Pocket Change #2: Pitch Decks that got $400m+, Western Union's Secret Weapon, and the Promised Land for Insurtech

If you like the content, send a word to your friends and tweet #PocketChange. ❤️

This week you can read about:

✅ How a 168-year old money transfer dinosaur is trying to fend off a plethora of remittance startups, the likes of TransferWise and WorldRemit 🔥

✅ One chart that helps you understand where is the Promised Land for insurtech (at least for SMEs) 💰

✅ A bill that is frustrating a lot of fintech companies in the Netherlands 😡

✅ What Jamie Dimon, the CEO of JP Morgan Chase, has to say about fintech 👨

✅ Tips on pitch decks from the CEO of Carda, a startup with $1bn+ valuation 🏦🏧🗣️

1. On the News

- Is fintech still hot? Which stocks have been the best bet for your money - banks, S&P 500 or fintech indexes? Click here to find out.🌶️ or ❄️?

- Credit Karma’s GM Anish Acharya (formerly of Google Ventures, Social Deck, Amazon) has joined Andreessen Horowitz as a general partner. “There’s a joke I sometimes give in a presentation on fintech: the best fintech investments are probably Google stock, Facebook stock, and Credit Karma stock”. Click here to find out why. 📈

- BNP Paribas is going beyond traditional banking services. Two years ago one of Europe's biggest banks partnered with the fintech startup OneUp to automate cloud banking tools for SMEs. Read about the results here. ⛅

- Big time for N26. The German mobile bank has raised an additional $170 million to speed up market expansion. 💵💷💶💴

- The 5-year lock up on bonuses and stock options seem to have upset many Dutch fintech companies. “The bill is an obvious mistake” - said Gaston Aussems, the CEO Mollie, a payment company. 😠😡

- TransferWise is on a hiring spree and all about diversity. One of Europe’s most progressive fintechs aims to hire 750+ experts in the next 12 months. Also, two CFOs: Ingo Uytdehaage (Adyen) and David Wells (ex Netflix) joined the company’s board. “We know that with these hires, we have not made our board any more diverse (...)” Kristo Kaarman, TransferWise’s CEO stated. Is this an IPO hint? And who’s going to be the next member?

- A six-year old Brazilian fintech, Nubank, is up to something new - the company that started as a credit card issuer and was focused on private customers, is now inviting entrepreneurs to test upcoming business accounts. 💼

- A $5 slice of a rare Ferrari? A nice overview by Forbes’ Jeff Kauflin of what Rally Rd, Otis, Masterworks, Arthena, YieldStreet, Roofstock and others are doing in this space 🏎️

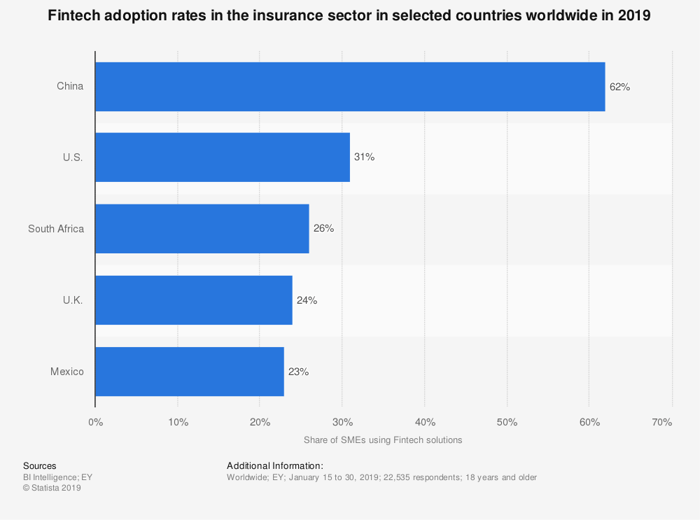

2. Chart of the Issue - Insurtech

The Promised Land for insurtech for SMEs is far, far away.

Unless you live in China.

