Own the change

Trusted by:

AI-driven digital acceleration

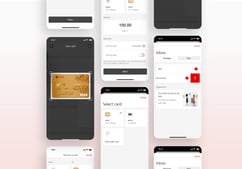

Mobile App Redesign

Mobile-first approach in the best-in-class banking app.

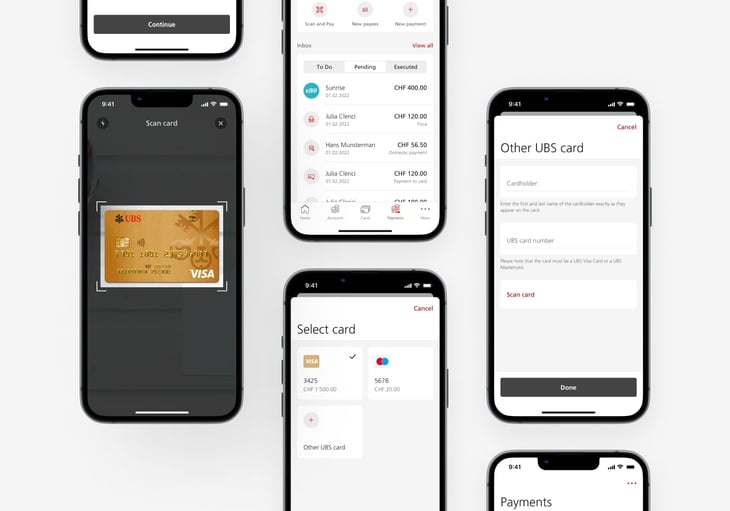

PropTech

21% conversion increase with product design services for Otodom .

Lab productivity

97% faster inventory management with Flutter.

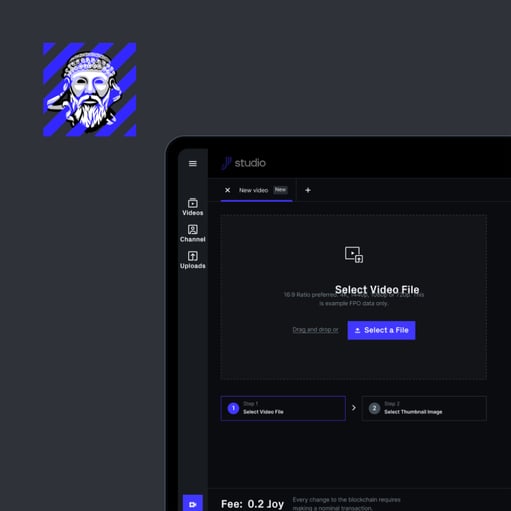

Blockchain MVP

Exquisite look & feel for a blockchain video platform.

AI for real estate

Consistency across products with a design system.

Virtual try-on

Joyful customer experience with a virtual try-on.

Full digital product expertise under one roof

-

01 Ideate

.Identify, shape and validate your product idea

-

02 Design

.Craft beautiful digital experiences across platforms

-

03 Develop

.Bring products to life with world-class engineering

-

04 Maintain

.Safeguard your product's quality and reliability

-

05 Scale

.Gain flexibility to adjust and expand on the fly

In our clients' words

Netguru always tries to make things possible.

Susanne Wechsler

Netguru has been the best agency we've worked with so far.

Adi Pavlovic

It doesn't feel like an external team, it feels like we're just working together.

Dally Singh

Netguru has an incredible remote culture. It really makes working together easy.

Scott Hickle

With Netguru, we’re now releasing many more features than we used to.

Marco Deseri

Let me put it this way: we have built a grand and impressive building. But without Netguru’s insights, we would be stuck on the ground-floor forever.

Artur Kryzan

Insights for change

Blog:

Generative AI Use Cases in Finance and Banking

Blog:

Enterprise AI-Powered Knowledge Base And Why We’ve Built One for Ourselves

Podcast:

Innovation Approach for the Corporates: How to Find One That Works

Blog:

10 Real-World Examples of How Team Extension Accelerates Delivery

Podcast:

Can Growth and Product Strategies Work Well Together? Disruption Talks with Hostelworld

.jpg?width=360&height=239&name=ux-indonesia-qC2n6RQU4Vw-unsplash%20(1).jpg)

Blog:

How AI Is Changing the Landscape of UX and Product Design

Tech as a force for good

Scaling up the fight to reduce carbon emissions with Coalition for Rainforest Nations

Helping an energy-tech startup increase clean energy access in sub-Saharan Africa

Relieving volunteers at a record-breaking annual charity fundraiser for pediatric care

Empowering a global community of women leaders with a scalable network hub

Build impactful products faster than the competition

Estimate project