12 Top Financial Analysis Software in 2026

Contents

The importance of selecting the right software for your company’s specific needs cannot be stressed enough, as it directly impacts the efficiency and accuracy of your financial planning, analysis, and reporting.

Financial analysis software automates time-consuming tasks, reducing manual data entry and report generation, while automating calculations for greater efficiency and accuracy.

In this blog post, we will explore the latest financial analytics software solutions in 2026, discussing their features, benefits, and use cases, to help you make an informed decision when selecting the best financial analysis software for your business. These tools provide real-time data insights, supporting data-driven decision making and delivering meaningful insights for advisory firms and finance teams.

Top financial analysis software

The below software solutions offer a wide range of features and pricing options, catering to the diverse financial scenarios and needs of businesses. The best financial analysis tools combine ease of use, sophisticated analytics, and real-time capabilities to transform raw data into actionable insights, making them essential for effective decision-making.

From handling financial and operational data to generating comprehensive financial reports and models, these top financial reporting software solutions provide robust reporting tools and support complex reporting requirements. They enable multiple users to generate reports and collaborate efficiently, ensuring data accuracy and streamlined teamwork across departments.

Key features to look for in financial analysis software include automated data integration, real-time dashboards, scenario planning, AI-driven insights, and customizable dashboards and reporting features.

Cube: Spreadsheet-native FP&A platform

Cube is a spreadsheet-native Financial Planning and Analysis (FP&A) platform that offers advanced features and capabilities, including:

- Native integration with Excel and Google Sheets

- Access to financial and operational data without switching platforms

- Streamlining the entire financial planning and analysis process

.jpg?width=3648&height=2761&name=cube%20(1).jpg)

Source: Capterra

Cube automation helps finance teams to:

- Save time previously spent on tedious tasks like financial consolidation

- Focus on strategy, planning, and corporate performance

- Improve accuracy

- Free up valuable time and resources for financial professionals

- Concentrate on higher-value tasks and initiatives

Source: Capterra

Image source: Cube

Oracle Essbase: Multidimensional database solution

Oracle Essbase is an ideal database management system for companies seeking online analytical processing (OLAP) or business intelligence (BI) applications. It offers powerful and reliable multidimensional analysis capabilities. Some key features of Oracle Essbase include:

- Financial statement analysis software solution

- Catering to the needs of financial analysts and other business users

- Sophisticated data analysis tools to make informed decisions

Smart View, one of Oracle Essbase’s standout features, allows users to easily generate and share various reports, pivot tables, and charts. It provides an ideal query and reporting tool. Additionally, Oracle Essbase can be integrated with other Oracle BI tools, including Oracle BI Enterprise Edition, further enhancing its capabilities and providing a comprehensive solution for comprehensive financial analysis and reporting.

Image source: Oracle Essbase

QuickBooks: Accounting software for SMBs

QuickBooks is a popular accounting software developed by Intuit, designed to cater to the financial needs of small and medium-sized businesses. It offers a comprehensive suite of features and tools, including:

- Invoicing

- Expense tracking

- Financial reporting

- Payroll management

- Inventory management

- Tax preparation

With its user-friendly interface and robust functionality, QuickBooks simplifies various aspects of financial management for businesses.

One of the key advantages of QuickBooks is its user-friendly interface, which makes it easy for business owners and finance teams to manage their financial statements, transactions and accounts. Furthermore, QuickBooks is also available. Online, the cloud-based version of the software, provides additional features such as:

- Payroll processing

- Invoice creation

- Bookkeeping

- Reporting

This offers a complete financial solution for small and medium-sized businesses.

Image source: Capterra

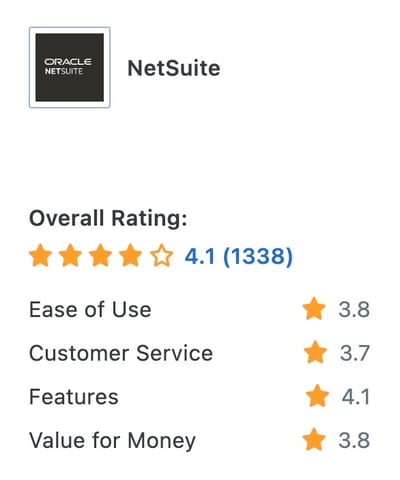

NetSuite: Cloud-based ERP software

NetSuite is a cloud-based Enterprise Resource Planning (ERP) software that offers a wide range of financial management capabilities, making it an ideal choice for accounting firms and businesses seeking comprehensive financial management solutions.

