Top Wealthtech Startups to Watch in 2025

Contents

By harnessing the power of technology, wealthtech startups are breaking down barriers and providing accessible, user-friendly investment options to a wider audience.

The surge in wealthtech startups is fueled by the need for more user-friendly, cost-effective investment options. They utilize technological innovations including artificial intelligence and machine learning, to offer personalized financial advice and strategies informed by data.

Providing a full range of features, wealthtech startups equip users to:

- Follow investments

- Oversee financial performance

- Streamline wealth management procedures

- Obtain personalized financial advice

Disrupting traditional wealth management

By utilizing technology to offer personalized, data-driven investment counsel and services, wealthtech startups are causing a shift in the traditional wealth management industry. Innovative features of wealth management apps help users manage their accounts for various goals, including saving for a house, paying off debt, or even obtaining personal loans.

The startups strive to democratize investing by making it accessible and affordable to everyone, assisting businesses and individuals in achieving their financial goals.

Attracting millennials and Gen Z investors

Millennials and Gen Z investors are drawn to solutions offered by wealthtech startups due to their intuitive design, user experience, and emphasis on financial education.

Platforms like Agicap, for example, offer businesses the tools to efficiently forecast, analyze, and optimize their cash flows with accuracy. By appealing to younger generations, wealthtech startups are not only gaining traction among retail investors but also among family offices, which are looking for more accessible and cost-effective ways to manage investments.

Deloitte employs the term "re-wired investor" to describe a fresh mindset, set of principles, and expectations exhibited by a new wave of investors. This group encompasses not only Generation X and Generation Y2 investors but also includes baby boomers who have been influenced by the attitudes and behaviors of their younger counterparts.

The "re-wired investor" approaches financial advice in a distinct manner compared to previous generations and anticipates a different mode of interaction with their advisors.

Rather than being treated as a generalized segment, these investors desire personalized attention as unique individuals ("Just me") with specific objectives and preferences. They seek advice tailored to their individual circumstances.

The focus on financial education is particularly important for young investors, as it helps them make informed decisions and develop a solid foundation in personal finance. Wealthtech startups play a crucial role in bridging the financial literacy gap and fostering a culture of knowledgeable investing and sustainable growth.

Top wealthtech startups for 2024

Some notable wealthtech startups have made a significant impact in the industry – take Fundrise, Stash, or Toggle AI. Each of these companies offers innovative investment platforms and AI-driven solutions that cater to the needs of both retail and institutional investors.

Fundrise

Fundrise is a wealthtech startup that aims to democratize access to commercial real estate investments for an average investor. Traditionally, commercial real estate has been one of the most inaccessible and exclusive asset classes to invest in, but Fundrise solves this problem by offering a platform where users can:

- Invest in commercial real estate projects

- Diversify their investment portfolio

- Earn passive income from rental properties

- Benefit from potential appreciation in property values

Image source: Google Play

By providing a user-friendly interface and low minimum investment requirements, Fundrise makes it easier for individuals to participate in the commercial real estate market and potentially earn attractive returns.

Fundrise opens up opportunities for average investors to access commercial real estate investments, enabling them to diversify their portfolios and explore the potential returns of this asset class.

With a total of $355.5 million in corporate funding, Fundrise continues to expand its reach and bring commercial real estate investing to the masses.

Stash

Stash is an investment platform that offers the following features:

- Enables users to invest in stocks and ETFs, even with small amounts of money

- Provides financial advice, equity, and ETF purchases

- Offers a seamless user experience tailored to the needs of new investors

- Provides educational resources to empower users to make informed investment decisions

- Helps users grow their wealth over time

Image source: Google Play

Stash simplifies the process for individuals to commence investing and regulate their finances, thanks to its comprehensive financial advice, the option to buy equities and ETFs, and a next-gen user experience.

