Pocket Change #1: French Fintech Teardown, PayPal Stats, Africa and how to Sell to Fintech

But first, do you love #hashtags? If you do, send a word to your friends about the newsletter and tweet #PocketChange. If you don't, don't tweet, but send a word anyway.

This is the 1st issue, so expect changes and upgrades in the future. And feel free to share your feedback.

This week, you can read about:

✅ How a French startup paved its way to the $79m funding and its own language;

✅ The one global trend that is leading to a new wave of digital challenger banks;

✅ What Uber’s push into fintech may mean for Monzo and others

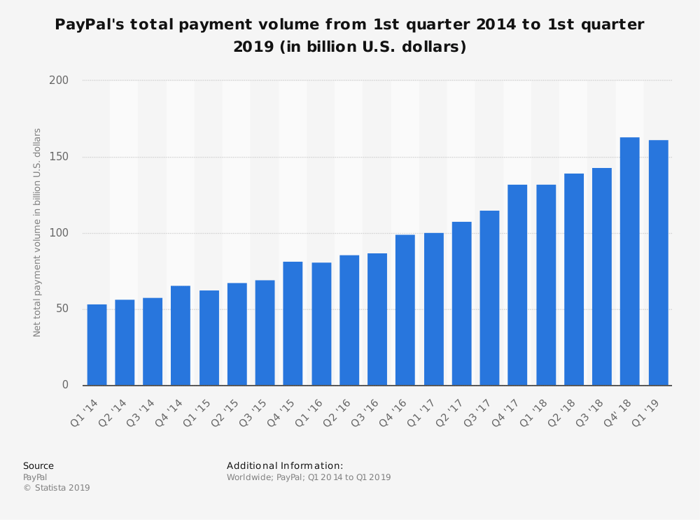

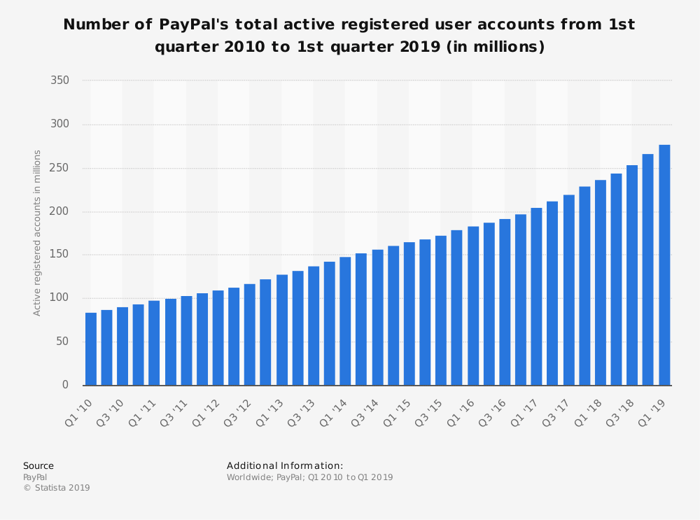

✅ Two charts to prove whether PayPal is flying or dying

✅ Why Africa is hot and who’s on the top 10 list in the region

✅ How to sell to fintech companies (it works with any other industry as well!)

1. On the News

- Fintech on a shopping spree, cash only. UK-based Jaja agreed to pay $671m in cash for the Bank of Ireland’s credit card unit. “Our vision is to enable a new generation of mobile-first credit card products with unrivalled functionality, service and security” - Neil Radley, CEO of Jaja Finance. More here.

- BBVA is pushing for more innovation. The bank announced another accelerator program - BBVA Open Innovation Accelerator Program - aimed towards early stage and seed startups. Over a year ago I wrote about why this is a smart move, actually.

- Fintech in Africa seem to be booming. According to the annual report by Disrupt Africa, the local ecosystem has increased by 60% since 2017. Africa is home to 491 fintech startups.

- Are we witnessing the birth of UGAFA? CNBC reports that Uber is looking for engineers with a knack for fintech in NYC. Yet, as John Detrixhe from Quartz spotted, the Uber push comes a few years after Asian competitors, the likes of India’s Ola, Indonesia’s Go-Jek or Malaysia’s Grab (all of which, unsurprisingly, have beaten Uber on their ground).

- This Uber push is bad news for any fintech company trying to expand to the US. The latest of the pack is Monzo, one of the UK’s most beloved digital banks. Some experts doubt that Monzo has enough charm and power. “Success in Europe might translate to success in the US for music and fashion - but not banking”. See why Monzo might fail (by Ron Shevlin)

- If there is one thing that the US may copy paste from EU, it is how to provide innovation-friendly legislation. The long-awaited fintech charter from the OCC (Office of the Comptroller of the Currency) turned out to be a market flop instead of game-changer. Even Google and PayPal walked away. See why the charter is not working.

