to automatically download transactions

-

Offer financial goal-setting and cash flow tracking across multiple financial accounts

What is Wealth Management?

Wealth management is a comprehensive approach to managing your financial resources to achieve long-term financial goals and objectives. It involves taking a holistic view of your financial situation, including income, expenses, assets, debts, and investments. Wealth management encompasses various aspects of personal finance, such as financial planning, investment management, retirement planning, and estate planning. The primary objective of wealth management is to create a tailored plan that aligns with your financial goals, risk tolerance, and values. By integrating all these elements, wealth management helps you build a complete financial picture and ensures your financial well-being.

Key Features of Wealth Management Apps

Wealth management apps are designed to provide individuals with a comprehensive platform to manage their financial resources effectively. Here are some key features of wealth management apps:

-

Financial Tracking and Monitoring: These apps allow you to link multiple financial accounts, track expenses, and monitor cash flow, giving you a clear view of your financial situation.

-

Investment Management: You can invest in various assets, such as stocks, bonds, and ETFs, and receive investment insights and recommendations to optimize your portfolio.

-

Retirement Planning: Plan and track your retirement goals, calculate retirement savings, and create a sustainable income stream for your golden years.

-

Financial Planning: Create a comprehensive financial plan, set financial goals, create a budget, and track your progress towards achieving those goals.

-

Financial Education and Resources: Access educational resources, such as articles, webinars, and financial advisors, to help you make informed financial decisions and improve your financial literacy.

Top 5 Wealth Management Apps for 2025

Here are the top 5 wealth management apps for 2025, each with its unique features and benefits:

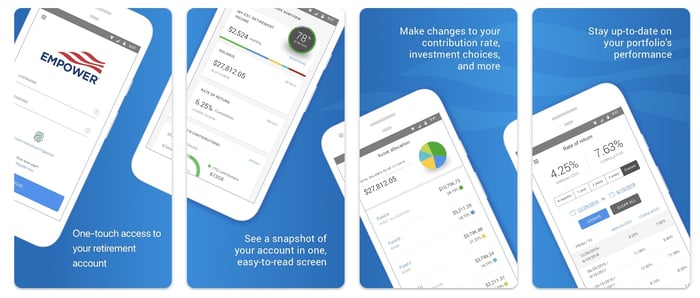

Empower: Best for comprehensive financial management and financial planning

Empower is a no-cost budgeting app that provides an extensive array of tools for wealth accumulation, retirement planning, and fee analysis. Upon linking your bank accounts, credit cards, student loans, mortgages, and other budget line items, Empower generates a comprehensive financial overview, empowering you to take charge of your finances.

Personal Capital is a versatile financial management tool that integrates with the Empower platform, providing investment insights and assisting users in calculating their retirement needs.

Key features:

-

Visual financial overview

-

Easy account tracking through account linking

-

Tools to facilitate wealth building and retirement planning

-

Fee analysis to assist in saving money

Image source: Google Play

With its visually appealing interface and seamless account linking, Empower emerges as a top choice for monitoring investments compared to other no-cost budgeting apps.

Recognized as one of the premier budgeting apps for efficient finance management and wealth accumulation, Empower offers budgeting tools, investment tracking, and personalized advice. A notable advantage is that it’s regarded as the leading free budgeting app, devoid of any monthly fees associated with the product.

Empower’s financial advisors offer tailored guidance and advice to ensure you stay on track with your financial goals. With its comprehensive suite of free budgeting tools, Empower is a good choice for those looking to upgrade their approach to financial management.

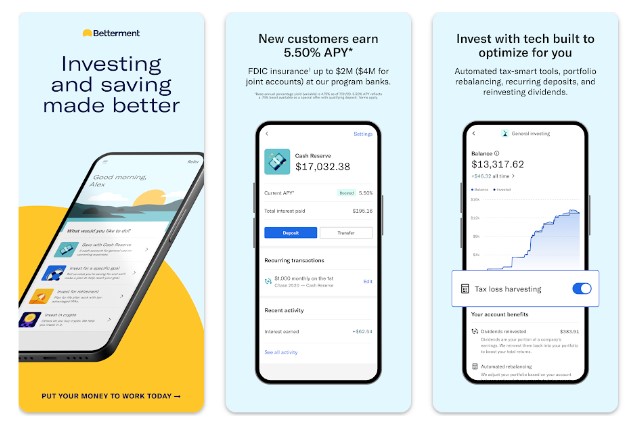

Betterment: Best for automated investing

Betterment is an automated investing platform, commonly referred to as a robo-advisor, presenting the following features:

-

Users can create and manage their investment portfolio online.

