Top Payment Innovations And Technologies To Watch in 2025

Contents

From mobile wallets to biometric authentication and smart speaker payments, these new technologies are revolutionizing the way people purchase and exchange funds.

The world of payments is constantly evolving, and payment innovations are shaping the future of how we transact. Let’s dive into the top payment innovations and understand what’s driving their growth, as well as their impact on the payments industry.

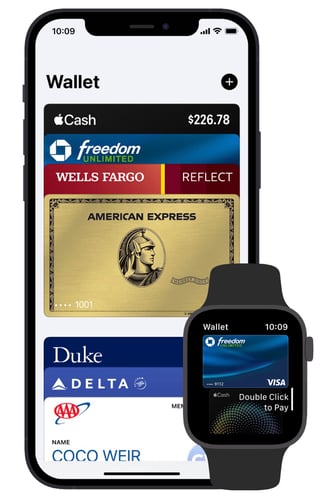

Mobile wallets: A dominant force

At the end of 2020, there were over 2.8 billion mobile wallets in use, and it is projected this number to increase by nearly 74% over the next five years, to reach 4.8 billion by the end of 2025.

Forecasts indicate that the utilization of applications like Apple Pay or Google Pay in North America is expected to experience a twofold increase between 2020 and 2025. However, it is important to note that Asia's market size will surpass North America's by a significant margin.

The aforementioned figures encompass applications like PayPal or Google Wallet, which allow users to store their credit or debit card information on their mobile devices for convenient online or in-store purchases.

China has been widely recognized as the global leader in proximity mobile payments, which involve using smartphones for contactless transactions. This distinction can be attributed to the popularity of prominent platforms such as Alipay and Tenpay in the country.

According to Statista’s study conducted in 2022 across various regions Mobile wallet adoption in 39 countries and territories worldwide:

- Asia exhibited significantly higher mobile wallet usage compared to Europe. In fact, out of the top ten countries with the highest mobile wallet adoption rates, nine were located in the Asia-Pacific region, with the top two originating from Southeast Asia.

- Saudi Arabia was the first non-Asian country to appear on the list, securing the ninth position. It wasn't until the 22nd spot that Sweden, representing Europe, made its appearance in the survey.

- Unlike in Asia-Pacific and the Middle East, where mobile wallets have gained prominence as the primary digital payment method, Europe and North America face competition from well-established digital payment systems like credit and debit cards.

- In emerging economies, mobile wallets represent the first introduction to digital payment solutions.

Market size of mobile wallet transactions in various regions worldwide in 2020 with forecasts from 2021 to 2025

Image source: Statista

This is evident in the widespread adoption of major contactless payments apps like Apple Pay, Google Pay, and a variety of digital wallets provided by banks and other financial services providers.

Image source: Apple

What’s more prominent is that Japan, which introduced the first mobile wallet in the world in 1999, and a society so close to having cash as a main and key payment form, has transitioned too.

Considering that Gen Z and Gen Alpha are digitally native, literate, and have a strong self-awareness, it is important for various financial services to invest in the financial fitness and education of soon-to-be leading capital investing and spending groups on the market.

Since it’s hard to get them engaged for a longer period of time, the service experience needs to include a repertoire of:

- Mobile banking

- Value-added Services (VAS)

- Banking-as-a-service (BaaS)

- Open Banking

- Data monetization

- Almost instant cross-border payments

- AI-enhanced robo- and personal finance advisors

- Social groups and family-level access

All of these unlock the doors for a personal, unified, securely shared financial ecosystem that enriches their banking experience.

Benefits of mobile wallets

- Convenience: Mobile wallets allow users to store all their payment information in one place, eliminating the need to carry around multiple credit and debit cards

- Speed: The solutions allow for quick and easy payments, reducing the time spent standing in line or fumbling with cash and cards.

- Integration: The wallets can be integrated with other apps and services, such as budgeting and expense tracking tools, making it easier for users to manage their finances. Adoption of Open Banking services is deepening that information sharing even more.

Instant transfers from account to account

You may ask, how account-to-account transfers are new and breakthrough? For many of the European markets and not only it’s the market standard. There’s BLIK in Poland, PIX in Brazil, MobilePay in Denmark that allow instant and secure money transfers on the go. Individuals and businesses can send and receive money near real time, any day, and any time of the day, all year round.

It is actually a very big deal, because FedNow, an instant transfers standard in the US, is launching in the United States as we speak. This market is the multifold size of others. And, based on the Federal Reserve research survey, 9 in 10 businesses expect faster funds transfers.