Key features of NetSuite include:

- Financial analytics

- Customer Relationship Management (CRM)

- Inventory management

- Real-time business insights

With these features, NetSuite provides a robust platform for managing various aspects of a company’s financial health.

Image source: Capterra

One of the main benefits of using NetSuite is its ability to:

- Link, automate, and streamline accounting and operational processes, boosting productivity and efficiency for finance teams

- Provide real-time business insights, allowing users to access critical financial information with just a single click

- Provide valuable business intelligence that can help inform forecasting and scenario planning

Image source: Captera

Sage Intacct: Financial management for small to midsize businesses

Sage Intacct is a software that offers comprehensive solutions for financial management and accounting. It has been specifically designed to meet the needs of small to midsize businesses. Some key features of Sage Intacct include:

- Comprehensive financial analytics capabilities

- Real-time insights into company’s financial health

- User-defined dashboards for enhanced visibility into business operations

Streamlining core accounting tasks such as:

- Accounts receivable and payable

- Budgeting

- financial reporting

- Cash flow forecasting

Image source: Capterra

Sage Intacct simplifies financial management for small to midsize businesses. By leveraging its features and capabilities, financial professionals can efficiently manage their financial accounts and gain valuable insights into their company’s financial and business performance.

Jedox

Jedox, an enterprise performance management solution, stands out for its focus on budgeting, planning, and forecasting.

Jedox's key features include:

-

Sophisticated modeling tool

-

Scenario analysis

-

Unified financial processes

Image source: Jedox

For finance professionals with complex financial planning needs, Jedox offers sophisticated modeling tools and scenario analysis. AI in finance helps unify financial processes and enhances collaboration across finance teams, making it a vital tool for businesses that depend on financial analytics.

Enhancing financial models with data visualization tools

In today’s data-driven business environment, data visualization tools play a crucial role in enhancing financial models and improving decision-making. By providing interactive and easy-to-understand visual representations of financial data, these tools enable financial professionals to effectively communicate complex financial information to stakeholders, making it easier for them to grasp the insights and make informed decisions.

Two popular data visualization tools that can enhance financial models are Microsoft Power BI and Tableau. Both tools offer powerful capabilities to create interactive visuals of financial data, enabling financial analysts to swiftly recognize trends and patterns in the data. Additionally, these tools can be integrated with various financial analysis software, further streamlining the data analysis process and improving the overall efficiency of financial planning and reporting.

Microsoft Power BI

Microsoft Power BI is a powerful data visualization tool that integrates with various financial analysis software tools, making it easier for financial analysts to analyze and present data effectively.

As a suite of software services, applications, and connectors, Microsoft Power BI enables users to transform disparate sources of data into insightful and interactive visualizations, facilitating deeper insights, better decision-making, and improved financial planning. These can in turn be incorporated in online product catalogs, investor reports, marketing emails and other relevant mediums.

Image source: Capterra

The integration capabilities of Microsoft Power BI allow financial professionals to:

- Seamlessly connect their financial analysis software with Power BI

- Access, analyze, and present financial data in a more visually appealing and interactive manner

- Improve the overall efficiency of financial planning and reporting

- Help financial analysts communicate complex financial information more effectively

- Make better-informed business decisions

Image source: Capterra

Tableau

Tableau is another popular data visualization tool that can help financial analysts.

- Create interactive and shareable dashboards for better decision-making

- Analyze and visualize financial data quickly

- Identify trends, patterns, and insights

Image source: Capterra

With its user-friendly interface and powerful capabilities, Tableau makes it easier for financial professionals to make informed decisions.

By using Tableau, financial analysts can create visually appealing and interactive dashboards that can be easily shared with other stakeholders, promoting collaboration on financial analysis initiatives.

In addition, Tableau’s integration capabilities allow users to connect their financial analysis software with the platform, further streamlining the data analysis process and improving the overall efficiency of financial planning and reporting.