Speaking of insurtech, here’s something special for all PocketChange subscribers - you’re the first to get the info!

On 10th October 2019, Netguru is organizing Disruption Forum, an insurtech & fintech evening in Paris.

3. Lessons Learned - How Western Union Tries to Change the game

If you somehow missed this brand, Western Union is the 168-year old leader in international money transfers, generating $5+ billion in annual revenue.

Eight years ago, Khalid Fellahi, the general manager of the company’s Africa division, had been tasked with building out the Western Union’s digital business.

Fast forward to 2018: digital channels accounted for 12% of Western Union’s revenues. The growth pace: 20% y2y. Amazing.

Key takeaways from their fintech strategy:

✅ Unlike many banks which are closing branches, Western Union DID NOT stop investing in physical locations

✅ Also, the company decided to outsource parts of building its digital arm to Silicon Valley engineers

✅ Western Union has found a way to make use of its physical network:

- the company struck a deal with Amazon to allow customers in 16 countries (eg. Kenya) to pay cash for orders with Amazon

- the company handles payments to many publishers for Google’s AdSense system more deals of this nature are coming

✅ Western Union recently announced a partnership with TechStars, a start-up accelerator.

- The goal is to hunt for innovations and raise 10 early-stage start-ups that are trying to disrupt cross-border money transfers and/or the payment industry in general.

4. Quote(s) of the Issue

Rob McMillan, an executive vice president at Silicon Valley Bank

You’ve got to be able to understand a dreamer from somebody that’s crazy. There’s a thin line.

McMillan oversees a division that lends to US wine producers. A wonderfully insightful story by Rachel Louise Ensign for WSJ.

JP Morgan Chase CEO, Jamie Dimon on Q2 2019 Results

Fintech, of course, is always going to try to eat your lunch, and I think that’s good, that’s called American capitalism, and we have to stay on our toes to compete.

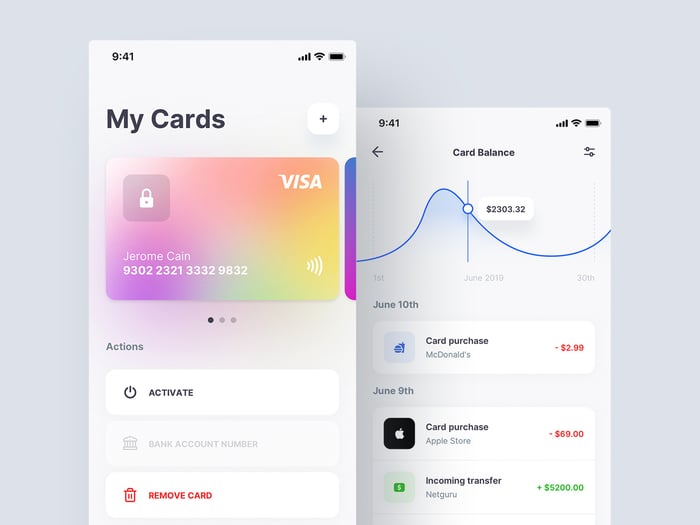

5. Eye-catching

Managing (and ordering) prepaid cards with a preview of their balances.

Check out this teaser by our own Michał Kubalczyk.

6. Tips&Tricks

- The perfect solution to the fintech IPO shortage? B2B may play a vital role here, believes Ron Shevlin

- Pitching for funds? Ever heard of a ‘domino chart’? Carta CEO Henry Ward explains his series A and series E decks

- ROI maximized - Andrew Beatty, Head of Strategy, Banking at FIS gives four tips on maximizing bank-fintech collaborations.

Well, that’s pretty much all. If you've missed the first #PocketChange, see one here.

Hope you enjoyed this issue – Pocket Change is semi-regular, so the next one will appear in 2-4 weeks’ time.

Meanwhile, hit me up on Twitter, LinkedIn, or leave a comment with your feedback. Which part of the newsletter is of the most value to you? Do you feel that anything is missing?

I’ll be happy to see what you think.