Assuming card fees account for 2-3% of revenue per transaction, and you are running a <10% profit margin ecommerce, the savings can give you a healthy and hefty inflow of cash to invest. With this, you can improve the growth and scale of your business.

What payment types are we talking about?

- Person-to-Person (P2P), eg. between friends, family, other individuals

- Consumer-to-Business (C2B), eg. paying for groceries or for a haircut

- Consumer-to-Government (C2G), eg. taxes, licenses

- Government-to-Consumer (G2C), eg. tax refunds, social security benefits

- Business-to-Consumer (B2C), eg. purchase refunds, employees wages

- Business-to-Business (B2B), eg. between businesses for products and services

- Business-to-Government (B2G), eg. tax payments

- Account-to-Account (A2A), eg.between customer’s various types of accounts

Having been on the forefront of the payments digitalization in Europe with several clients, we can firmly say, convenience and seamless payment experience beats alternatives.

Benefits of introducing instant transfers on the market

- Payments are realized instantly while reducing fraud risk

- It helps to create new products and services like P2P payments or managing liquidity

- Having a competition helps the market, the customers, and the businesses

- The fees, it’s a small nickel of a typical cost for card payment

- There is also a full repertoire of use cases shared by FedNow

Payments without passwords - biometric authentication

The traditional use of passwords for payment authentication is giving way to more secure and user-friendly alternatives, such as biometric authentication. This trend is fueled by the increasing need for enhanced security and the growing adoption of biometric technology in smartphones and other devices.

Biometric authentication uses an individual’s unique physical characteristics, such as:

- Facial markers

- Fingerprint markers

- Iris markers

- Vocal markers

To authenticate payments at the point of sale (POS). This method provides a reliable alternative to validating payments with a PIN or signature and has been embraced by financial institutions to enhance security.

The biometric authentication and identification market and trends

As of 2020, the worldwide market for biometric authentication and identification was valued at more than 3.5 billion U.S. dollars. The primary beneficiaries in terms of value were government entities and border management bodies.

However, projections indicate that by 2026, the global authentication and identification market is expected to reach close to 8.8 billion U.S. dollars. During this period, banking and financial institutions are anticipated to become the most valuable end users, surpassing the two billion U.S. dollar mark.

When surveyed in 2021 about their willingness to switch from using a PIN code to fingerprint authentication for in-store payments, the results showed that people in different regions have different approaches to biometric authentication:

- 94 percent of respondents from Saudi Arabia expressed readiness to adopt fingerprint authentication.

- 69 percent of respondents from the United States were open to making this transition. Overall, in 2022, more survey respondents are comfortable with facial recognition technology than in 2020.

Biometrics emerged as the most effective method of passwordless authentication in 2022. These methods significantly mitigate the risks associated with insecure password management practices and minimize potential attack vectors for hackers. Facial recognition market size is set to grow from US$5B in 2021 to US$12.67B by 2028.

In 2022, automated fingerprint identification systems generated nearly nine billion U.S. dollars in market revenue, and forecasts indicate that this figure will climb to approximately 20 billion U.S. dollars by 2027.

However, it is anticipated that face recognition will witness the highest surge in usage among biometric segments in the coming years.

Checkout.com launched their AI-led ID verification in June 2023, that will help with the tech’s adoption and to fight fraudulent activities across members, but being able to ID the user within 120s.

The benefits of biometric authentication

- Enhanced security: Biometric authentication provides a higher level of security compared to traditional passwords or PINs since it relies on unique physical characteristics.

- Convenience: Users don't have to remember complex passwords or PINs. Instead, they can simply use their biometric data to authenticate their transactions.

- Faster transactions: Biometric authentication speeds up the payment process since users don't have to enter their passwords or PINs manually.

The rise of mobile point of sale (mPOS)

Mobile point of sale (mPOS) technology is revolutionizing the payment process, allowing merchants to accept payments from anywhere and freeing them from in-store payments and central checkout areas.

According to a Statista report, the number of users in the Mobile POS Payments market is expected to reach 1.94bn users by 2027. Moreover, the transaction value is expected to grow (CAGR 2023-2027) of 14.00% resulting in a projected total amount of US$5.58tn by 2027.

Image source: Statista

The benefits of mPOS technology

The rapid adoption of mPOS technology is a testament to its potential in transforming the payments landscape. As more merchants embrace mPOS solutions, t he demand for seamless and secure payment experiences is expected to grow, further accelerating the rise of mobile payments and the global cashless payment volumes.