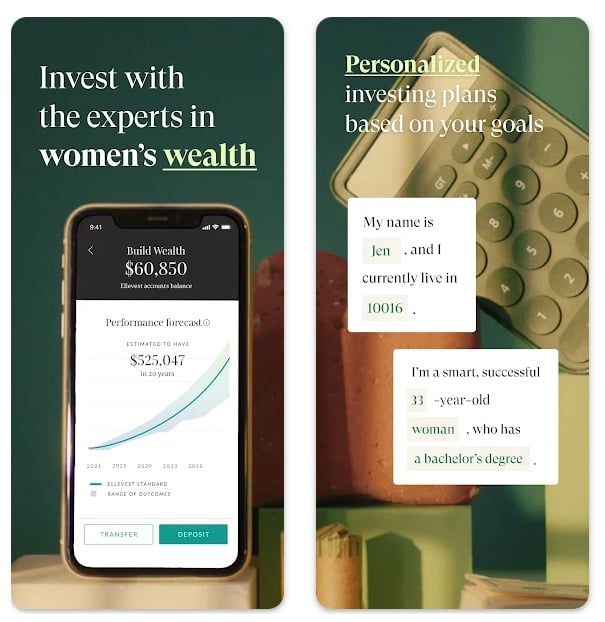

Ellevest

Ellevest is a unique and innovative wealth management platform that is tailored specifically to address the financial needs and goals of women. It recognizes that women often face distinct financial challenges and opportunities compared to men, and aims to bridge the gender investing gap.

Image source: Google Play

The company offers:

- Targeted approach: Addressing the gender pay gap, longer life expectancies for women, and career interruptions for reasons like caregiving

- Personalized investment advice: Using a data-driven approach to understand each client's unique financial situation, goals, and risk tolerance.

- Retirement planning: Helping women create sustainable financial plans to ensure they can maintain their lifestyle throughout retirement.

- Socially responsible investing: Allowing clients to align their investment portfolios with their values, supporting companies and initiatives that take into consideration social and environmental goals.

Toggle AI

Toggle AI is a New York-based wealthtech startup that uses machine learning to provide global market analytics and portfolio monitoring services to retail and institutional clients. By employing machine learning algorithms and natural language processing, Toggle AI supplies investors with the necessary insights to make informed decisions regarding their portfolios.

Image source: Google Play

Toggle AI is committed to closing the financial literacy gap among investors and cultivating a culture of informed trading and sustainable investment. With the power of AI and machine learning at its core, Toggle AI is transforming the way investors approach the stock market, making data-driven decisions more accessible and reliable than ever before.

Cadre

Cadre is a wealthtech startup that offers direct access to select commercial real estate investments through its digital platform. The platform enables mainstream investors to invest in customized commercial real estate portfolios with enhanced transparency and reduced fees.

Cadre's argument for investing in real estate is that it does not demonstrate a high correlation with stocks or bonds, making it an attractive diversification option for investors. With $133.3 million in funding through a convertible note, Cadre continues to innovate and broaden access to commercial real estate investments.

Image source: Cadre

Betterment

Betterment is a robo-advisor offering low-cost portfolios, financial planning, and educational resources to help users reach their financial goals. Serving as a fiduciary, Betterment acts in the best interests of its clients, providing a streamlined process for managing money and guiding users toward informed investment decisions.

Image source: Betterment

The platform offers a streamlined and user-friendly process for managing money, making it accessible and convenient for investors, especially those who may be new to the world of finance. Betterment's user interface is designed with a focus on simplicity and ease of use.

Vise

Vise is a wealthtech company that offers:

- Convenient management of client accounts and portfolio templates in a single platform

- AI-powered generation of tailored portfolios for financial advisors and clients

- Portfolio engine that recommends investments based on the client’s circumstances

Image source: Vise

Summary

In conclusion, by leveraging advanced technologies like AI and machine learning, wealthtech startups are providing users with personalized financial advice, data-driven strategies, and comprehensive financial planning tools to help them achieve their financial goals.

As we look to the future, wealthtech startups will continue to drive innovation, expand access to exclusive asset classes, and empower users with financial planning tools and resources. With the rapid advancements in technology and an ever-increasing focus on financial education, the wealthtech industry is set to transform the way we invest and manage our finances for the better.