-

Personalized portfolios are offered based on individual goals.

-

Additional financial planning tools are available to assist users in achieving their financial objectives.

Betterment provides information regarding external accounts held by various financial institutions, highlighting the importance of accurate financial data for wealth management and advising services.

Operating as a robo-advisor, Betterment offers:

-

Automated portfolio management

-

Risk assessment

-

Financial planning

-

Tailored advice and recommendations

Image source: Google Play

Betterment is an ideal choice for individuals who favor an automated approach to investing and wealth management.

With its intuitive interface and goal-based investing features, Betterment streamlines the investment process and assists in keeping you aligned with your financial objectives. If you’re looking for a wealth management app that emphasizes automated investing, Betterment could be a fitting option.

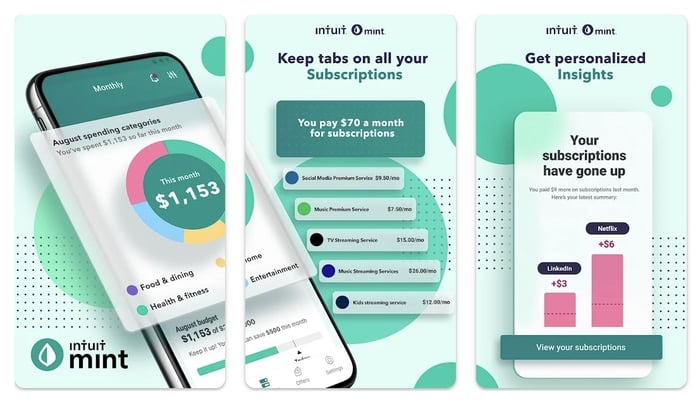

Mint: Best for budgeting, wealth tracking, and multiple financial accounts

Mint is a well-known budgeting app that incorporates wealth tracking features, enabling users to monitor their net worth and track financial progress. The app offers an extensive array of features, including:

-

Tracking financial goals

-

Generating reports on financial habits

-

Synchronizing bank accounts

-

Tracking expenses

-

Categorizing expenses

-

Automating savings

-

Offering saving tips

-

Providing bill alerts

-

Access to credit scores

-

Investment features

Mint helps users track their spending habits, providing insights into their financial behaviors and alerting them to overspending to improve their budgeting strategies.

Image source: Google Play

One of the primary advantages of using Mint is its accessibility, offering a free version of the app with a multitude of features for budgeting and wealth management. Its distinctive features, including access to credit scores and investment insights, distinguish it from other budgeting apps.

By assisting users in comprehending their spending patterns and establishing personalized budgets, Mint greatly contributes to improved financial management and the achievement of financial goals. If you’re seeking a comprehensive budgeting app that also integrates wealth tracking features, Mint stands among the top choices.

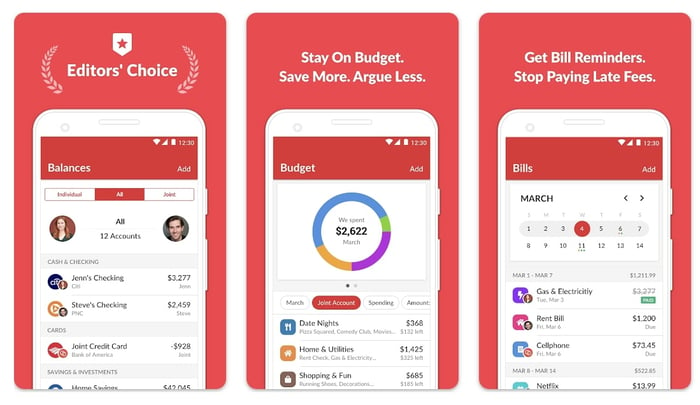

Honeydue: Best for Couples

Honeydue is a wealth management app designed specifically for couples. It allows partners to link their financial accounts, track expenses, and create a joint budget. Honeydue also provides investment tracking and retirement planning tools, making it an ideal app for couples who want to manage their finances together. With its user-friendly interface and collaborative features, Honeydue helps couples achieve their financial goals and maintain a healthy financial life.