- Increased sales: mPOS (mobile point of sale) technology enables merchants to accept payments from customers anywhere, anytime, and in any form. This allows merchants to expand their reach, increase sales, and improve customer satisfaction.

- Improved customer experience: mPOS solutions offer a more convenient and seamless payment experience for customers. This eliminates the need for customers to carry cash and reduces the time spent waiting in line.

- Cost-effectiveness: mPOS tools are more cost-effective than traditional POS systems since it eliminates the need for bulky equipment and extensive setup. Merchants can use their smartphones or tablets as POS devices, reducing hardware and software costs.

QR code payments: Fast and easy

Consumers are becoming more and more comfortable with QR codes, and so more companies are adopting them for payments. According to Deloitte, in 2023, 4% of consumer transactions globally use QR codes. That number is expected to grow at a Compound Annual Growth Rate (CAGR) of 16.1% by 2030.

Image source: Deloitte

Why is it worth merchants' attention?

QR code payments offer faster, safer, more accessible experience throughout the customer checkout journey.

The examples of QR payments implementation

- Venmo allows customers to pay touch-free in stores. Customers just need to scan their phone to pay. No cards, PINs, keypads, or mPOS. Fast and easy.

- For McDonalds, QR codes provide the ability to maintain features across online and offline channels, for example, the benefits for purchases with cash can be tracked just as well as a mobile order, through the scan of a QR code.

- For Coinbase and TacoBell, creating omnichannel experience via presence of QR codes on print and digital media that simplifies customer purchases tracking across channels

The benefits of QR code payments

- Seamless payment experience: Contactless digital payment removes the need for customers to use cards, cash in a physical form and reduces spread of germs.

- Faster service: Digital payments allow real-time payment, are convenient, accurate, and provide quick settlement between financial institutions for transactions.

- Affordable and accessible: Lower setup and transaction costs help merchants pass savings along to consumers. What’s more, QR code payments are easily available to customers right in the palm of their hand - their mobile devices.

Smart speaker payments: convenience vs. security

Smart speaker payments refer to the process of making a payment or purchasing a product or service by issuing a request to an AI unit, such as a smart speaker or smartphone, to complete the payment. This innovative payment method offers unparalleled convenience, as it allows users to make transactions with just their voice.

According to predictions, the overall global transaction amount for ecommerce transactions made through voice assistants is set to surge from 4.6 billion U.S. dollars in 2021 to 19.4 billion U.S. dollars in 2023. This represents a growth of over 400 percent in a span of two years.

This rise is attributed to the expanding chances available for voice assistants to buy products, particularly through smartphones and smart home devices.

The benefits of smart speaker payments

- Convenience: Users can simply use their voice to complete the transaction, making the process quick and easy.

- Improved customer experience: This payment method offers a more seamless and personalized offers and customer experience.

- Increased sales: Users can quickly and easily reorder products they use regularly, leading to increased sales and customer loyalty. Additionally, smart speakers offer opportunities for targeted advertising and promotions, further driving sales.

However, the convenience of smart speaker payments comes with security concerns. Research indicates that 74% of users have security concerns when making payments through voice assistants, and this could lead to a decrease in payments.

As the usage of smart speakers grows, it is essential for businesses and consumers to strike a balance between convenience and security.

Buy now pay later (BNPL) disrupting traditional credit

The Buy Now Pay Later (BNPL) trend is disrupting traditional credit methods by offering short-term financing options that allow consumers to buy now and pay later. This trend has become popular due to its affordability and easy repayment process, and it has the potential to replace traditional credit methods.

The worldwide market size for the buy now pay later sector was evaluated at USD 753.53 billion in 2022 and is projected to reach a value of more than USD 9,226.65 billion by 2032. This represents a compound annual growth rate (CAGR) of 29% during the forecast period from 2023 to 2032.

Image source: Precedence Research

The benefits of BNPL

- Maximizing sales and revenue

- Offering customers a range of flexible payment options at checkout

- Reducing the risk of chargebacks

- Offering multiple installment payment plans tailored to the budget of customers.

- Be an answer to customers purchase preferences during the time of downturn and

- Minimizing the upfront transaction burden, by creating time-limited recurring payments plans.

Conclusions

From the rise of mobile wallets to the adoption of passwordless payment methods to cross-border transactions, the financial services industry is witnessing a revolution in how we transact and manage our financial lives. As new technologies such as mPOS, QR codes, smart speaker payments, and BNPL continue to gain traction, it is crucial for businesses and consumers to stay informed and prepared for the future of payments.