Domo

Domo is a cloud-based business intelligence platform that empowers organizations to transform their financial data into actionable insights. Its key features include:

-

Real-time data analytics

-

Customizable dashboard

-

User-friendly interface

Source: Domo

Source: Domo

Domo allows users to visualize and analyze financial information, facilitating informed decision-making. Its features include customizable dashboards, data integration capabilities, and collaborative tools.

Companies leverage Domo to gain a holistic view of their financial performance, aiding strategic planning and resource optimization. Domo's emphasis on real-time data analytics contributes to its popularity among those seeking dynamic and responsive financial analysis solutions.

Financial planning and forecasting with financial analysis tools

Financial planning and forecasting tools such as Anaplan and Workday Adaptive Planning can streamline financial processes and improve decision-making for finance teams and business professionals. By automating and simplifying various aspects of financial planning and analysis, these tools can help businesses better manage their financial accounts, gain valuable insights into their financial performance, and make informed decisions on how to improve their financial health.

These tools offer a range of features and capabilities that can enhance the efficiency and accuracy of financial planning, budgeting and forecasting processes. By utilizing this financial analysis tool, financial professionals can not only save time and resources, but also make better-informed decisions that can positively impact their company’s financial performance.

Anaplan: Enterprise planning platform

Anaplan is a powerful platform designed for enterprise-level planning. It enables companies to:

- Connect, model, and streamline their business processes for optimum efficiency

- Utilize its proprietary Hyperblock technology to build comprehensive financial models

- Streamline financial processes and improve decision-making

Image source: Capterra

Various sources suggest that the cost of an Anaplan project ranges from $30,000 to $50,000 or more. This amount will depend on the size and complexity of the project. By offering planning, forecasting, and performance management features, Anaplan proves to be a valuable tool for finance and FP&A teams aiming to enhance their financial planning and analysis capabilities.

Image source: Capterra

Workday Adaptive Planning: Financial planning and analytics tool

Workday Adaptive Planning is a powerful tool for financial planning and analytics. It has been designed for budgeting, planning, and reporting needs. Offering seamless integration with other systems such as ERP, Salesforce automation (SFA), customer relationship management (CRM), and more, Workday Adaptive Planning can streamline financial processes and improve decision-making for finance teams and business professionals.

Image source: Capterra

According to various sources, the pricing for Workday Adaptive Planning starts at $15,000, depending on the organization’s size. By providing a range of financial planning and analysis features, Workday Adaptive Planning can help businesses better manage their financial accounts and gain valuable insights into their financial and business performance measurement.

Image source: Capterra

SAP Business Planning and Consolidation (BPC)

SAP BPC, an integrated solution for financial planning and consolidation, aligns financial plans with strategic objectives.

Key features of SAP BPC include:

-

Integration with SAP solutions

-

Advanced analytics

-

Scenario planning and real-time insights

Image source: SAP

This platform seamlessly integrates with other SAP solutions, making it a powerful choice for handling historical financial data. SAP BPC caters to finance professionals by providing advanced analytics, scenario planning, and real-time insights, addressing complex financial planning needs within large enterprises.

Younium: Subscription Management and Financial Operations Platform

Younium is a subscription management software designed for B2B SaaS and technology companies that require handling complex billing, revenue recognition, and subscription analytics. It bridges the gap between financial operations and subscription-based business models.

Some key features of Younium include:

- Advanced subscription management for recurring, usage-based, or tiered pricing models

- Automated billing and invoicing with multi-currency and multi-entity support

- Revenue recognition compliant with ASC 606 and IFRS 15 standards

- Real-time subscription metrics, including MRR, ARR, churn, and retention

Integrations with ERP, CRM, payment gateways, and tax engines

Younium’s platform helps finance teams:

- Automate complex billing cycles and reduce manual errors

- Improve forecasting and financial accuracy with detailed dashboards and analytics

- Gain visibility into recurring revenue performance and customer lifetime value

- Scale subscription businesses globally with compliance-ready financial operations

Choosing the best financial software for your business

In conclusion, selecting the right financial analysis software is an essential step in optimizing your business’s financial planning, analysis, and decision-making processes. By assessing your business requirements, comparing features and pricing, and considering integration capabilities, you can choose the best finance analysis software solution that caters to your specific needs and helps you achieve your financial goals. So, take the time to explore the top financial analysis software options of 2023 and invest in the one that suits your organization best, ensuring improved financial performance and informed decision-making.