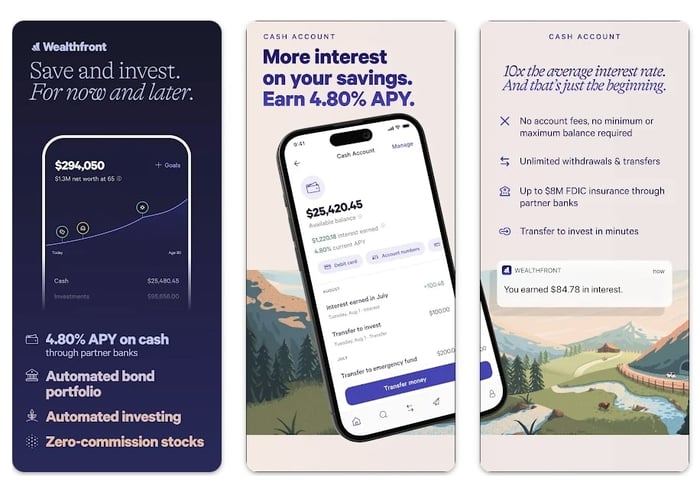

Wealthfront: Best for Simple Investment Process

Wealthfront is a robo-advisor that provides a simple and automated investment process. It offers low fees, diversified investment portfolios, and tax-loss harvesting. Wealthfront also provides financial planning tools, including retirement planning and investment tracking, making it an ideal app for individuals who want a hassle-free investment experience. By leveraging advanced algorithms, Wealthfront ensures your investments are optimized for long-term growth, helping you achieve your financial objectives with ease.

(Note: The other sections, such as Empower, Betterment, and Mint, are already provided in the original text.)

Honeydue - Best for couples

Honeydue is an easily navigable wealth management app that seamlessly integrates financial organization and collaboration tailored for couples. Equipped with an intuitive toolkit, Honeydue empowers partners to efficiently handle their finances and strategize for the future by synchronizing all their financial accounts within a unified platform.

Highlighted features:

-

Streamlined financial overview designed for couples

-

Effortless account synchronization for comprehensive tracking

-

Tools facilitating wealth management and financial planning

-

Expense analysis to optimize spending

Image source: Google Play

With its visually appealing interface and straightforward account integration, Honeydue stands out as the preferred choice for those seeking efficient financial tracking compared to other wealth management apps.

Recognized as a premier wealth management app, Honeydue streamlines budgeting, investment monitoring, and provides personalized financial insights. Importantly, it distinguishes itself as a top choice due to its cost-effectiveness, offering valuable features without imposing monthly fees.

Wealthfront - Best for simple investment process and retirement planning

Wealthfront is a prominent robo-advisor and wealth management app, aiming to streamline and automate the investment process. The app focuses on constructing diversified portfolios and optimizing investments for long-term growth.

Upon linking your accounts and defining your financial goals, Wealthfront utilizes advanced algorithms to efficiently manage and rebalance your portfolio.

Key features:

-

Automated portfolio management

-

Goal-oriented investing

-

Tax-efficient strategies

-

Easy account linking and tracking

Image source: Google Play

With its intuitive interface and hands-off investment management approach, Wealthfront excels as an excellent option for those seeking automated and diversified investment solutions.

It's highly regarded as a top robo-advisor for individuals looking to enhance their investments without the intricacies associated with traditional wealth management.

Additionally, Wealthfront offers competitive fee structures, adding to its appeal for investors mindful of fees.

How to choose the right wealth management app

Selecting the appropriate wealth management app begins with assessing your needs and objectives. When choosing a wealth management app, it is crucial to evaluate how well it aggregates and provides access to users' financial information, as this is essential for comprehensive wealth management and financial planning. If you’re in the market for an app emphasizing budgeting, investment tracking, or automated investing, evaluating the specific features and pricing of each app before deciding is crucial.

Your income and requirements should steer your choice between a free or paid wealth management app. While a free app may offer a range of features, a paid version is likely to furnish more comprehensive tools and assistance to help you achieve your financial goals. Be cautious of potential hidden fees associated with paid apps.

To commence, try using a single app and acquaint yourself with its features. Once you feel at ease with the app, consider exploring additional wealth management apps to broaden your financial toolset and refine your wealth management strategy. Remember to make use of free trials for paid apps, as they present a risk-free opportunity to evaluate their offerings.

Ultimately, the appropriate wealth management app aligns with your financial goals and provides the features and tools necessary to attain them. Invest time in researching and comparing different apps to discover the ideal fit for your financial journey.

Summary

In conclusion, wealth management apps have become essential tools for individuals seeking to take control of their finances, optimize spending, and achieve financial success. The best budgeting apps for 2025 offer unique features and benefits that cater to various aspects of financial management and investment tracking.

Aggregating and accessing users' financial information is crucial for comprehensive wealth management and financial planning, as it allows financial advisors to provide more accurate and personalized advice.

As technology continues to advance, the future of wealth management apps promises even greater innovation and personalization. By staying informed about the latest developments and trends, you can ensure that you are making the most of these powerful tools to manage finances and build wealth.