- Well, everybody already knows that Libra, the Facebook coin, is coming, with the launch expected in 2020. But have you read the whitepaper yet? “It can have massive implications on how people interact financially globally and on our privacy” - says @peterlih, Peter Grosskopf, CTO at Digital Asset Exchange of Börse Stuttgart. See the whitepaper.

- In other news, Stuart Sopp, CEO at Current, claims that Facebook ripped off the logo for Calibra from his company.

2. Chart of the Issue - PayPal

Among the fintech crowd, PayPal looks like an old dog. Yet the company which was once treated only as a side dish to eBay is definitely capable of learning new tricks. See any signs of hiccups there?

3. Lessons Learned - the Fintech Case Study of the Issue

PayFit is a fintech startup from France that has evolved from a simple payroll service into an HR platform used by almost 3,000 companies across Europe. PayFit recently raised a new $79 million funding round and in 14 months PayFit grew from 60 to over 200 employees.

In a rare self-written case study, Florian Fournier, CPO and co-founder at PayFit, shared:

✅ Why they decided to create their own language in the first place?

✅ How the company tries to ensure alignment of the product vision within all teams?

✅ What helped them realise that things considered as priorities (eg. a mobile app) turned out to be secondary for customers?

✅ How the new role - at the intersection of Product Manager, Product Designer and Software Engineer - was created?

✅ Why the product was split into two and then quickly merged again

✅ Some metrics and reasoning behind PayFit’s expansion beyond the French market

✅ Why the company is moving from a top-down approach (priority developments defined by product managers) to a bottom-up approach.

Read the full PayFit's story here.

4. On the Market - Financial Literacy is on Fire

Financial literacy is trending. And industry unicorns are rushing to expand their customer base with youths and kids.

Recent examples:

- Stripe leading a $22,5m round in Step, a startup that is developing mobile-based banking services for teenagers, with over 500,000 users on the waiting list.

- Revolut about to launch an app for kids and youths this summer.

And there is a slew of startups focused on younger users - the likes of Greenlight, Hibbo, or Current.

Why does it make sense to focus on kids?

For one, to grow the brand as they grow.

“Schools don’t teach kids about money. We want to be their first bank accounts with spending cards, but we also want to teach financial literacy and responsibility.” - CJ MacDonald, the CEO and co-founder at Step, explained.

There are good numbers behind this reasoning - see more in our “The State of Banking for Families” report. There is a chance that you'll fall in love with Pockee, the proof-of-concept app for family banking by Netguru, too!

Yet, making money more relatable and redesigning children’s accounts are also on the corporate agenda. More in an interview with Dan Makoski, Chief Design Officer at Lloyds.

But financial literacy does not involve only the younger users. For instance, check Canada.

- Almost half of Canadians are worried they are not going to have enough money for retirement,

- over 40% are overspending so much on credit cards that they carry a balance = most likely they are neither saving nor investing.

And there is this one Canadian startup, Mogo, which believes that globally this trend is leading to a new wave of digital challenger banks.

What is the opportunity that they see? Providing one finance app that makes it easy and engaging to get financially fit. Learn more on the conference call transcript.

5. Quote of the Issue

Angel Santodomingo - EVP and CFO at Banco Santander at the Q1 2019 earnings call

“If it’s not a bank, it's going to be a fintech. If it's not a fintech, it's going to be one of the big communications or media or social media companies. Competition is going to be here, and it is going to be intense (...). We welcome that. It makes us better.”

6. Tip, Tricks and Events of Choice

- The three fintech-related takeaways from the Mary Meeker’s annual Trend Report

- Super insightful read on how to sell to fintech companies from Chad Dyar, Enablement Leader at OnDeck. Yeah, these rules will work in other industries as well

- If you feel stuck in your career, check this Trident Career Model by Pat Kua, Chief Scientist at N26

7. Machine Learning Workshops

Oh, and by the way. If you believe that Machine Learning in Finance is a thing (we do!), my friends at Netguru are organising free workshops in London.

12th July 2019 at Level39, London

Well, that’s pretty much all.

Hope you enjoyed this issue – Pocket Change is semi-regular, so the next one will appear in 2-4 weeks’ time.

Meanwhile, hit me up on Twitter, LinkedIn, or leave a comment with your feedback. Which part of the newsletter is of the most value to you? Do you feel that anything is missing?

I’ll be happy to see what you think.